QUESTION: Sir,

You have advised us to avoid sovereign debt after the ECM date. I imagine that the crisis will affect nations unequally. It seems obvious that money would leave bonds in the more challenged, negative rate countries (EU and Japan). Might these flows come into US Treasuries, thereby stabilizing US rates, at least short-term? Could this be a trading opportunity (long) in our Treasuries? Thank you.

PK

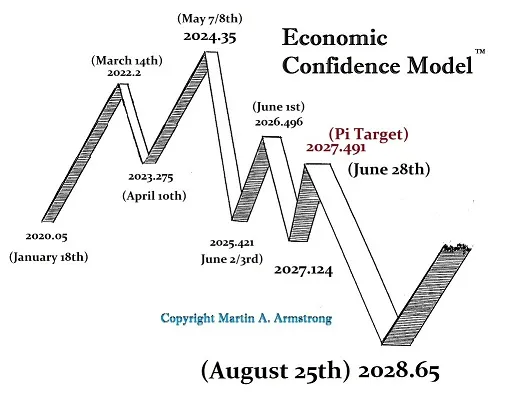

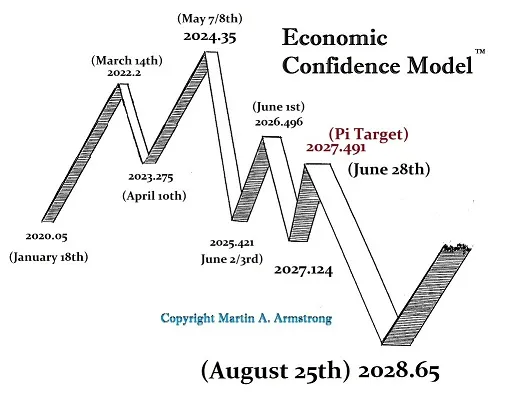

ANSWER: So far, it appears that the capital flows will continue pointing to the USA going into 2022. Thereafter, we should expect a change in that trend in the same position of the ECM, which created the 1987 Crash also due to a capital flight from the dollar.