Everything is Connected – Connecting the Dots

Trying to understand forecasting will be critical as we move forward. The HUGE turning point appears to be 2018 and that is most likely when things will start to come unglued. How do I even make such a statement? This is not a claim that I make based upon some gut feeling. I arrive at this statement not by looking at some domestic fundamental or speculation on what Trump might do or not. It is not based upon my contacts behind the curtain. This is simply looking at Socrates and nothing else.

So how do I arrive at that statement? It is the process of understanding that everything is connected. A share market in any country will rise if the currency declines to maintain its international value PROVIDED there is still a fundamental level of confidence in the country. If there was an invasion by another country, then no the currency and the share market would collapse because there would be a risk that the nation does not survive and thus there would be no rule of law to support asset values. Hence, we must look beyond the simple chart pattern on an isolated market to the external factors as well to determine the outcome. NO MARKET can be forecast accurately in isolation. Those who simply look at a single market can be correct in the same manner as a broken close is correct twice a day for one second. So we must look at a given market within its sector and then filter it through the lens of international currency.

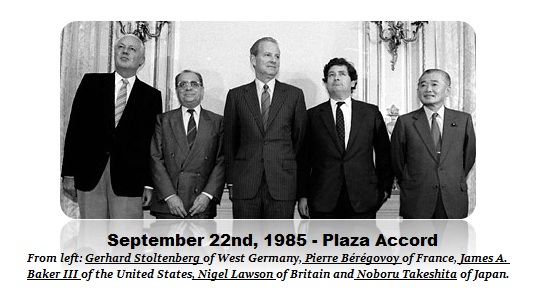

I have argued against the conspiracy theorists who claim gold is not up because it has been manipulated by the bankers. I have fought against the bank “real” manipulations and warned clients when they are in action. But the bankers are not capable of manipulating a market counter trend – nobody is. Japan tried to support the share market after 1989 and failed. We have had 8 years of quantitative easing by Mario Draghi without any success. Not even a central bank can manipulate the economy no less a single market. The entire Plaza Accord was the gathering of 5 countries to try to manipulate the dollar lower for trade. The US Treasury and Federal Reserve Bank could not pull that off. Why listen to such nonsense about gold is manipulated to prevent a rally? These types of nonsense PREVENT you from understanding how the world really works.

When I warned the White House back in 1985 that trying to manipulate the dollar lower creating the G5 would increase the volatility and lead to a crash in 2 years (1987), the White House responded and said they disagreed that volatility would increase.

When I warned the White House back in 1985 that trying to manipulate the dollar lower creating the G5 would increase the volatility and lead to a crash in 2 years (1987), the White House responded and said they disagreed that volatility would increase.

Of course, when the 1987 Crash hit, the Brady Commission was forced to request my work. My greatest accomplishment was to prevent them from taking crazy sanctions against the market players when the real cause was the G5.

I was advising under contract the equivalent of about 50% of the value of the US National Debt at that time. The Japanese to ease trade restrictions, had been buying US debt and owned bout 33% of the US national debt at that time. I warned the Treasury that to lower the value of the dollar by 40% as the Plaza Accord said that was their goal, this would set off a crash and higher volatility because foreign investors will be forced to sell and exit the dollar. Yes, the value of exports would look good to foreign consumers, but US assets would also look like a sell. The capital flows went crazy causing the 1987 Crash. Advising around the world forced me to see everything from everyone’s perspective. It is that connection that is the key.

I was advising under contract the equivalent of about 50% of the value of the US National Debt at that time. The Japanese to ease trade restrictions, had been buying US debt and owned bout 33% of the US national debt at that time. I warned the Treasury that to lower the value of the dollar by 40% as the Plaza Accord said that was their goal, this would set off a crash and higher volatility because foreign investors will be forced to sell and exit the dollar. Yes, the value of exports would look good to foreign consumers, but US assets would also look like a sell. The capital flows went crazy causing the 1987 Crash. Advising around the world forced me to see everything from everyone’s perspective. It is that connection that is the key.

Capital will move to the most advantageous location globally because we are all connected. Everything has an international value. We compare things in terms of value based upon our own currency and local markets. Currency is a MENTAL language. If you are American, you may go to Rome and the prices you will convert in your head to dollars just as a European will do the same traveling to the States. Capital will always move to the best spot globally for capital will act in its own self-interest.

Capital will move to the most advantageous location globally because we are all connected. Everything has an international value. We compare things in terms of value based upon our own currency and local markets. Currency is a MENTAL language. If you are American, you may go to Rome and the prices you will convert in your head to dollars just as a European will do the same traveling to the States. Capital will always move to the best spot globally for capital will act in its own self-interest.

On May 28th, 1997, again I wrote to then Robert Rubin who was Secretary of the Treasury. Rubin was doing the same thing that the Plaza Accord did in 1985 and trying to talk the dollar down criticizing the Japanese again all for trade. Our models were warning of another crash and indeed it hit within just a few weeks of my letter and became known as the Asian Currency Crisis. The Asian Currency crisis was a period of financial crisis that gripped much of East Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. Indonesia, South Korea and Thailand were the countries most affected by the crisis.

On May 28th, 1997, again I wrote to then Robert Rubin who was Secretary of the Treasury. Rubin was doing the same thing that the Plaza Accord did in 1985 and trying to talk the dollar down criticizing the Japanese again all for trade. Our models were warning of another crash and indeed it hit within just a few weeks of my letter and became known as the Asian Currency Crisis. The Asian Currency crisis was a period of financial crisis that gripped much of East Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. Indonesia, South Korea and Thailand were the countries most affected by the crisis.

It was Tim Geithner who responded in just 4 days.Our model has been well known behind the curtain for decades. When the Asian Currency Crisis hit, I was invited to China to meet with the central bank.

By monitoring the world, what emerges is the overall trend. Trump won not by some isolated fluke. We put that forecast out years in advance and it did not matter the flip-flopping polls or how much money Hillary spent. Our computer saw the trend forming decades in advance. The Catalonia voted in July 2016 to separate from Spain followed by BREXIT was showing you the global trend. Once you understand that NOTHING takes place in isolation, you can see the trend coming before it arrives.

Our forecast that gold would peak in 2011, the US share market would rally to new highs made back in 2011 that Barron’s thought was nuts, and that the euro would collapse, were all connected. If one unfolded, the other HAD to follow. Once you see that the world capital flows dictate the outcome of everything, then investing and trading becomes a lot easier. Gold could NOT have continued higher if the dollar was shifting and the capital flows were pointing back to equity. Plain and simple. Everything else is just an excuse.

So why do I try to teach people? Because I can say buy or sell. Most people will not do so unless they agree and/or have confidence in that conclusion. The way to invest securely demands you have confidence in you action. But there is something more at stake here. We are looking at the collapse in government structures – the fall of Socialism. This is simply unsustainable from an economic viewpoint. You can make $1 billion, but it will do no good if you live in a totalitarian state.

The move to electronic currency and to eliminate cash is all because government is collapsing. They are desperate for money to retain power. This is now an outright war – them against us. This is far more dangerous than people suspect.