The King of Wall Street Dies at 86 – John Gutfreund

The man who made Wall Street famous was John Gutfreund, which he always pronounced as GOOD-friend, has died at the age of 86 who became known as “King of Wall Street” back in 1985 for building the Investment Bank and bond trading house of Salomon Brothers into the number one underwriter in the world, the number one market-maker and trader of the most profitable investment-banking firms ever to have existed from trading. Gutfreund assumed control of Salomon in 1978. He agreed to sell Salomon in 1981 for $554 million to Phibro Corp., a publicly owned commodities-trading firm that had benefited from gold, silver, and rising oil prices as inflation spiked in the late 1970s. Gutfreund was deposed as head of Salomon Brothers after the 1991 trading scandal of manipulating the US government Treasury Auctions.

Gutfreund was a trader with a good nose for the market – that “feel” so necessary to stay on top. John Gutfreund joined Salomon as a statistics trainee in the mid-1950s, and per request of Billy Salomon, Gutfreund became his golf partner. It was this friendship that allowed Gutfreund to quickly climb the corporate ladder at Salomon Brothers. He was named partner at the young age of 34, and then took over the firm at 49 becoming the CEO. He transformed Salomon from a traditional bond-trading firm into a completely new breed. It was Salomon Brothers that also pioneered the businesses of mortgage-backed securities, under Lewis Ranieri. He also saw the value of computers and sought to create computer-driven trading techniques promoting that venture under John Meriwether, his bond trader extraordinaire, which would later blow-up as the Long-Term Capital Management disaster of 1998. Salomon Brothers also became the largest underwriter of municipal bonds, the department where Gutfreund got his start in trading cultivating his “nose” for the trend. Over time, a good trading will lose the emotions and see the world in black and white. Michael Lewis wrote in “Liar’s Poker,” based upon his 1989 account of working at Salomon about Gutfreund: “He was the last person a nerve-racked trader wanted to see.” He was also famous for teaching traders telling them to come to work “ready to bite the ass off a bear” every day.

Gutfreund also transformed the traditional private partnership that dominated Wall Street into the real first public corporation. This was a major departure. Even Loyd’s of London put together groups of people to share the risk of venture. It had been a private trading club generally and not something that was a public corporation. So it was indeed Gutfreund who was the pioneer in taking a risk-based business and institutionalizing it into mainstream.

Market manipulation was the name of the game in the commodity world. The takeover of Salomon Brothers by Phibro would indeed alter the course of Wall Street forever. The company known at first as Philipp Brothers was founded in 1901. It was later acquired and became the Philipp Brothers Division of Engelhard Minerals & Chemicals Corporation, the major gold refinery of 1967. In 1981, the company was spun off as Phibro Corporation, and that same year the company subsequently acquired Salomon Brothers, creating Phibro-Salomon Inc. Phibro Energy, Inc. was established in 1984, absorbing the oil department of Philipp Brothers. There was a rather famous connection between Marc Rich (1934 – 2013) and PhiBro. Rich once worked for Philipp Brothers, but left the firm in 1974 to set up a Swiss operation known as Marc Rich & Co. AG, which would later become Glencore Xstrata Plc. Rich was indicted for tax evasion and never returned to the USA, staying in Switzerland. Bill Clinton not only repealed Glass Steagall for Goldman Sachs, he also granted Marc Rich a controversial pardon.

In 1981, commodity trading firm Phibro Corporation acquired Salomon Brothers, which was founded in 1910 by three brothers along with a clerk named Ben Levy. In 1978, John Gutfreund rose as the head of Salomon Brothers, which had remained a partnership. Gutfreund was now selling the firm to the huge commodity firm Philips Brothers of Marc Rich fame, known as Phibro on the street. This takeover was right in line with the major high on the Public Wave that peaked at 1981.35. Yet, Gutfreund rose from the ranks as a bond trader to seize on the reversal of fortunes to oust David Tendler in 1984.

PhiBro were great traders coming from the commodity markets. They had conquered the world in 1980, shorting gold, silver as well as oil, and thus were now trying to buy Salomon Brothers when they were at the top of their cycle. Gutfreund became a co-CEO with Phibro’s David Tendler. The currency swing following 1981 was dramatic from a percentage basis. Neither PhiBro nor Salomon Brothers comprehended what was going on internationally regarding capital flows. They got caught in this new pendulum swing with extremely high volatility. The commodities crashed and burned, and the tables were turning. This shifted the profit base from PhiBro now to Salomon Brothers. Gutfreund now seized control and started to expand the firm into the currency trading, and enlarged the firm’s positions in underwriting and share trading. Salomon Brothers was now also trying to expand into Japan, as well as Germany and Switzerland. Gutfreund renamed the company Salomon Inc., and used Phibro to expand capital base of Salomon to boost profits.

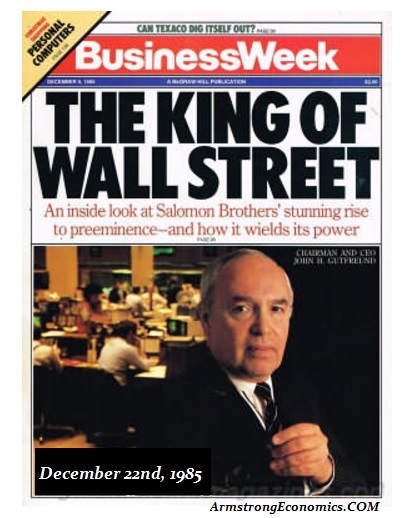

Gutfreund broadened Salomon’s client services and its global presence by creating a mortgage-securities unit, moving into mergers and acquisitions, building its foreign currency-exchange operation and opening offices in Tokyo, Zurich and Frankfurt. Salomon’s capital grew dramatically from about $200 million exploding to $3.4 billion when Gutfreund seized control. This is when BusinessWeek magazine put Gutfreund on its cover in 1985 with the headline: “King of Wall Street.”

It was October 1981 when Goldman Sachs purchased J. Aron & Co. for $135 million in an effort to compete with Gutfreund with the Salomon-Phibo merger. Its current head, Lloyd C. Blankfein, came from J. Aron and has now focused Goldman Sachs as a mean, lean, trading machine.

The competition between these two Jewish firms fueled Wall Street’s evolution. Leading up to 1980, Sidney Weinberg (1891-1969) at Goldman Sachs brought in his heir that perhaps began the desire to cultivate contacts within government. In 1968 Henry Fowler (1908-2000), former Secretary of Treasury, was recruited. It was Fowler who opened those political doors in a host of different nations, however it was Gus Levy (1910-1976) who was the aggressive one, pushing the firm into taxable bond dealing expanding from commercial paper. From 1969, Goldman Sachs now moved into the bond market.

Salomon Brothers was taking market share away from Goldman Sachs. The decision to get back into proprietary trading appears to have been from Steve Friedman and Robert Rubin to be competitive with Salomon. Goldman Sachs was still hesitant sitting, to a large extent, watching trading profits grow at Salomon, and that was the trend at Morgan Stanley, First Boston, and of course Merrill Lynch.

The October 1981 takeover by Goldman Sachs of J. Aron & Co. altered the culture within the firm. From that point onward, Goldman would also drift toward becoming a lean, mean, trading machine bent on proprietary trading.

Many assumed that Gutfreund was the real model for Tom Wolfe’s 1987 novel “Bonfire of the Vanities,” which he denied. Nevertheless, this perhaps contributed to Gutfreund beginning of the end. Some of the traders in the firm became arrogant. The power clearly went to their heads for the famous line from Lewis’s book that lives on, was what they called themselves – “big swinging dicks.”

Yet the idea of creating first private mortgage backed security actually began there at Salomon Brothers during the 1980’s. It was in 1987, when Ronald Perelman, the head of Revlon Inc., attempted to buy a 14% stake in Salomon. Gutfreund feared Perelman and to counter that move, he sold a 12% share to Warren Buffett’s Berkshire Hathaway Inc. for $700 million to discourage hostile takeovers on September 28th, 1987. This is the link between Buffett, Salomon, and his trading silver with Phibro.

It was that fateful year of 1991 when Salomon admitted it had violated U.S. Treasury Department auction rules by placing orders for securities in the name of customers who hadn’t authorized them. The audacity to manipulate government bond auctions was gutsy to say the least. Paul W. Mozer, then the head of government bond trading at Salomon, served four months in federal prison for lying to regulators.

Trader Paul Mozer, who had a 12-year career at the firm coming from Morgan Stanley, allegedly submitted illegal bids for U.S. treasury securities in August of 1990, attempting to corner the market by purchasing more than the 35% share allowed per individual transaction. Yet, what he eventually plead guilty to was based on only two transactions in the five-year notes on February 21, 1991 for $6 billion, which was $2 billion more than the bank was allowed to buy. The plea did not match the events.

Other Salomon employees would later tell the NY Times they were shocked:

“This was not driven by personal gain, if this is true. There’s a game here. And it was a desire to win the game.” Mozer’s supervisor, John Meriwether who started and blew up Long-Term Capital Management in 1998 requiring a Fed bailout his hedge fund with a position of nearly $100 billion. Meriwether, at the time in Salomon, claimed to have chastised Mozer for the manipulation when it came to his attention, but he did not fire Mozer raising serious questions about the trading culture overall inside Salomon Brothers.

Shortly before the Salomon Bros. scandal erupted, Paul W. Mozer must have been aware that the Treasury knew about the trade and there would be ramifications. Before the announcement by Salomon Brothers on August 9th, 1991, Mozer then sold about $1.7 million worth of Salomon stock, which was about 46,000 shares, confirmed by the firm. The government froze the funds for it smelled like insider trading in the real sense.

Salomon Brothers and Mr. Mozer’s lawyer said that Mr. Mozer had offered to reverse or rescind the sale. Salomon’s stock price sank sharply after the scandal was revealed. Mozer’s lawyer denied that any violation of insider trading laws had occurred. To this day, Paul Mozer is entirely omitted from Wikipedia – very strange – and it tends to suggest that he was by no means acting alone.

The President of the NY Federal Reserve at that time was NOT in the pocket of the bankers. The Fed sent a letter that was pointed and demanding. The letter was signed by an executive vice president of the bank, but it was clear, Edward Gerald Corrigan (born 1941), was pissed off and stood behind every word. Corrigan by then knew enough to become incensed by these schemes on his watch. The letter said that Salomon’s bidding “irregularities” called into question its “continuing business relationship” with the Fed and pronounced the Fed “deeply troubled” by the failure of Salomon’s management to make a timely disclosure of what it had learned about Mozer. Corrigan demanded a comprehensive report within ten days of all “irregularities, violations, and oversights” Salomon knew to have occurred. The real interesting factor that demonstrated the more-likely-than-not involvement of everyone right up to Gutfreund was the fact that Gutfreund failed to inform the Board of Directors, including Buffett, that the Fed had even sent such a letter.

Gutfreund was criticized for failing to notify U.S. regulators quickly enough about Salomon’s fake bids and manipulation practice. Gutfreund then resigned from the firm, with Buffett taking over as chairman for nine months. Gutfreund paid a $100,000 civil penalty and was barred from serving as chief executive of a securities firm. Salomon was acquired in 1997 by Travelers Group Inc. for $9 billion and now is part of Citigroup Inc.

Gutfreund’ reputation was destroyed, but there were a half-dozen general partners who were also let go at the time which included Michael Bloomberg who founded Bloomberg news, and then served three terms as New York City mayor. He did not leave empty handed. He left with $10 million to ease his pain of being fired. It was Gutfreund who had hired Bloomberg with his MBA when he was desperate for a job.

There is no question that Gutfreund deserved that title “The King of Wall Street” since he shaped it into what it is today, good, bad, and indifferent. This aggressive trading culture that emerged was perhaps inspired by Gutfreund which has led the world into all sorts of trading scandals and manipulations with numerous fines. None of this has had much class and the ethics degenerated far beyond Gutfreund ‘s time at the screens. This aggressive manipulating culture has now run its course and the cycle has changed direction. Banks are shutting down their proprietary trading desks. Everything became way too careless.

The fact that the Fed came down on Salomon Brothers and was shutting them down threatening to take their primary dealer license away, inspired Goldman Sachs to do a reverse takeover of government. The repeal of Glass-Steagall Act, also known as the Banking Act of 1933 (48 Stat. 162), was to prevent the very thing that Goldman Sachs was involved in during the Great Depression. The stock in Goldman Sachs Trading Company crashed more than anything falling from $326 to $1.75, it was intended to prohibit commercial banks from engaging in the investment business. It was enacted as an emergency response to the failure of nearly 5,000 banks during the Great Depression. The accusations that Goldman Sachs had engaged in share price manipulation and insider trading contributed to the firm becoming the target of jokes in Vaudeville.

Stephen Friedman and Robert Rubin took over the role of managing Fixed Income where they planned to expand into proprietary trading.

Stephen Friedman and Robert Rubin took over the role of managing fixed income where they planned to expand into proprietary trading. Goldman Sachs moved into quantitative analysis in the late 1970s, relying still on academics. It was Freidman and Rubin who changed the culture creating the trading profit bonus and starting in 1986, Goldman Sachs began to take talent from Salomon offering a huge bonus structure and adopting the trading mentality it now acquired from J. Aron & Co.

In 1986, Goldman Sachs hired Fischer Black of Black–Scholes, famous for valuing

stock options. It was Rubin who brought in Black, and the problem they had was the newly embedded options within debt. However, the issue they did not understand, that they were now walking into, was there is a great language problem between traders and programmers. You MUST be good at both, or you are screwed.

Goldman Sachs, the most profitable firm in Wall Street history, moved its headquarters to a new 43-story skyscraper at 200 West St. in 2010 after almost three decades at 85 Broad St.

Stephen Friedman, former CEO of Goldman Sachs, resigned as Chair of the Federal Reserve Bank of New York on May 7, 2009 Friedman was criticized for apparently at least creating an unethical image of benefiting from his role as Chair of the New York Fed branch due to the federal government’s aid to Goldman Sachs in recent months. Amazingly, Friedman remained on the board of Goldman even as he was supposedly regulating Goldman. Like Hank Paulson Secretary of the Treasury, Friedman also applied for, and got, a conflict of interest waiver from the government. Who gives out such waivers is unknown and why they are not done openly in Congress is obvious. Friedman was also supposed to divest himself of his Goldman stock after Goldman became a bank holding company, but thanks to the waiver, he was allowed to go out and buy 52,000 additional shares in his old bank, leaving him $3 million richer. Being exempt from insider trading is a government benefit. Friedman’s eventual resignation announcement came within an hour of the government’s release of the 2009 stress tests for 19 U.S. financial institutions. It was effective immediately.

Goldman Sachs, the very firm who was the worst example from the Great Depression crash, led the charge against the trend to take over government. They installed Robert Rubin under Bill Clinton as Secretary of the Treasury. Ironically, the very firm that inspired Glass-Steagall seized control of Congress with political donations to get it overturned. This began once again the age of Transactional Banking.

As one trader to another, Gutfreund was at the top of his game. It is just having a nose to smell the blood on the tape as we use to say. Perhaps we are a dying breed. He use to call me “kid” for when I was a market maker in the metals, I did my refining with Engelhardt. Phibro/Philipp Brothers was a division of Engelhard Minerals & Chemicals Corporation. It was always a small world. I sold a boat-load of silver forward to them the day of the high, January 18th, 1980. They remembered that trade very well.