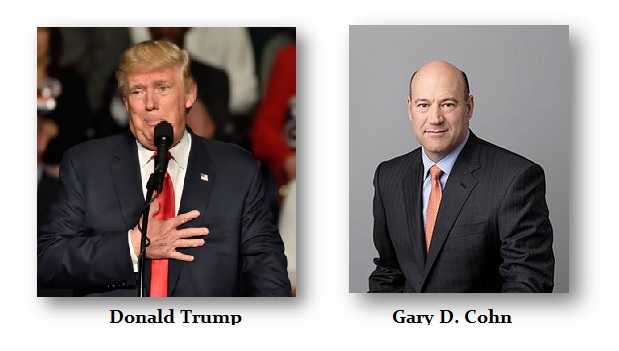

Gary Cohn Resigns from Trump Administration – Good Riddance!

The drop in the market yesterday was widely attributed to Gary Cohn resigning from the Trump Administration over his tariff policy. That must be a real shock because Gary Cohn has resigned as White House chief economic advisor. The press attributes Cohn’s planned departure comes on the heels of a decision by President Donald Trump to impose stiff tariffs on steel and aluminum imports. However, Cohn resigning has something far more seriously implied behind the curtain. When Trump allowed people from Goldman Sachs to enter his administration, he was not draining the swamp, but filling it.

The drop in the market yesterday was widely attributed to Gary Cohn resigning from the Trump Administration over his tariff policy. That must be a real shock because Gary Cohn has resigned as White House chief economic advisor. The press attributes Cohn’s planned departure comes on the heels of a decision by President Donald Trump to impose stiff tariffs on steel and aluminum imports. However, Cohn resigning has something far more seriously implied behind the curtain. When Trump allowed people from Goldman Sachs to enter his administration, he was not draining the swamp, but filling it.

Cohn was brought in by Trump’s son-in-law and close adviser, Jared Kushner. Kushner lost access to the most valued U.S. intelligence report, the President’s Daily Brief, as the White House imposes greater discipline on access to secrets. The link between Kushner and Goldman Sachs has also been a questionable agenda behind the curtain. Cohn would NOT leave the Trump Administration simply over the tariffs on steel and aluminum. Goldman Sachs would not yield personal access to such a minor issue when Cohn personally manipulated the debt of Greece to enter the Eurozone. My sources are not so convinced about the noble position of Cohn.

Cohn was brought in by Trump’s son-in-law and close adviser, Jared Kushner. Kushner lost access to the most valued U.S. intelligence report, the President’s Daily Brief, as the White House imposes greater discipline on access to secrets. The link between Kushner and Goldman Sachs has also been a questionable agenda behind the curtain. Cohn would NOT leave the Trump Administration simply over the tariffs on steel and aluminum. Goldman Sachs would not yield personal access to such a minor issue when Cohn personally manipulated the debt of Greece to enter the Eurozone. My sources are not so convinced about the noble position of Cohn.

Goldman Sachs, I believe, placed two other people in strategic positions – Steven Mnuchin running the Treasury who has testified his agenda is to restore Glass Steagall, which would allow Goldman Sachs to revert to an Investment Banking house and kick out the other banks from the industry – particularly J.P.Morgan and Citibank. There were 5 Investment Banks before 2007. Lehman Brothers and Bear Stearns were allowed to collapse by then form Goldman Sachs’ Hank Paulson eliminating competition. Now restoring Glass Steagall will eliminate competition once again for Goldman Sachs. I believed that this has been the entire agenda of this TRIPARTITE invasion of the Trump Administration.

Steven Mnuchin previously worked for Goldman Sachs but he left them in 2002. There has long been the rumor that once you work for Goldman Sachs, you remain as an alumnus and you still need to call them on something like this position.

The third less known person I believe was a plant from Goldman Sachs is Alan Cohen who took the number two position in the SEC. Alan Cohen spent 13 years as head of compliance and a board member of Goldman Sachs. Normally the head of compliance takes the fall whenever the firm gets in some trouble. Cohen has been shielded during any legal process against Goldman over those 13 years. Cohen joined the Securities and Exchange Commission as a senior policy adviser to yet another Goldman connection Chairman Jay Clayton. Cohen will deal with two of the biggest issues confronting Wall Street: Brexit and new European rules that will upend banks’ research businesses.

Goldman Sachs, I believe, had placed strategic people within the Trump Administration that formed a Tripartite control over economic policy with tremendous influence that would shape the future for the firm. I believe this was an incredible strategic play to take over the Trump Administration and steer the USA into a bargaining chip for the firm in the Eurozone to fight legislation that would restrict Goldman in Europe. There is no way that Gary Cohn would depart over the simple tariff issue. There was FAR MORE at stake here than meets the eye.

These highly paid people do not walk away from million dollar salaries and bonuses to work for peanuts in government that everyone knows will be for just a brief stint. There are other considerations in play here and only a fool would think that Gary Cohn left for just a magnanimous level of principle. Trust me, if I died suddenly, my bet it would be at the direction of the New York club.