The Dollar High – Real or Adjusted?

QUESTION: Hi Marty,

you said that the Dollar will make a major high going into 2020/21 and that will bring on the break in the monetary system. will the Dollar make new all-time high in nominal (165) terms or will it take an inflation-adjusted high to break the system?

thanks for the education.

JP

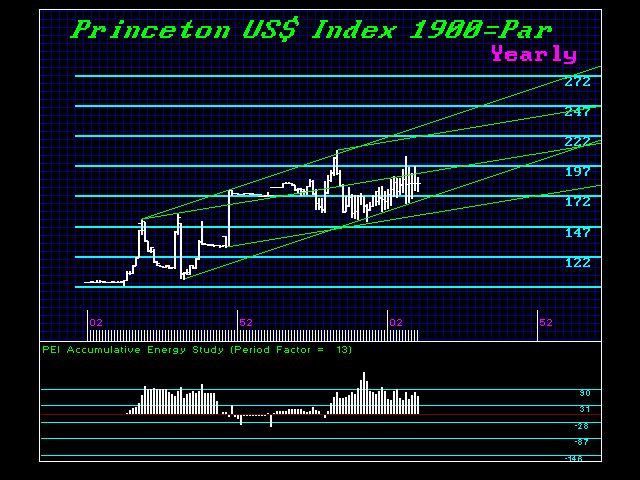

ANSWER: Here is a chart on our Dollar Index back to 1900. We can see how the dollar rallied for World War I and the Great Depression as everyone defaulted in 1931. Then there was the Plaza Accord high in 1985, which was followed by a 10-year decline. This projects out to a 26-year rally into 2020/2021 and should be a nominal new high. That will break the back of emerging market debt, and probably the European banking system.

ANSWER: Here is a chart on our Dollar Index back to 1900. We can see how the dollar rallied for World War I and the Great Depression as everyone defaulted in 1931. Then there was the Plaza Accord high in 1985, which was followed by a 10-year decline. This projects out to a 26-year rally into 2020/2021 and should be a nominal new high. That will break the back of emerging market debt, and probably the European banking system.

Keep in mind that the USA took the bad loans out of the banks and stuffed them in Freddie and Fannie. In Europe, the bad loans are still on the books of the banks because everyone fears that a bailout would result in money flowing from the north to the south. This is why Draghi is keeping QE in place and buying debt that matures. The banking crisis just never ends. That combined with Draghi leaving next year means that and any halt to QE by the ECB will leave marginal governments unable to sell their new debt. The whole thing gets very dicey very fast.

I am continually called throughout Europe because they know this is just a waiting game. I do not think the solution will be one that anyone is willing to talk about without blood pouring from the ticker-tape. We may be doing another documentary on this very subject in advance to hopefully educate people as to what, why, and how we move beyond this. That is in the preliminary stages. If I know for sure, I will let everyone know. It will probably be filmed at a university in Europe.