The Separatist Movements in Canada & One-Size-Fits-All of Marx

Many people are aware of the various attempts of Quebec to separate from Canada. What they are unaware of is the supporters of the Western Independence Party of Alberta. There has been an undertone of the separatist movement in Alberta which actually stems from the Great Depression usurpation of the Federal Reserve by Franklin D. Roosevelt.

Why is the Western Canada separatist movement caused by Roosevelt’s usurpation of the Federal Reserve? Everyone looks to the United States and assumes whatever structure they adopt must be correct. The Euro was crafted because the USA has a single currency. They did not consolidate all the debts and that has created a nightmare. Canada, likewise, assumed the one-size-fits-all policy of Roosevelt and has been paying the price regionally ever since.

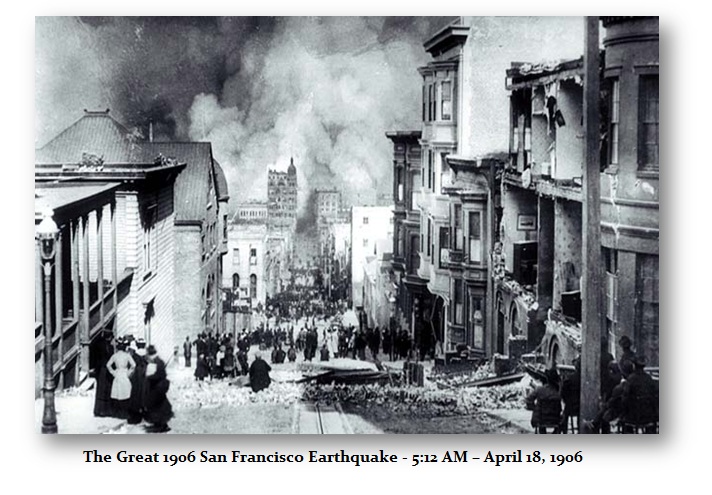

So what is the link with the structural usurpation of the Federal Reserve?  When the Fed was created, it was the solution to the Panic of 1907, which was set in motion by the disruption of the internal domestic capital flows caused by the San Francisco earthquake of 1906. The insurance companies were in New York. Consequently, the cash flowed to the West and a shortage developed in the East.

When the Fed was created, it was the solution to the Panic of 1907, which was set in motion by the disruption of the internal domestic capital flows caused by the San Francisco earthquake of 1906. The insurance companies were in New York. Consequently, the cash flowed to the West and a shortage developed in the East.

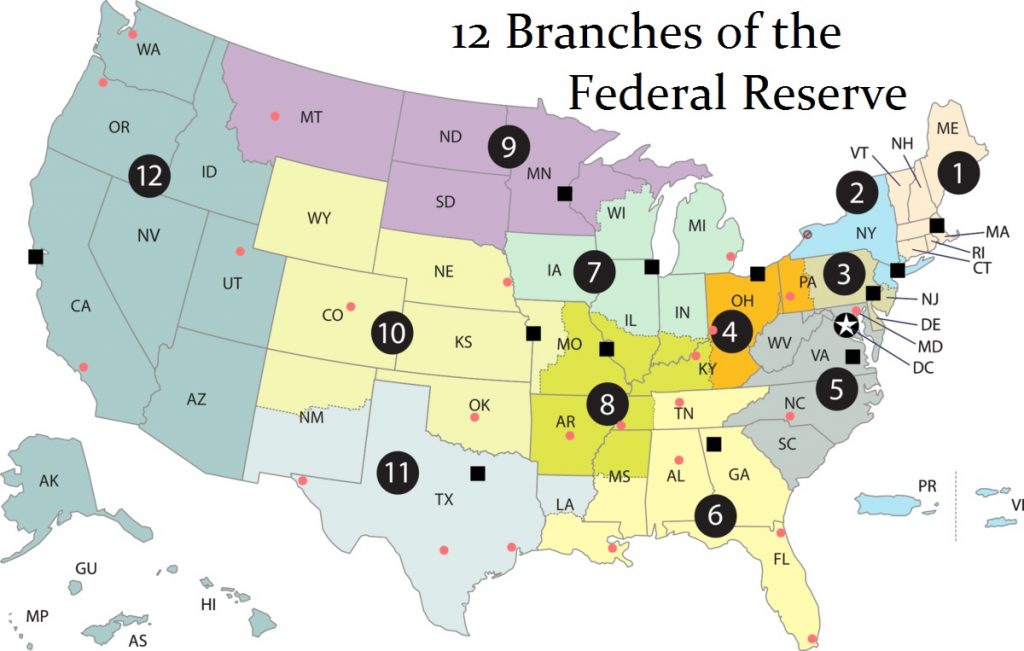

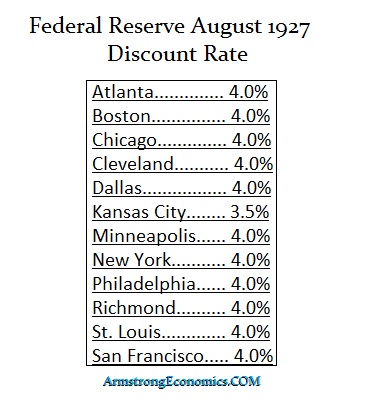

The original structural design of the Fed was to establish 12 branches to manage the capital flows domestically. Interest rates would decline where there was an excess of cash and rise where there was a shortage. This, they believed, would cause capital to move between the branches to balance the national capital flows and economy. Each branch acted independently to manage the capital flows. When crops would come to market, then Kansas would have an excess of cash and rates would decline as we can see from the table showing the rates set by each branch in August 1927.

When Roosevelt comes to power in 1933, he wanted to control the economy for his socialist agenda. He usurped the power of interest rates from the various branches of the Fed and consolidated then into Washington DC making it one-size-fits-all. He, therefore, abandoned the structural design of the Fed and ever since the capital flow focus has been internationally, not domestically.

As a result, the regional problems have resurfaced. The central bank raises interest rates to stop real estate or stock market bubbles in New York and that harms the commodity regions in middle America. When commodities have boomed, the financial regions are normally suppressed. The Fed raises rates to stop stock speculation in New York and prevents farmers from running their operations when commodity prices are at their lows. Canada has done the same thing raising interest rates to stop real estate booms in Toronto while the commodity-based economy in Alberta is sent into bankruptcy.

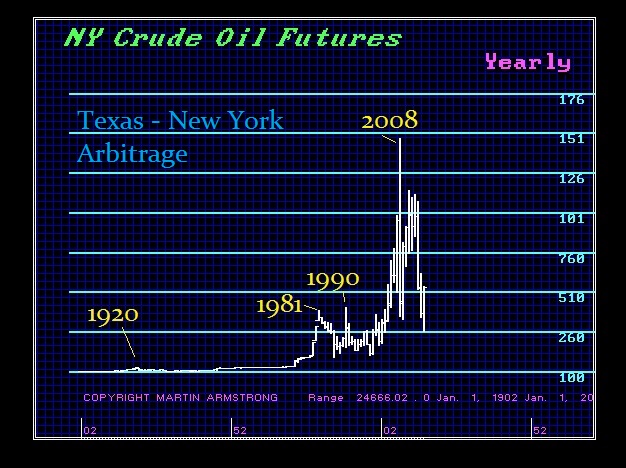

I have called this the Texas-New York arbitrage. Here is a chart showing when oil peaks in price, it is typically counter-trend to the financial markets. Oil peaked in 2008 when the stock market was crashing. Once again, oil prices are down and Alberta suffers while the financial markets are booming in Toronto.

What is resurfacing is the regional differences within Canada as well as the United States. The one-size-fits-all policy of central banks with regard to interest rates pits East v West in both Canada and the United States. Farmers, oil producers, and miners are forced to pay higher interest rates when their economies are declining because of speculative booms in Toronto or New York.

This is the root cause of the regional separatist movements we are witnessing in Canada. The structure of the central banks was originally intended to manage the domestic capital flows. That has been part of the whole socialit agenda to abandon that policy and create the one-size-fits-all policy of Marxism.