Singapore – World Economic Conference 2018

The Singapore WEC is being held as we now approach the timing for the markets to make their decision. This WEC will be focused on Asia, including Japan, China, Hong Kong Peg, Southeast Asia, India, Australia, and New Zealand. Additionally, we will cover Russia for our clients who prefer not to travel to the USA.

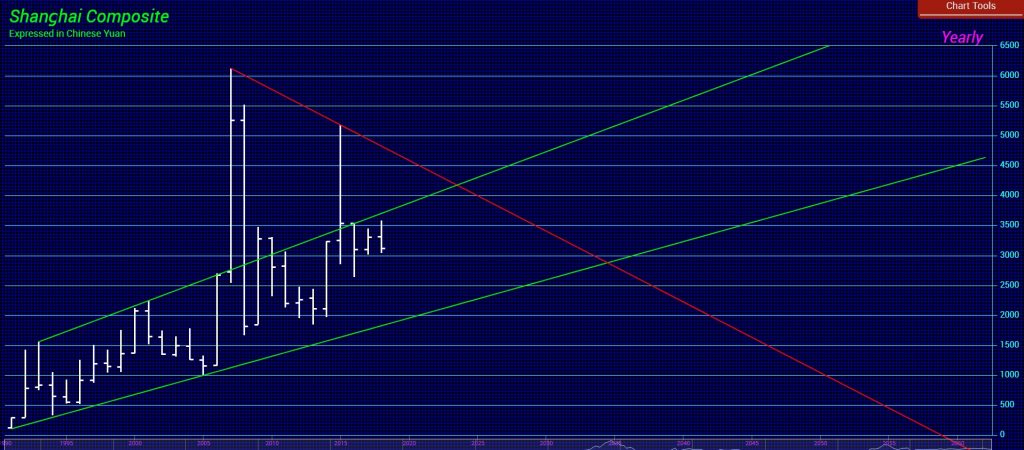

This event will be focused on that region as a whole and what is to come. However, we will still cover an overview of Europe and America. The fate of Asia obviously depends on the dominant economy – China. How will China fair as the Sovereign Debt Crisis comes into play going into 2020? What about oil and gold in yuan? The Chinese debt issue of a 250% debt to GDP Ratio? Will the housing boom end as people stop using real estate as a bank account? What about Japan? Has Abe Economics failed in Japan? Shinzo Abe is fighting for his political life following a string of scandals and sliding ratings. The rise in hunting the rich in Australia and New Zealand and will this kill their economies into 2020?

Asia is the hotbed no doubt. But it is also the future. We cannot experience the gain without the pain. The difference between risk and uncertainty is rather distinct. Since society has no clue about the course of future events, then RISK applies to situations where we do not know the outcome of a given situation. Nonetheless, our track record has been incredible in exposing the long-term trends allowing clients to accurately measure the odds of RISK in the future. However, UNCERTAINTY applies to situations where we cannot know all we need to set accurate odds in the first place. Therefore, RISK and UNCERTAINTY have an asymmetric structure, or in other words, they are not identical. If there is UNCERTAINTY about the future, then it is impossible to comprehend what the RISK.

That is what these World Economic Conferences are all about – defining the RISK presented by the future that also provides OPPORTUNITY as well as what areas to avoid to prevent catastrophic loss. The single greatest THREAT the markets present to all investors is the LACK OF LIQUIDITY!!!!!!!!!

That is what these World Economic Conferences are all about – defining the RISK presented by the future that also provides OPPORTUNITY as well as what areas to avoid to prevent catastrophic loss. The single greatest THREAT the markets present to all investors is the LACK OF LIQUIDITY!!!!!!!!!

Liquidity is the critical factor in the financial markets as a whole as well as to a financial institution’s capacity to meet its cash and collateral obligations without incurring unacceptable losses. Quantitative Easing has destroyed the bonds markets in Europe and Japan. Because the government has bought the bonds excessively and manipulated interest rates to extreme unrealistic lows, they have wiped out the bid of the private sector. Pensions funds cannot buy 10-year bonds at even 2.5% for that is locking in a loss when they need 7-8% to break-even.

LIQUIDITY IS OUR BIGGEST RISK

With Liquidity at dangerously low levels and more and more banks reducing their trading and letting experienced staff go, when the crisis hits, we will be looking at gaps and flash crashes. Without the Liquidity in the markets – VOLATILITY will rise beyond what the general market expects.

The Singapore WEC will provide an in-depth look at the world with a focus on Asia. From Japan and China to India and Australia and all the countries between with their markets and currencies will be covered. How Asia will handle the debt crisis on the horizon and the impact Europe will have upon Asia will be critical moving forward. Then we have the rising trade war and how governments do not even understand the risks that they are introducing.

The Singapore WEC will include a SPECIAL REPORT on Asia covering the currencies, share markets, and real estate.

Welcome to the Singapore WEC Where we Will Assess the RISK & UNCERTAINTY for Asia