Do We Really Borrow From Only Ourselves? Does the Debt/GDP Ratio Means Anything?

QUESTION: Mr. Armstrong, the famous economist Paul Krugman says that debt is ok when we owe it to ourselves. He calls it “deficit scolding” as he wrote in the New York Times. Would you like to comment on this statement?

GH

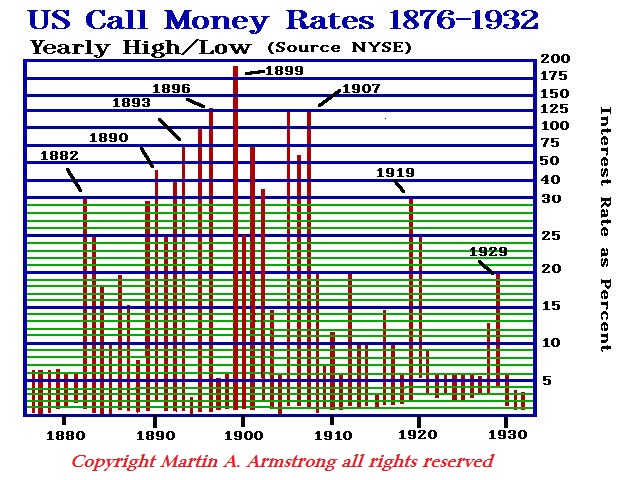

ANSWER: Paul Krugman seems to lack any historical understanding of how nations rise and fall. Anyone who claims debt is OK and can be infinite because “we” owe it to ourselves is clueless. He wrote in the article you referred to that “we have a more or less stable ratio of debt to GDP, and no hint of a financing problem.” The debt to GDP ratio is interesting but totally irrelevant. China’s debt to GDP stands at 250%, the USA at 103%, and Greece buckled at 186%. Obviously, this ratio is rather meaningless as a forecasting tool. I have published this chart on call money rates previously. In my studies, I quickly discovered that you cannot reduce the cause of any effect to a single issue. We can see that the peak in call money rates took place during 1899 and it was the lowest in 1929 when the Great Depression hit. You can’t even claim that if interest rates hit some magical level the stock market would crash. The world is far more complicated than just this one-dimensional approach to everything.

Capital flows were fleeing the USA in 1899 so interest rates went higher with a shortage of money. In 1929, the capital was in the USA for it rushed here because of World War I. The inflow of capital created an excess so the peak in call money rates was lower than 1899 when capital was fleeing. We even have the world of President Grover Cleveland from the Panic of 1893 commenting on the net capital outflow because of the “unsound” financial policy of the Silver Democrats.

Capital flows were fleeing the USA in 1899 so interest rates went higher with a shortage of money. In 1929, the capital was in the USA for it rushed here because of World War I. The inflow of capital created an excess so the peak in call money rates was lower than 1899 when capital was fleeing. We even have the world of President Grover Cleveland from the Panic of 1893 commenting on the net capital outflow because of the “unsound” financial policy of the Silver Democrats.

The greatest mistake in the analysis is always trying to reduce any effect to a single cause. The world is a complex mechanism. It is indeed like a rainforest. There are countless species and each is interconnected. Exterminate one and you will find that it was the food source for another which dies. That species, in turn, was the food source for yet another and so on. The world economy is equally complex. This is why I say we are ALL CONNECTED. Create a war in one region, we may not be involved with troops, but the capital flows shift.

Everything is interconnected. There is no single cause and effect. Looking at GDP debt ratios is pointless. This is also why fundamental analysis is notoriously wrong. The majority tries to reason the future based upon this one-dimensional analysis and they NEVER got it right. I have posted this video clip of Larry Summers before. He is asked why can’t you guys ever get it right just once. His excuse is blunt. The economy is extraordinarily complex like the weather. He argues nobody can forecast the direction.

Everything is interconnected. There is no single cause and effect. Looking at GDP debt ratios is pointless. This is also why fundamental analysis is notoriously wrong. The majority tries to reason the future based upon this one-dimensional analysis and they NEVER got it right. I have posted this video clip of Larry Summers before. He is asked why can’t you guys ever get it right just once. His excuse is blunt. The economy is extraordinarily complex like the weather. He argues nobody can forecast the direction.

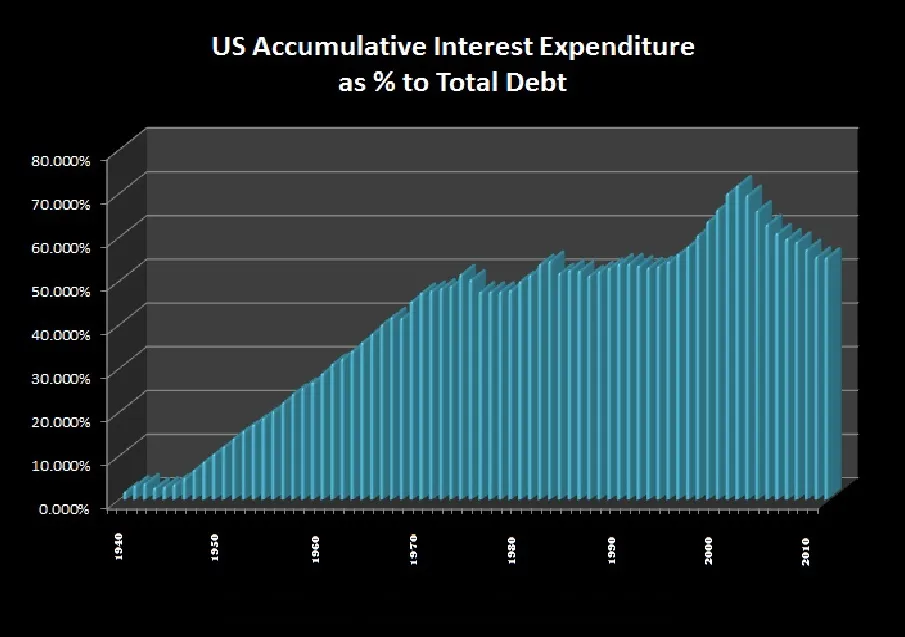

For anyone to say that debt can be infinite when we owe it just to ourselves is a fool. At times, 70% of the national debt has been accumulating interest payments. A national debt is the single greatest way we transfer wealth among citizens as well as nations. I kept yelling on Capitol Hill that Quantitative Easing would fail, it would not “stimulate” the economy for a very simple reason. The assumption that the Fed would buy 30-year bonds and then the banks would lend into real estate with lower interest rates was crazy. The debt is NOT owned by exclusively Americans. China was smart and it sold the 30-year bonds and swapped to 5-year or less paper. The money was transferred out of the country. To pretend this is a debt we “owe” ourselves is just fantasy.

Even domestically, if I am the lender and you are the borrower, then you are paying me because you borrowed the money. Your wealth is transferred to me because you could not wait to buy something for cash. Sorry, I believe Adam Smith was someone who tried to observe HOW things actually work instead of trying to support a predetermined conclusion.