Warning About People Soliciting Money for Trading

It has come to our attention that there are individuals soliciting clients for money to trade on their behalf claiming they have mastered our system and will use it. These people have NEVER managed money and handing them money is no different than asking a cab driver to conduct surgery on you because he sounds like he knows something about medicine. Managing money is a difficult task, to say the least. It takes nerves of steel and every study has shown that someone who trades a small amount of money even successfully, loses money when they try to trade size. In fact, 66% of large-cap active managers failed to top the S&P 500 in 2016. Some 58% of hedge fund managers reported a decline in assets under management in 2016 and 63% of funds-of-fund firms also reported a decline in assets under management.

Handing money to anyone without a LIVE TRADING background is suicidal!!!!! Emotion will ALWAYS overrule their decisions when it counts most! This is why I have NOT endorsed anyone. I am at that stage in life that money does not impress me. I am interested in demonstrating that there is a better way to manage our economy and our future. This service is about trying help clients stay on the RIGHT side of the market. I need not push any philosophy religious or otherwise.

Life is a journey of learning. We have all made mistakes in life. If you learn from your mistakes, that is the path to wisdom. If you fail to learn, that is the path to ruin. Most losses take place in trading because people try to find a trade or they are listening to the TV. There is far more at stake here than personal OPINION. A trader who follows his opinion and tries to claim he is better than someone else is a total fool. Success requires always assuming you are wrong and that demands you constantly recheck what you are doing. NEVER marry a trade or form an inflexible opinion.

Historically, my best trades in life were usually the hardest to do. You have to fight your inner gut to stay calm and do what has to be done in the middle of everyone around you in a state of panic and chaos. If you have never been there, you will not know how to survive. Emotions will get the better of you every time.

When I shorted the markets for the Russian collapse that manifested into the Long-Term Capital Management Crisis, that was easy to initiate. The hard part came when to take profits and reverse. I sold $1 billion against the Yearly Bullish Reversal in the yen at 147 and had to cope with a contagion that hit every market contrary to all fundamentals. It was a liquidity crisis so everything was sold without logic.

The Japanese yen fell to 103. I covered all my shorts in everything, flipped, and then left the office. It was a gut-wrench trade for I was truly alone. I put in my stops and it would work or not. Very black and white. This was a discipline that I knew I had to walk away and not second guess myself, which would be a disaster. The market would decide. The New Yorker Magazine reported:

“The hedge-fund manager who used to work for Armstrong remembers him coming out of his office in September, 1998, two months after he’d got short in front of the ruble crisis. Monica Lewinsky was on TV. “My oscillators just turned,” Armstrong announced. He booked his profits, pulled out of the market, and went to his beach house, on the Jersey Shore.”

I traded through many crashes. It was that EXPERIENCE that I drew on. Sometimes you just have to fight your emotions to go against the majority and ignore what they are even saying. They will all think you are mad. But the majority will also be wrong. This is not an easy thing to do when you are managing other people’s money. What is critical to trading is to see HOW someone acted in the middle of a panic. Were they calm? Did they join the majority or comprehend what was really at stake? Anyone can trade a trend – but can they trade in the middle of a panic?

My drawdowns were less than 2%, which is unheard-of. Many people dubbed me the “legend” I supposed for trading. The best way to make money is to REDUCE your trading activity. All the analysis of starting funds found that 22% of emerging manager funds made a loss in their first year of trading. There is a difference between theory and reality. The emerging managers are also more volatile and represent the risk of significant losses to investors. It takes a seasoned trader with a global perspective to survive. Someone who keeps their head in the middle of a panic. At the same time, a fund that grows in size too large, cannot trade like a small fund. Returns tend to decline with size, not expand.

Investors are regularly reminded that past performance is NO guarantee of future results, but track records continue to play an important role in manager selection AS THEY SHOULD! The primary reason for this is a track record provides the evidence of their decision making and survival. Do not be fooled by claims of a forecast like someone correctly called Trump would win. The test of skill is not a single forecast. Even a broken clock is correct twice a day. The true test of any ability to forecast is to be found in a broad spectrum of forecasts, not a single call or a single market. Everything is connected and if they do not comprehend that, they present a clear and significant danger to investment management.

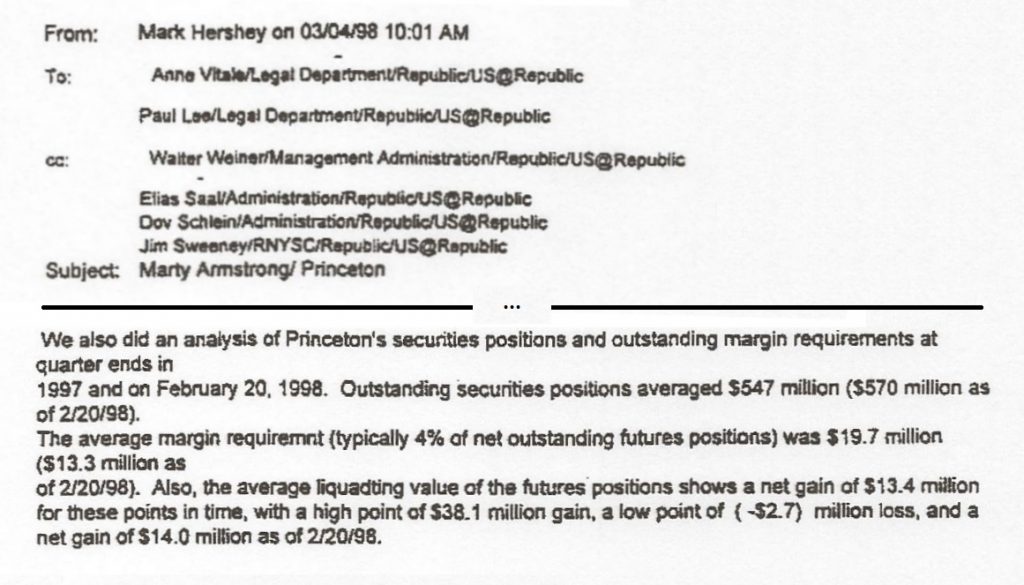

Here is an audit on a half-billion fund from Republic National Bank showing again the drawdown max for 1997 was $2.7 million compared to $38.1 million gain and I used only 4% of the cash for margin. You cannot guarantee the return made one year will be repeated the next for the basic reason that volatility rises and declines from one year to the next. Even the indexes do not perform the same from one year to the next. So a good funds manager is consistent in avoiding serious losses. Not that his rate of return is the same or increasing every year. That is not practical.

However, a track record reveals something much more important. How did someone respond to abrupt market movements? Did they get out in advance? Did they just panic and follow the crowd? How quickly did they abandon a losing trade? This is where the seasoned trader comes into play. Anyone can trade a trend with just buy and hold. That is not the definition of a trader. Only a trader sees the cycle and is comfortable with both sides. The buy and hold strategy is a fool for they make money only in a bull market and lose everything in the crash.

Many people dream of being a hedge fund manager and yearn to cut their teeth on other people’s money. If he puts forth trades that are hypothetical, does he have the courage of his convictions to trade in a flexible manner or refuse to admit when he is wrong? There is so much more to selecting a fund manager than meets the eye. The best hypothetical track record means nothing. Do they have the courage to actually trade it? Most will bail-out when it counts. The studies of the 1987 Crash saw that many models said sell. Big fund managers unplugged the computers and would not sell because they thought the computers were wrong.

We will be setting up a forum for our clients who are subscribers to Socrates run by people who have used the models for more than 20 years. You will be able to ask questions there that will be answered without soliciting you for money. We have a couple of major banks with EXPERIENCE in trading who we are looking at allowing our models to be used formally to prevent others from trying to solicit people using our track record pretending it is theirs.

I have stated I am not interested in returning to funds management. That is a job which is 7 days a week and you have to be on call 24 hrs a day. I still have a hard time sleeping more than 3 hours straight. I greatly appreciate all the offers and understand that the track record of the funds I managed for Deutsche Bank and Magnum remains probably the best ever. Nonetheless, we all have our shelf-expiration dates and I just have no interest in going back to that lifestyle – been there done that!

I will make an effort to find the right firm who I believe is seasoned to survive the chaos unfolding because what lies ahead will be far greater than most are even capable of trading. We are entering a period of extreme volatility on just about every front. Public Confidence in the entire system is gradually collapsing. This will indeed try the character and soul of the best funds manager.

So please do not listen to anyone who claims to have mastered our model. Emotions will override any model if they are not a truly seasoned trader. A lot of people think they can become rich as a hedge fund manager. It takes a hell of a lot more than simply a few good trades.