London Property Market

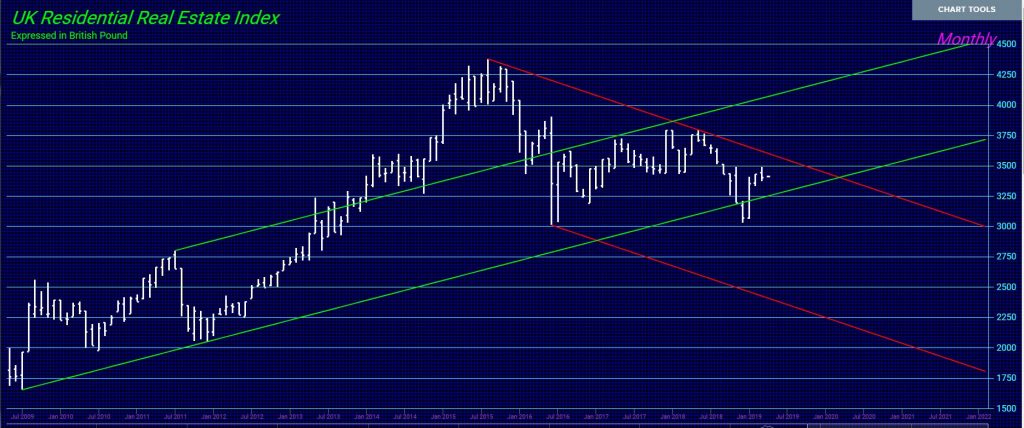

COMMENT: I just wanted to say how amazed I am at Socrates. The Nationwide Building Society (real estate) here in Britain has confirmed that London was the worst-performing region in Britain and has declined now for 7 years. Just wanted to thank you. I sold out and you probably saved my marriage. My wife disagreed but now she is very happy and wants to shake your hand in Rome. I can’t wait for Socrates to go public.

Cheers from sunny London

SH

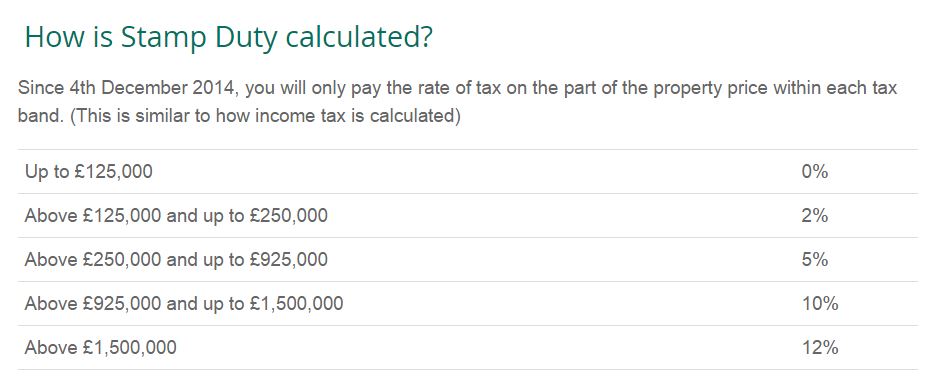

REPLY: The biggest problem with London real estate has been the change in taxation to supposedly make the property more accessible to lower income. What’s next? We devalue the stock market to 1% so people on welfare can invest? This all means that the government deliberately wanted to create a bear market with a real estate crash. The stamp duty was really abusive. It is hard to see where London property could survive after that.

REPLY: The biggest problem with London real estate has been the change in taxation to supposedly make the property more accessible to lower income. What’s next? We devalue the stock market to 1% so people on welfare can invest? This all means that the government deliberately wanted to create a bear market with a real estate crash. The stamp duty was really abusive. It is hard to see where London property could survive after that.

The London housing market sales began to crash from the peak in the Economic Confidence Model 2015.75 as reported in November 2015. Values crashed by 11.5% in the first month after the turn of the ECM. Landlords were joining together to challenge the Conservative’s (i.e. Tory’s) tax hike by filing a suit in the high court against their tax increase on “buy-to-let” investment properties. In July 2015, we warned that the Conservatives were going after the non-domiciled residents in London and that would stop the real estate boom.

The London housing market sales began to crash from the peak in the Economic Confidence Model 2015.75 as reported in November 2015. Values crashed by 11.5% in the first month after the turn of the ECM. Landlords were joining together to challenge the Conservative’s (i.e. Tory’s) tax hike by filing a suit in the high court against their tax increase on “buy-to-let” investment properties. In July 2015, we warned that the Conservatives were going after the non-domiciled residents in London and that would stop the real estate boom.

When the figures came out, they showed that the number of homes bought over the previous year crashed by 40% between March 2017 and March 2016. That was a drop from 173,860 to 102,810 properties sold. “That was thanks to new stamp duty rules introduced at the beginning of last April, which hiked stamp duty on second homes and led to a buying frenzy just before the rules were introduced,” reported Emma Haslett.

The biggest problem with these politicians who have attacked real estate, once the impose these crazy taxes, they do not lift them. Consequently, they tend to create a protracted bear market that can go for decades. Property investment shifted to the USA where they did not follow that socialist path against real estate as took place in Canada, Australia, and New Zealand. As the currency declines, prices will find a bottom. But they will have to decline to compensate for the tax increases.