Understanding the Fractal Nature of TIME

COMMENT: I attended your 2015 WEC where you laid out the future for the euro. I was skeptical, to say the least. All these people constantly focus on the dollar. Then your model gave buy signals on the euro and you said it would then rally into 2018 and that could form the slingshot down. It came close to your target and now here in France, the government has warned of a euro crisis blaming Italy. I attended your euro conference in Frankfurt and again you explained why the euro would decline.

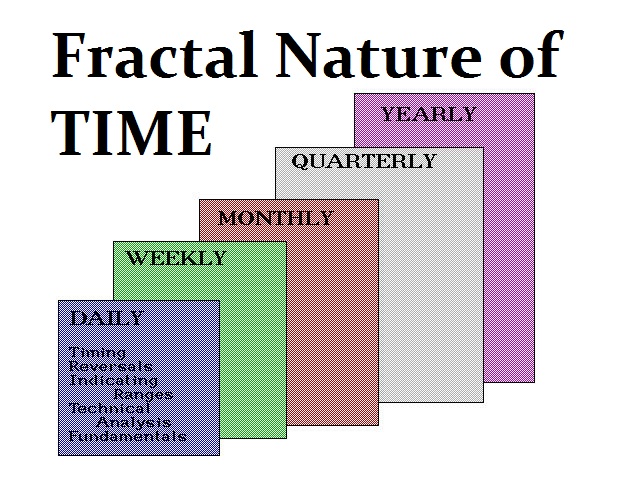

I have come to understand that your model is really split into timing levels. I think you need to explain that better because the rest of us are used to what you would call I guess a flat forecast that is not relevant to the time. Just a suggestion. But a lot of people do not catch on that you can forecast the long-term yet also provide the forecast for the short term counter-trend moves.

I can’t make Singapore but will be there in Orlando.

merci et bonne chance

PV

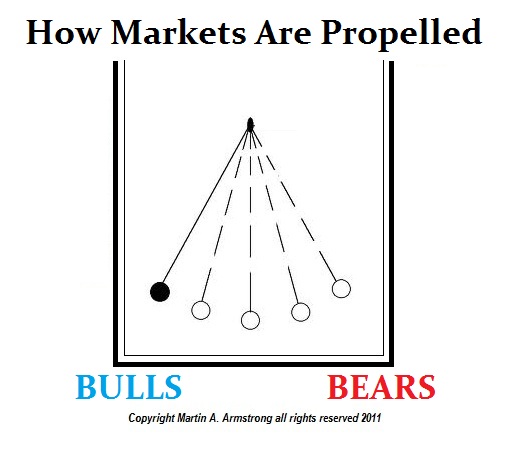

REPLY: Thank you for the perspective. You are probably correct. The very reason why we are one of the largest institutional advisers in the world is because we can forecast not just time, but distinguish the short-term from the long-term. I suppose it can get confusing when the long-term warns the euro is crashing and yet you have a 13-month rally which is also necessary to create the energy for the resumption of the decline. This is how the energy in a market is created for the opposite direction.

REPLY: Thank you for the perspective. You are probably correct. The very reason why we are one of the largest institutional advisers in the world is because we can forecast not just time, but distinguish the short-term from the long-term. I suppose it can get confusing when the long-term warns the euro is crashing and yet you have a 13-month rally which is also necessary to create the energy for the resumption of the decline. This is how the energy in a market is created for the opposite direction.

It is always the false counter-trend move that creates the energy to swing back the other way. We did elect a Quarterly Bearish Reversal at the end of the 1st quarter 2018. That confirmed the counter-trend rally was over. On the weekly level, it was 57 weeks up to the February high. There we were electing Weekly Bullish confirming the counter-trend rally would begin.

Take gold. Here too the line the model drew was 1362 on a monthly level and 1341 on a quarterly closing basis. Gold would crash at the end of every quarter to avoid a buy signal. Likewise, it just could not get through the 1362 number. This also confirmed the position with the dollar that was reflected in the Euro. The risk of a coming dollar rally.

You are correct that 99.9% of forecasts are flat one-dimensional. Our model enables big players to sort out the small counter-trend moves from the point where you have to flip a major portfolio in the billions. How you trade personally and for huge size is totally different. OPINION will not cut it. It has to be black and white. We must reduce it to a specific number and then the targets in time.

I suppose you are correct. I do not explain this difference between our forecast and everyone else in sufficient detail over the course of events.