European Banks Lending in USA Rather than Europe?

European banks have been lending in the United States quiet aggressively because (1) the economy is doing good so there is a demand for loans contrary to Europe, and (2) the behind the curtain view that the euro will decline and the dollar will rise. During the first half of 2017, European banks have lent about $53 billion in US dollars taking the currency risk which they have benefited from as the euro declines. According to Bloomberg, Europeans’ combined market share in the United States rose to nearly 24%.

The concern of some has been that the loans are going into leverage structures once again. In total, banks and other companies issued $494 billion in new leveraged loans 2017, which has been the largest amount since 2011. The European banks at the top of the list are the British Barclays Bank, which bought Lehman Brothers Holdings’ US businesses after the collapse. Barclay’s now controls more than 6% of the market for new loans and is the third largest leveraged loan arranger in the US this year. Barclay’s is also big in issuing credit cards in the United States. The second on that list is Credit Suisse Group AG. Then we have Deutsche Bank, which on the one hand wants to withdraw from US markets, has also been looking at lending in dollars for the same reason of gaining on the currency in the face of a collapsing euro. We see similar policies being adopted in the British HSBC, Swiss UBS, French BNP Paribas, Dutch ING Groep and Credit Agricole.

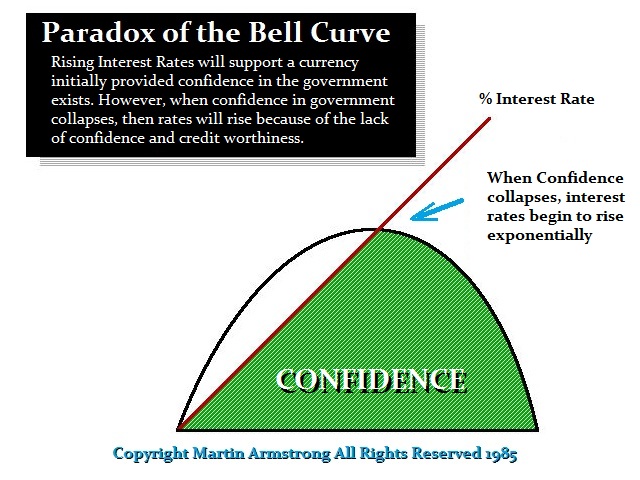

While many believe that as major central banks continue to push ahead with monetary policy normalization of raising interest rates, they wrongly think that raising rates will hurt the credit market and create a downturn. What they fail to grasp is that rates can rise with no impact provided the economy is expanding, but rates can also rise because there is no demand and government is forced to keep offering higher rates to find buyers of their debt in the real world. It all depends upon what people believe. This is why low rates in Europe have FAILED to stimulate demand when people lack confidence in the future, they will NOT borrow at any rate. Expectations of profit MUST exceed the level of interest rate before people will borrow. They function differently than governments which are addicted to debt and borrows all the time with no cyclical expectation.