Fannie & Freddie to go Public in 2020?

QUESTION: Hi Martin ! always wondered What would be the outcome of Fannie/ Freddie going private ? they have been trying this for years, but now looks like they are giving it another try and may be successful under the guise of ” protect the taxpayer ” …. what do you think will be the ramifications especially for real estate REITS and MREITS as well as homeownership going forward .

Thank you

JD

ANSWER: Fannie Mae and Freddie Mac are two companies that are in the longest conservatorship perhaps on record. Because the law governing these agencies is separate from banking conservatorship law, judges have largely done nothing about Fannie and Freddie shareholder complaints to date. The government’s 2012 net worth took all of the money that they said was worthless back in 2008-2011 that was on the balance sheets. Keep in mind that FHFA was acting as conservator when this was all agreed.

Fannie Mae and Freddie Mac will be allowed to retain capital, but the Senior preferred securities purchase agreement will be amended and the lawsuits will be settled in order for the companies to go to the public markets and raise new money via selling new equity to investors. They would like to do an IPO by 2020. After the balance of the senior preferred gets written off, the warrants will be exercised and the junior preferred will likely equitize some or all of their shares to help facilitate the recapitalization of Fannie Mae and Freddie Mac. There will be risks that include higher capital requirements, a shorter timeline to recapitalization, more CRT/STACR deals, more regulation and/or lower guarantee fees.

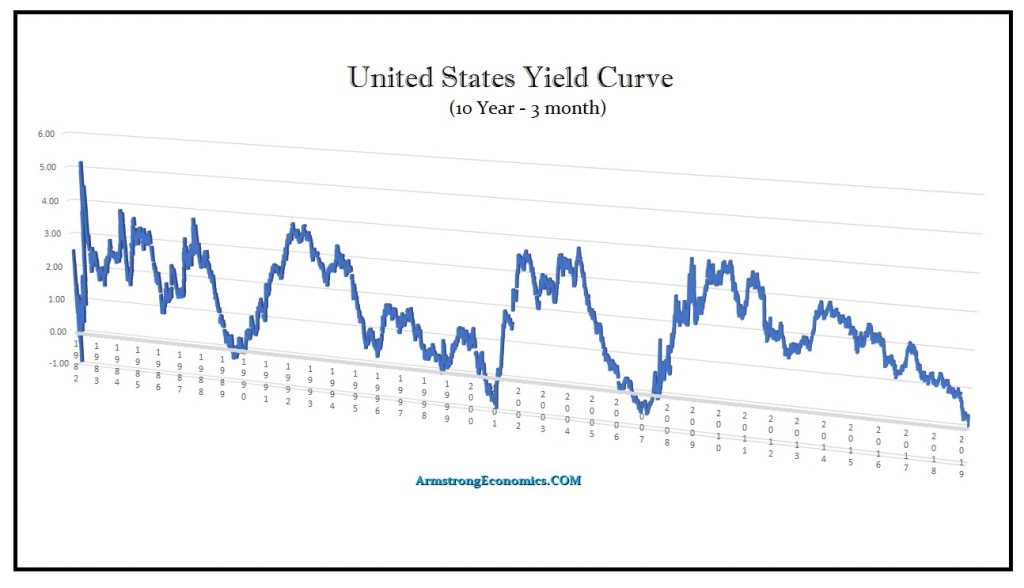

Moreover, we face a period where the interest rate is going to enter a major divergence. Central banks will be forced to create interest rate caps on sovereign debt, assuming people will buy them at these low rates of under 3%. This all hinges upon confidence. When we begin to see economic stress in the sovereign markets, such as in Europe with the ECB unable to stop QE, sovereign rates will become merely artificial and irrelevant. The ECB moved to negative interest rates but that did not lower private interest rates.

Expect divergences as we move forward into the next cycle which will peak in 2024. Expect wild movements ahead on the yield curve as well.