Understanding the Global Market Watch

The Global Market Watch (GMW) is only an advisory tool. It is not something to trade on by itself. It is merely a system designed to be an alert. We were articulating this in the verbiage under “Pattern Recognition,” but it led to more confusion since it can be opposite of other models simply because it is purely pattern based. For this reason, we have eliminated this from the verbiage.

The importance of this model is rather significant. This model records patterns in all markets and then matches the current activity to a historical database of patterns. The GMW constantly adds patterns to the database should a newly discovered pattern emerge. This model is, therefore, proving that fundamental analysis is really pointless, for the same patterns will apply across all markets. The common denominator is, not the market, but how people react to the market. Just like BREXIT, markets move based upon ANTICIPATION and whatever people BELIEVE. Markets do not wait a few months to see how BREXIT might actually unfold.

The comment provided in the far right column is also DYNAMIC. It will change constantly for the Weekly to Yearly level, but remains fixed once that session is complete like a Daily level. The reason this changes constantly is because it assumes that whatever the time level is at that point it is complete. In other words, by Tuesday, it assumes that is it for the week. As the market moves, it is showing you simply what it WOULD BE at that point had the week, month, quarter, or year closed that day.

OPEN-HIGH-LOW-CLOSE COLOR CODE

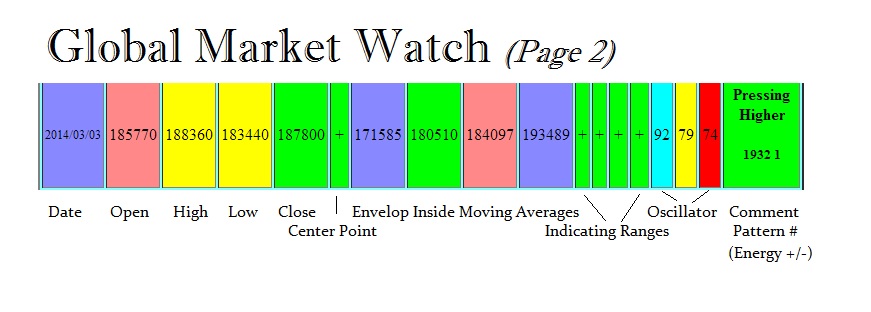

The first column is the date. Then comes the open, high, low, close.

Green implies that it was higher than the previous and red implies it was below. A close that is dark red implies it finished lower than the previous session and closed below the open, whereas light red would imply only one of those two conditions were met.

Conversely, the same would be true with dark green after closing higher and above the open, whereas light green signals only one of those factors is present.

We also use yellow for the high and low to indicate an outside reversal, which means it both exceeded and penetrated the previous unit’s price action.

We will use light cyan to indicate an inside trading session that failed to make a high or low beyond the last trading session. Closed sessions appear in dark blue.

COMMENTS COLOR CODE

The comment receives a color that is independent of the actual comment. This is based upon the Indicating Ranges. Therefore, if a market is above all four ranges, then they reside below as support and the color will be dark green. If the indicating ranges are at least above zero (neutral), then the color will be light green. Likewise, gray would be for absolute neutral. If the range count is below zero, the color will be light red. If at least three or more ranges are negative then the color turns dark red.

Therefore, something can read bullish but it may be red to warn that there is important overhead resistance and the rally may be more of a reaction. The color reflects if you are above or below support, and that is independent of the comment that allows you to qualify that move. Hence, a bullish indication with a dark green color would be more bullish from a trend perspective than a bullish with a dark red background as it warns that this is just a rally.

The color will change to yellow for patterns that often produce turning points like highs and lows. The cyan color is used when there is something to pay attention to.

ENVELOPE

The envelope is generally a 3% +- move from current levels; 6% for weekly and about 20% for monthly or higher. Markets generally trade within this envelope. When they tend to move above or beyond, they are often making an extreme move. Within the envelope, you will find P1 and P2 which are moving averages.