The Stock Market – Up & Away or Crash & Burn?

QUESTION: Mr. Armstrong,

In your blog you talked about a global recession and hard landing. Does this mean the US stock market will rally because funds will flow from the rest of the world to the US stock market? Or will the US stock market succumb to the global recession and go lower too?

This is very confusing for most of us and a very critical time in the markets. I hope you will guides us with your knowledge and experience.

Thank you for all you do!

KC

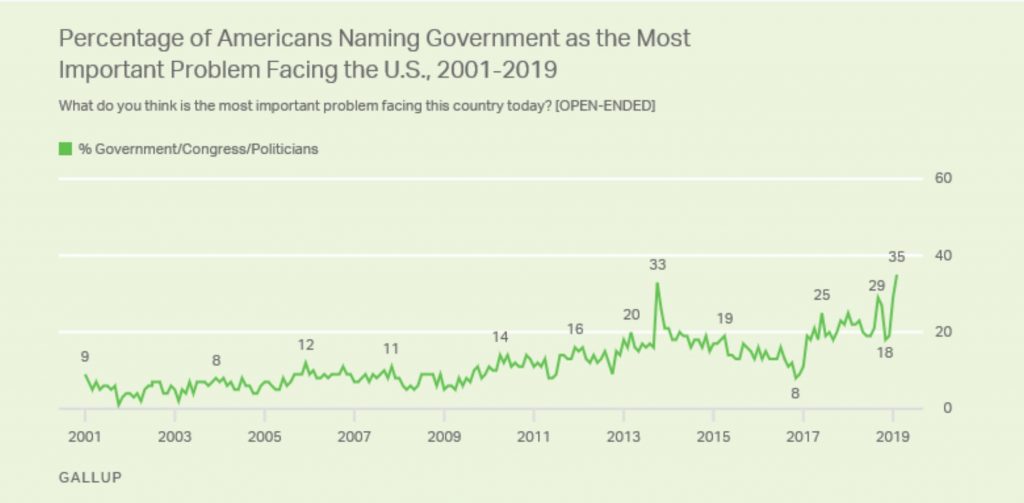

ANSWER: The key to pushing capital fleeing into the stock market will be the decline in public confidence within the government. Everything is unfolding on schedule. You see turmoil everywhere from Canada to France and Italy. The level of people distrusting government is climbing. Normally, it will take a 45% level of people turning against the government to set off the spark.

So no, there still does not appear to be a major crash of 50-62% as the majority are calling. The market is testing resistance, but here too we do not see this as breaking out and taking off just yet. We are in a choppy consolidation building a higher base that qualifies as a cycle low. We will be ready to take off soon. Just be patient.