Slingshot v Phase Transition

QUESTION: You’ve just mentioned there remains a chance for gold to perform a slingshot move downward and then up in January. Does it still appear the Dow will slingshot (make a new low) also even though it has recently broken to new highs?

S

ANSWER: We achieved the slingshot in the S&P and the NASDAQ, and I have previously warned that we did not need to do that in the DOW. Still, there are fractal slingshot moves that take place on daily, weekly, and monthly levels. We do not need to accomplish that in the stock market. However, since this is 2016, which is 7 years up from the low, there is a risk of a temporary high and what might appear to be a correction in 2017. However, this need not be a slingshot insofar as penetrating the 2016 low. The majority of people are bearish already. Therefore, we can coil and build a based for a Phase Transition.

However, keep in mind we are running out of time. This in itself is rather serious because we may not have time before the explosion unfolds. These four political elections from hell are illustrating a problem with confidence in government. That collapse in public confidence will send the herd stampeding into private assets.

The difference between a SLINGSHOT and a PHASE TRANSITION is rather significant.

The SLINGSHOT typically fakes everyone out by first moving in a false direction and then swinging back to new record highs or lows. The fuel to create such a move traps people on the wrong side and then they fight it. For example, when everyone just sits with positions and prays for new highs, they lack the buying power to keep the trend moving and everyone wants to sell the new high to make a profit or break even. That typically results in just a water-torture test that slowly eats away at those long positions.

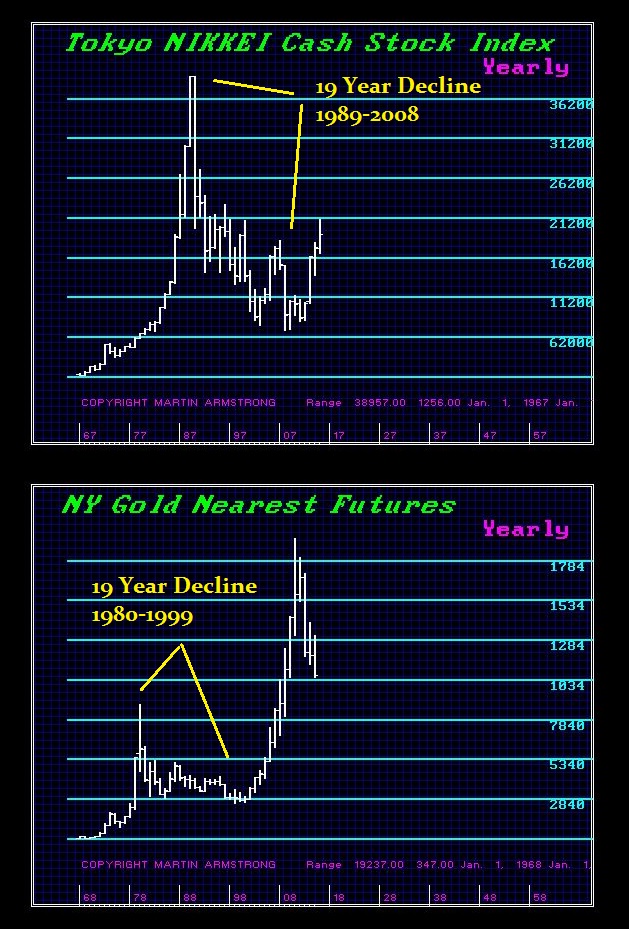

It is a classic pattern for bulls to refuse to admit a mistake, thereby causing a 19-year bear market. This was the primary reason why the NIKKEI could not recover in Japan. Everyone was long and waiting for the rally so could sell just to break even. I know real estate agents in New Jersey who say if the price of the average home ever went close to 2007 levels that half the state would be up for sale. This is simply how ALL markets trade be it gold, stocks, or real estate. This appears on a worldwide basis regardless of culture or the century. This is simply how human nature responds. People will cling to their mistakes for a very long time before they throw in the towel.

So yes. Unless gold can close above 1362 on a monthly basis, the risk of a slingshot move still exists. Of course, the goldbugs will say that could never happen. They are no different from the Japanese who refused to believe the NIKKEI would make lower lows. But this is the actual mechanism that creates the breakout rallies. The greater the slingshot on the downside, the steeper the move on the upside.

This is simple physics. The more you pull back on the projectile, the further it will travel. Why has the US share market continued to rally yet the vast majority keep calling for a crash? This is precisely how a slingshot operates. The fuel to the upside is created by that false move which can last for several years. They are still fighting the market and trying to sell the high, but they are constantly forced to buy it back.

The most bullish position for gold would not be a rally, but a slingshot to the downside first. That will convince everyone it’s a bear market and then they will fight the rally exactly as they have done in the US share market. Then you will have the confirmation that it will move sharply higher. Without a slingshot, gold must coil to create the base for a Phase Transition. We should see what will unfold by January.

A Phase Transition is different. This is an explosive rally that emerges from a base that is akin to a spring. The tighter the spring is compressed, the greater the move to a new level. This is calculated mathematically by using the degree of energy that has been compressed. This is the basis of our Energy Models. When released, it simply explodes. This type of move often sucks everyone in and they expect it to be the norm.

Phase Transitions often alter the thinking of people so dramatically that they lose all reason. The Phase Transition in gold created the 1980 high on January 21, 1980, at $875, which unfolded in just 8.6 weeks. That simple brief period set in motion decades of people calling for the same thing over and over again. That brief Phase Transition convinced scores of people this was permanent and gold would soar to multiples of $1,000.

The collapse of Rome was also just 8.6 years. It is amazing how this frequency appears throughout history and has such a profound change to the upside or downside. We see the complete implosion of the Roman economy where the coinage was mostly silver to less than 2%. People hoarded money, so to pay the bills the only recourse was debasement. Taxes collapsed as did the economy just after the Emperor Valerian I was captured in 260 AD. By 268AD, his son Gallienus was assassinated and the coinage no longer resembled what existed pre-260 AD.

The Phase Transition in the Dow going into 1929 ruined the reputation of the leading economist and market commentator Irving Fisher (1867-1947). Three days before the high he announced, “Stock prices have reached what looks like a permanently high plateau.” The Phase Transition of the US share market into 1929 on a monthly level was 37.3 months (8.615 * 4.3). Likewise, on the weekly level, the overall final Phase Transition was also 13 weeks from 300.10 to 386.10. However, on the daily level, the final rally was a brief slingshot and from that low it was a 17.2-day rally (2 * 8.6) that created the major high at 386.10. Therefore, those final 17.2 days caused Fisher to proclaim a new permanent high level had been reached. This is the classic Phase Transition. Then, even as the market began to crash, precisely on the 34th day of that decline a temporary low formed which was four cycles of 8.6 days. He then announced that the market was “only shaking out of the lunatic fringe.” He coined a saying that has long since remained.

Thereafter, Fisher came to understand the mechanism that a rising currency increased the “real value” of debt and people could not service that debt, which resulted in a cascade of defaults. Nevertheless, the Phase Transition has a historical impact upon the thinking process of people. In Japan, it took 19 years to reverse that decline as it did in gold. In the case of the US stock market, it took 25 years to exceed that 1929 high. It was 19 years until 1948, which was the final fake low before the breakout rally truly began that was also 19 years. In the case of Europe, it appears it may also take until 2027 before any real life comes back into the economy once again.