Italy – the Coming Revolution & Euro Crisis for 2021?

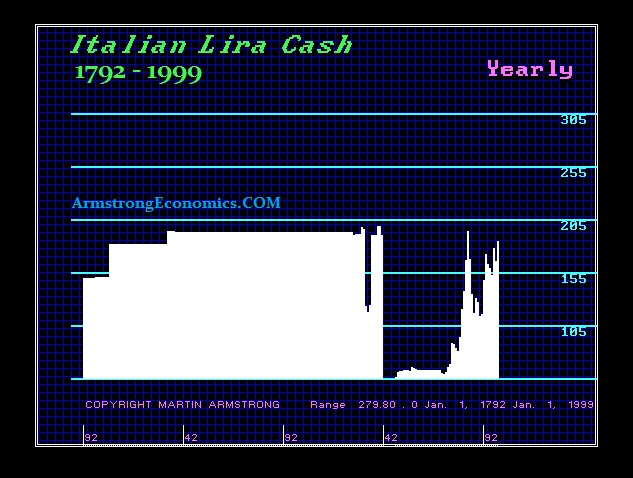

QUESTION: Mr. Armstrong, you obviously have a database on Italy that is without comparison. Nobody else even had a chart on the Italian lira you recently published on the blog. I know you are well aware of the revolutions in Italy and the history. I was wondering do you have any forecast for the next revolution? It seems that the five-star movement may perhaps be the beginning. Any hint about the future?

VDM

ANSWER: Well to give you a target year where it can begin will be 2021. The Five-Star Movement is indeed the prelude. However, the attempt to stay in the Eurozone will be the undoing of Italy. The most threatening issue in Italy that will lead to revolution is most likely an attempt to raise inheritance taxes as being suggested by Brussels.

Culturally, Italy has the lowest inheritance tax in all of Europe. The German inheritance tax rates range from 17% to 50%, depending on your relationship to the decedent. In Italy, the Italian Inheritance Tax (Imposta sulle Successioni) is applied to all the assets worldwide belonging to the deceased if the person is a resident of Italy ONLY. If the person lives outside of Italy, then the tax is applied ONLY to assets in Italy. Where everyone else has generally inheritance taxes of 15% or higher for the immediate family, Italy that rate is just 4%. Here is the breakdown:

- 4% to be paid for transfers to the surviving spouse and children, with an exemption of Euro 1,000,000 for each beneficiary

- 6% to be paid for transfers to brother and sisters of the deceased, with an exemption of Euro 100,000 for each beneficiary

- 6% to be paid for transfers to relatives within the fourth degree of relationship to the Deceased, and other relatives on the spouse side up to the third degree (no exempt amount is available)

- 8% to be paid for transfers to any other (unrelated) parties.

So why do I say that inheritance taxes are the greatest threat to Italy? Rental income in Italy is extremely low. People have plowed their savings into real estate BECAUSE of the inheritance tax. Many have numerous properties and rental income just pays for the taxes and maintenance. If the inheritance tax is tripled, as Brussels suggests, what you will see in Italy is the biggest crash in real estate in modern history. This will be like taxing your bank account by 50%+. Many people use real estate, as they do in China, as their savings. In 2017, part of the very reason why the Five-Star Movement won was also the drastic imposition of property taxes in Italy. If it is your primary home, there was a 2% stamp duty to buy it. A second home was hit with a 9% stamp duty tax. However, if you say it is your primary residence to pay only the 2%, the government will check you for the first 5 years and if they determined you do not live there for the minimum 6 months, the penalty imposed will be 20% of the value of the property. Effectively, that is the imposition of a sales tax when you buy the home. You then have an annual property tax between 0.4% and 0.7% of a property’s fiscal value (valore catastale), the rate being decided by the local municipality according to a property’s size.

So why do I say that inheritance taxes are the greatest threat to Italy? Rental income in Italy is extremely low. People have plowed their savings into real estate BECAUSE of the inheritance tax. Many have numerous properties and rental income just pays for the taxes and maintenance. If the inheritance tax is tripled, as Brussels suggests, what you will see in Italy is the biggest crash in real estate in modern history. This will be like taxing your bank account by 50%+. Many people use real estate, as they do in China, as their savings. In 2017, part of the very reason why the Five-Star Movement won was also the drastic imposition of property taxes in Italy. If it is your primary home, there was a 2% stamp duty to buy it. A second home was hit with a 9% stamp duty tax. However, if you say it is your primary residence to pay only the 2%, the government will check you for the first 5 years and if they determined you do not live there for the minimum 6 months, the penalty imposed will be 20% of the value of the property. Effectively, that is the imposition of a sales tax when you buy the home. You then have an annual property tax between 0.4% and 0.7% of a property’s fiscal value (valore catastale), the rate being decided by the local municipality according to a property’s size.

The tax reforms that have begun post-2016 are already creating political unrest. A change in the inheritance tax on top of the changes in 2017 to the property tax threatens to undermine the real estate market and that will come back and further bankrupt the banks. It is simply beyond the contemplation of how these people in power only look at their theories and are so desperate for taxes, they are blind to the consequences they are setting in motion.

Unfortunately, 2021 will be 3 waves of 51.6 years from when in 1866 Victor Emmanuel allied himself with Prussia in the Third Italian War of Independence. He eventually entered Rome on September 20th, 1870 and set up the new capital there on July 2nd, 1871. The next wave brings us to 1918 which is the final unification of Italy when the Terre irredenta joined the Kingdom of Italy. Going into the next wave is when you had the National Front (Fronte Nazionale, FN) form which was a neo-fascist political party in Italy during 1967. The peak of that wave was 1970, which marked the National Front’s failed coup attempt launched in December 1970, with the group disappearing soon afterward. This brings us to 2021 for the peak of the next wave. Each wave has brought political change so we are more likely to see a crisis unfold in Italy and this may lead to the crisis in the Euro.

Unfortunately, 2021 will be 3 waves of 51.6 years from when in 1866 Victor Emmanuel allied himself with Prussia in the Third Italian War of Independence. He eventually entered Rome on September 20th, 1870 and set up the new capital there on July 2nd, 1871. The next wave brings us to 1918 which is the final unification of Italy when the Terre irredenta joined the Kingdom of Italy. Going into the next wave is when you had the National Front (Fronte Nazionale, FN) form which was a neo-fascist political party in Italy during 1967. The peak of that wave was 1970, which marked the National Front’s failed coup attempt launched in December 1970, with the group disappearing soon afterward. This brings us to 2021 for the peak of the next wave. Each wave has brought political change so we are more likely to see a crisis unfold in Italy and this may lead to the crisis in the Euro.