Capital Flow & War

QUESTION: Marty, at one of your WEC events during the nineties, if I remember correctly, you had said that your capital flow analysis revealed that the dollar rises during European and Middle Eastern wars and declines with North American wars. Could you refresh my memory on that?

I will see you in Shanghai. Never been there. Looks like it will be a very interesting conference.

Cheers;

KL

ANSWER: Nice to hear from you. Yes, your memory is not bad. Capital Flows are very distinct. Capital will always seek to move away from a war zone. In the case of Europe, it was the massive capital outflows from Europe which fled to the USA for both World War I and World War II. The USA was near-bankrupt in 1896 when JP Morgan came to the rescue. That is what made the USA the financial capital of the world. The same was true of the Suez Canal Crisis.

The Arab–Israeli War of 1948 broke out when five Arab nations invaded the territory in the former Palestinian mandate immediately following the announcement of the independence of the state of Israel on May 14, 1948. I hate to point out but 2020 will be 72 years from that event. This was followed by the major devaluations of currencies against the dollar – i.e. British pound. During the Cuba Missile Crisis (October 16-28, 1962), the currencies were fixed. The capital flows still managed to cause the British pound to rally from $2.78 to $2.81.

In the case of the Gulf War (August 2, 1990 – February 28, 1991), like Russia and the Lebanese War, our computer was picking up the capital flows which were indicating there was something brewing in the Middle East. You can easily see that the Euro began to spike upward in advance of the August 2, 1990, Iraqi invasion of Kuwait. In this case, it was the USA which was the invading force and thus was intimately involved in the war. Hence, the dollar declined compared to rising with World Wars I & II and other events not involving the US as the aggressor.

Even for 911, the US government used our study to identify the capital which was strategically moving in advance to profit from the attack. Later, the National Commission on Terrorist Attacks Upon the United States (also known as the “9/11 Commission”) conceded that there was highly unusual trading activity in the airline stocks of American and United prior to September 11, but they tried to play it down as coincidence to discourage these further strategies. The capital flows clearly reflected sharp movement in advance which was international, not domestic.

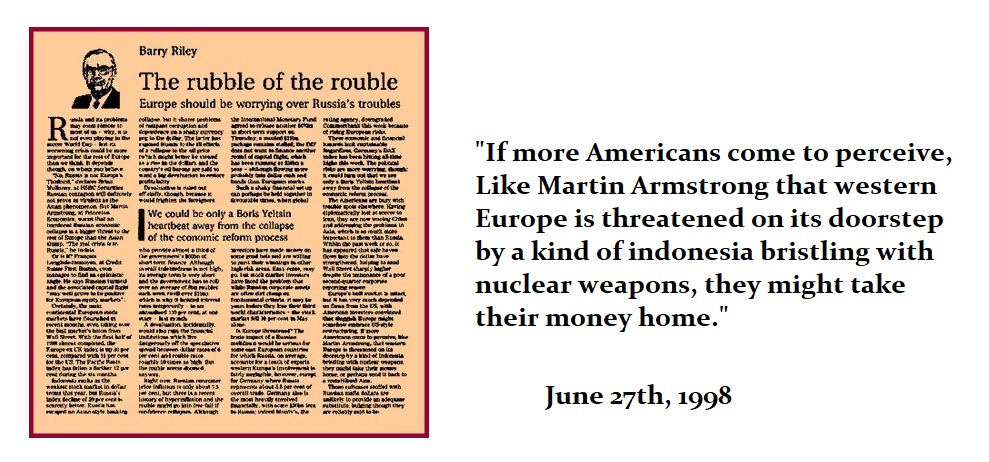

It was our Capital Flow models that forecast the collapse of Russia back in 1998. We were able to forecast that event which turned into the Long-Term Capital Management crisis because the “club” was all on the same trade – buying Russian bonds expecting the IMF to always bail out Russia so it was a “guaranteed trade” and they ignored risk. That led to a massive liquidity crisis where they began selling assets everywhere to raise money to cover losses in Russian bonds they could not sell.

It was our Capital Flow models that forecast the collapse of Russia back in 1998. We were able to forecast that event which turned into the Long-Term Capital Management crisis because the “club” was all on the same trade – buying Russian bonds expecting the IMF to always bail out Russia so it was a “guaranteed trade” and they ignored risk. That led to a massive liquidity crisis where they began selling assets everywhere to raise money to cover losses in Russian bonds they could not sell.

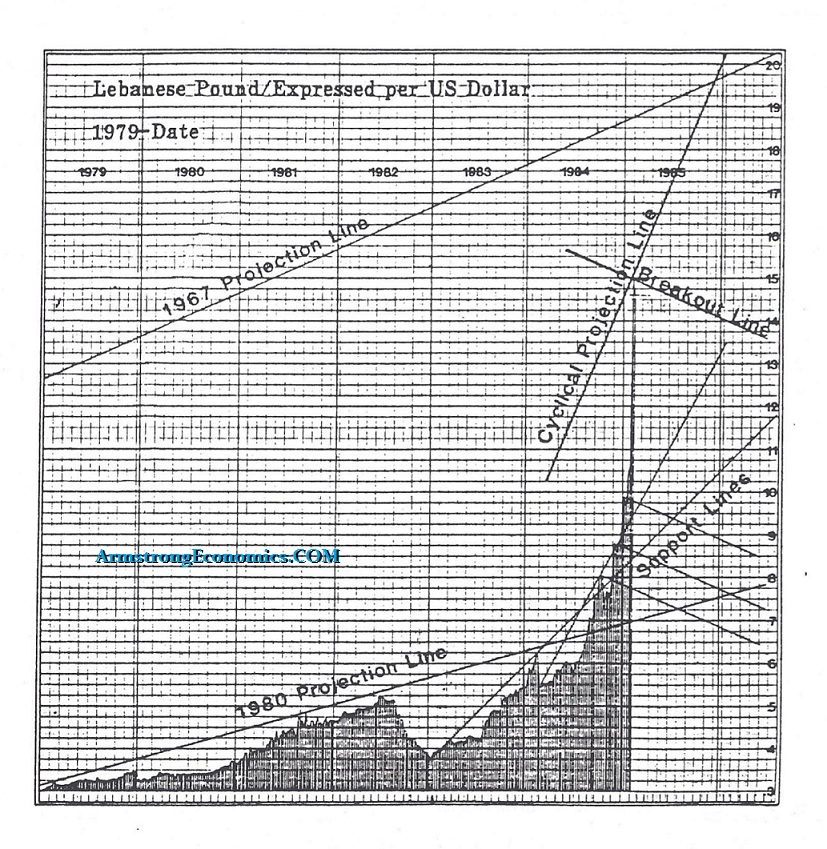

I have told the story at various WEC events how I stumbled upon this relationship. We had a client back in the 1980s which was a major bank in Lebanon. They found a ledger with the price quotes each day of the Lebanese pound back into the mid 19th century. They asked if we could create a model on their currency. We fed in all the data and the computer came back and forecast that Lebanon would fall apart in 8 days. I thought there was something wrong. I told the client what the computer forecast and they very calmly asked, what currency would be best? I was stunned. They obviously knew something was brewing. The computer was correct to the very day.

Then a Saudi client was one of the biggest shipping companies with very high political connections. He called and said that Iran would begin attacking shipping in the Gulf and asked what gold would do?

I began to realize that people with inside information moved money in advance of geopolitical events some to profit, and others to avoid losses. This is what the computer picks up. It does not identify the person.