What is the Difference between Institutional & Speculation?

QUESTION: Mr. Armstrong; I was talking to a friend who works in one of the banks you probably classify as the club. He knew you right off the bat. He said you have been probably the largest institutional advisor in the world. He said clients question the bank’s research and openly contrast it with yours. My question is simply this. What makes your institutional advice so dominant? Is it different from what you put out on your blog?

Just curious

HD

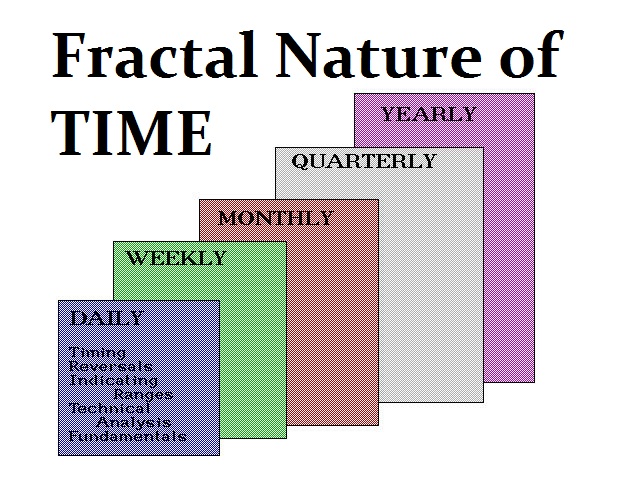

ANSWER: Interesting question. Institutions CANNOT be flipping their portfolios back and forth. They are not interested in what will the Fed do next week. They cannot react to such short-term swings. Our models are fractal and dynamic. We have the largest database ever assembled and that is what it takes to do accurate long-range forecasting. What you also must understand is how can a guy write a book and describe the feeling it is to give birth. Sure, he can interview women and write down the overview of what they say. But he cannot possibly really know what it feels like.

Look, 99% of all these self-proclaimed analysts have NEVER traded size. They look at the market from a short-term trader perspective and do not even understand how to do strategically position a portfolio of size. Oh sure, they can advocate the standard 60% equities and 40% bonds. Yet what happens when government bonds default? What happens when 10-year rates are 3% or less and you need to make 8% to cover your liabilities moving forward? They are clueless when it comes to actually the problems in size and how you even place orders.

The questions from institutions are strikingly different. They need to know when major trends change and how to adjust their portfolio and when. Our asset allocation is by no means 60-40. They are not concerned about when is the high Tuesday or Wednesday. Therefore, our institutional services are strategically different. You are either long or short. There is no pension fund that can buy even a 10-year government bond paying 3% for they are locking in a 50% loss or more. If you have not played in the big leagues, don’t bother. How you hedge is strikingly different from speculative trading.

We are able to differentiate between short-term changes in trend and long-term. That is the key. Plus, even if someone comes up with a new model and tries to get a meeting with a major institution if they can get 15 minutes that will be a miracle. Why? Nobody is going to take an unproven model for if it fails, that person loses their job. We have a track record and reputation going back into the 1980s which is LIVE – not hypothetical. There is no risk with us because they already know we have more institutional clients than anyone for decades and understand the game not read books about it.