Can European Sovereign Debt Really Crash Without a Free Market?

QUESTION: Hi Marty,

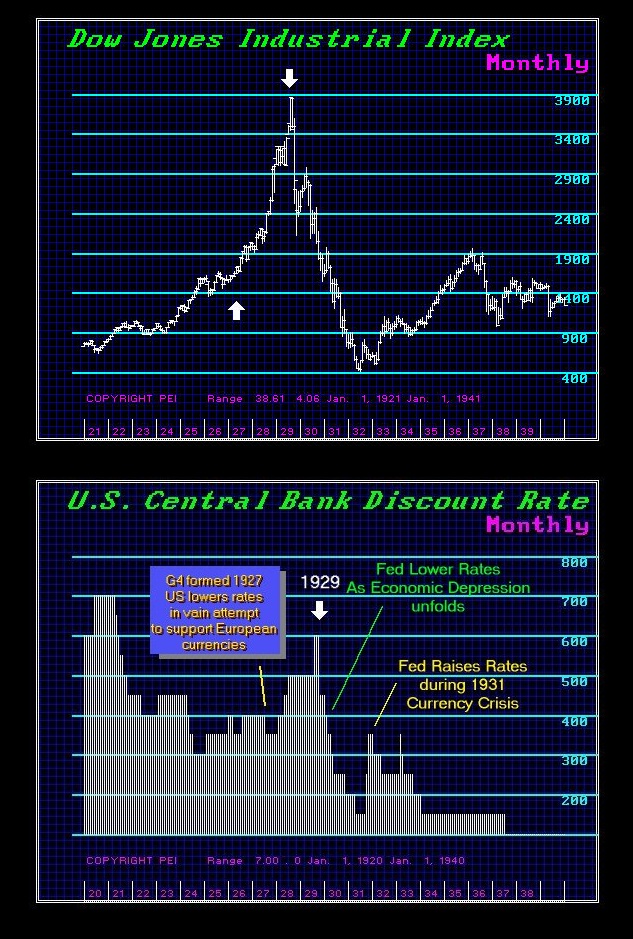

When the stock market crashed in 1929, followed by the bonds into 1933, we saw a minor bump in the stock market. As this occurred during a Public Wave, are u suggesting during our current Private Wave, we will see bonds collapse first 2020+, as capital flees into the stock market for a peak in 2022/2023? How will European bonds collapse when the ECB continues QE? Or will the catalyst be one or two large bank ( DB), or country failures (Italy), or Brexit?

Who ranks in importance?

Thank you?

ANSWER: One of the fascinating aspects of what we face is clearly the sovereign bond markets. The ECB and the Bank of Japan fund their government debts without end, and they have both destroyed their bonds markets. I will have to run back to Europe because things are just getting really crazy there. The ECB cannot sell the bonds it has already bought. They have already stated that as bonds mature, they will reinvest that money aside from any new purchases because there is no market. Since they have destroyed their own bond markets, we are UNLIKELY to see a crash if there are no bids and offers. They will simply pretend that sovereign debt is perfectly fine.

What we should expect to see is private sector debt decline as rates rise. The premium of private over government will widen simply because the government debt is not a free market number. I can say that there are a lot of people in various governments who are contacting us these days. This shows there are people who are deeply concerned that this is not going to end very nicely.

As far as which is more serious, BREXIT or an Italian exit, it will be the latter and not the former. Why? Italy was a founding member of the euro and it uses the euro. Therefore, Britain never joined the euro thanks to Maggie Thatcher. Italy leaving the euro will be far more devastating to the euro itself and will complicate matters since the ECB is saturated with Italian debt. There are a lot more ties that have to be cut besides trade, as is the case in Britain.