Market Update for Gold

Gold has been backing off with the prospect of rising interest rates, but a weekly closing below 1225 will signal that the high is possibly in place. However, a weekly closing below 1205 will signal that a serious decline is likely. Technically, we can see critical points at 12434.47 and 1202.13, and a closing below 1202 will signal serious trouble for gold. Gold needs to close above 1265 today to keep it alive near-term. Closing below that price level is neutral and a close below 1230 is bearish just from a tech perspective. A close beneath 1225 will warn correction ahead.

To answer all the questions coming in how the gold promoters are burning people at the stake, they cheer every rally. They never say sell. It is always the same thing – up, up, and away no matter what else is happening in the world. They pitch each time this rally is real but lack any sense of where gold fits within the global scheme of market movement. Everything has its time and place. Gold will breakout, but it requires the collapse in public confidence. We are just not there yet. Trump and Bernie illustrate that this is coming.

Nothing has taken place to negate the prospect of new lows. Markets typically have to move to extremes on both sides to trap people. That is the character of markets – ALL MARKETS. It is human nature we are talking about. My dispute with gold promoters is that they use the same nonsense stock brokers did during the Great Depression – just buy and hold, it will eventually make new highs. In the case of the Dow, it took 25 years for 1954 to exceed the 1929 high. In real terms, it was 1966 adjusted for inflation that produced new highs.

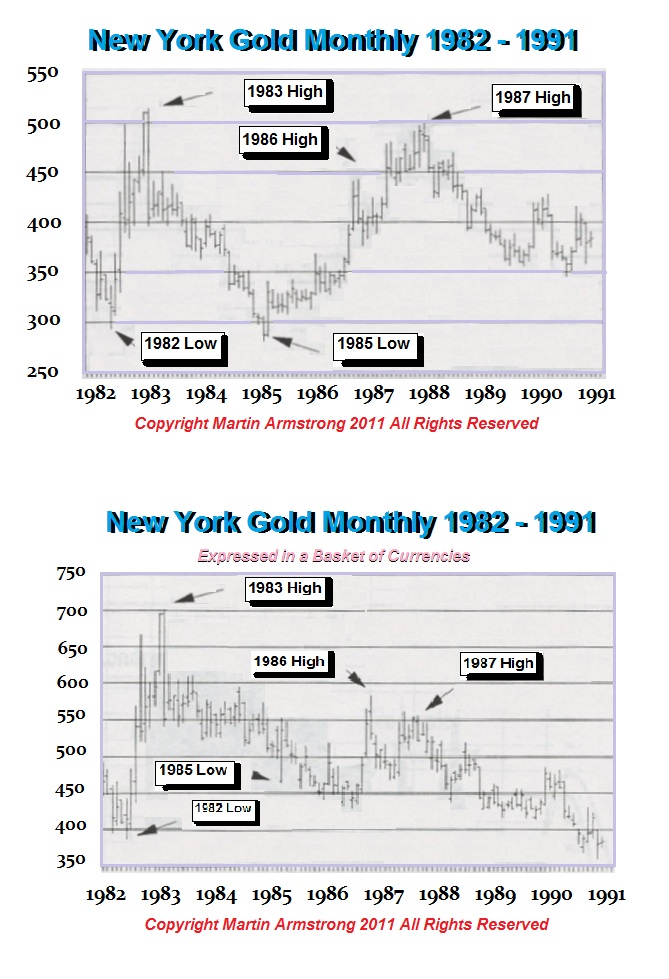

Gold has not broken-out in real terms and that may not arrive until 2023. For example, gold broke through the 1980 high in 2008 in nominal terms in dollars and broke out again in Swiss francs in 2006. So monitoring any instrument in a basket of currencies and adjusted for real inflation is critical.

Back in the 1980s we ran full pages ads in Barrons’ warning gold would collapse. Back then, we saw a dollar rally in motion and I even appeared on FNN (now CNBC) to deliver a forecast that the British pound would fall to par. They thought I was nuts. How could the pound fall from $240 to $1 in just 5 years?

Back in the 1980s we ran full pages ads in Barrons’ warning gold would collapse. Back then, we saw a dollar rally in motion and I even appeared on FNN (now CNBC) to deliver a forecast that the British pound would fall to par. They thought I was nuts. How could the pound fall from $240 to $1 in just 5 years?

Then in 1985 at the start of this current private wave, we took the back page of the Economist Magazine for three weeks in July to announce that the Economic Confidence Model was turning and the age of deflation would end.

Everything has its time and place. If you do not monitor the world, you are not going to see when that time is coming due.

No market should ever become some dogma. This is about understanding how the world works; this is not propaganda for how you want it to work. Sorry – that is Marxism.

Opinion has no place in forecasting. It just doesn’t.