Banking Insurance – The Real Risk Behind the Curtain

COMMENT: I’m sure you are aware but just highlighting that the ‘Assumption’ goes deeper than personal bank accounts, as this is ALSO the assumption taken by the clearers too! They assume that if one CCP fails then the others just pick it up. Obviously, given that then the stress tests are taken just for one bank failure they do not price-in the fact that there will be no bid for anything! As you say, this is obviously why the ECB is so vulnerable… Everything is fine until it is not…

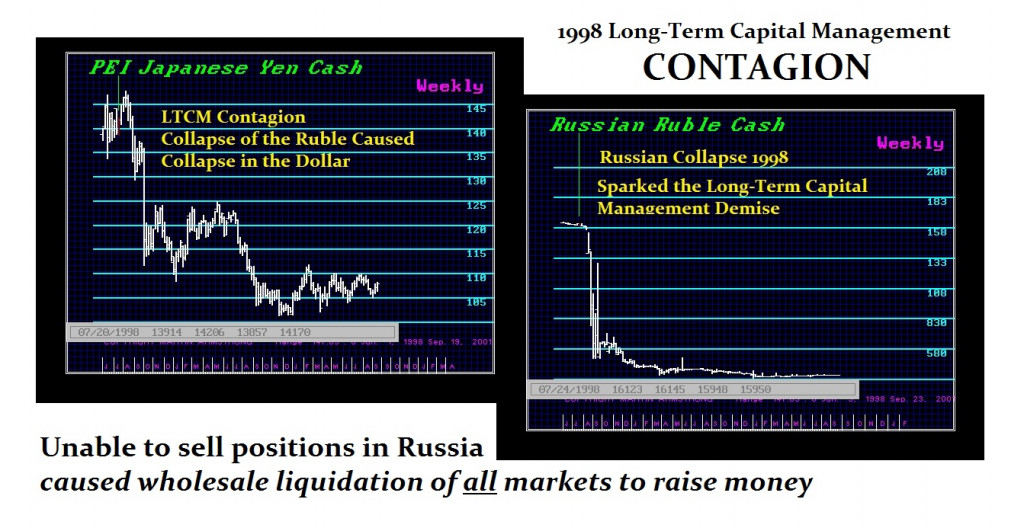

REPLY: You are absolutely correct. People do not understand that the “ASSUMPTION” for everything is a single failure and not a contagion as was the case in the S&L Crisis or the Long-Term Capital Management Crisis. For those who do not know what we call a “CCP” it is a central counterparty clearing house. Those who lack the experience of actually being behind the curtain in the financial industry are clueless as to what is really going on. We are extremely vulnerable far beyond what most people dare to consider. A banking crisis can take down a CCP in a contagion. That was why the Fed had to step in during the Long-Term Capital Management collapse. The markets will freeze when nobody knows who is acceptable counter-party risk.

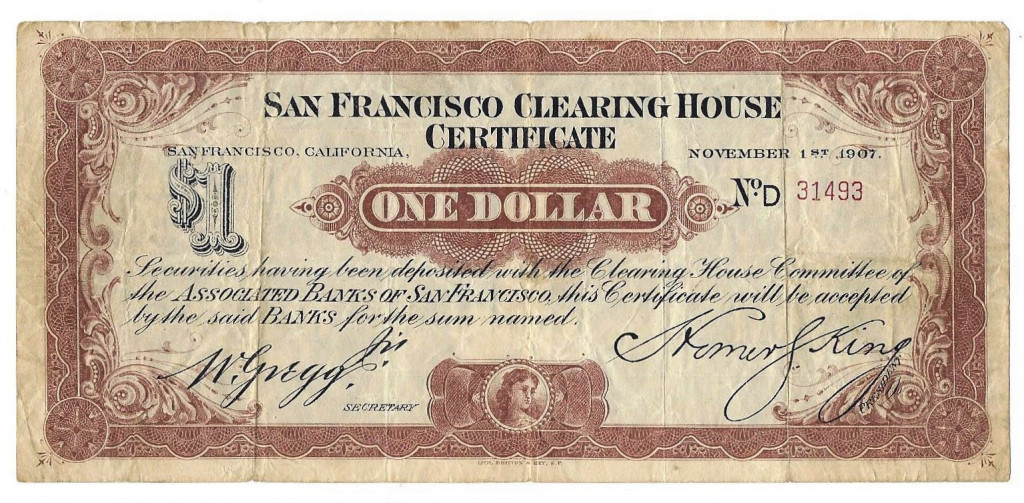

That was the entire reason elastic money was invented long before the Federal Reserve. The Clearing Houses issued their own money to enable trades to be settled. As the panic subsided, then the newly created money was redeemed and expired. Contagions froze the economy and liquidity vanished.

This is why we are introducing a RISK TABLE into our professional reports. Our greatest risk is a serious CONTAGION with the first crack exposed.

This is why I urge people to have cash outside the system enough for 30 days living expenses.