Understanding The Dollar Strength

It is fascinating to watch how the bias in people just ensures not just that a sucker is born every minute to replace the one that wises-up, but there are suckers who never learn from experience and cling to their ideas no matter how much it costs them. The U.S. dollar has been climbing against major currencies for several months, with the dollar index .DXY up is trading up about 2.84% for the year. It is true that the dollar has strengthened since late 2015 as the Federal Reserve began raising interest rates against a background of steady economic growth, slowly rising inflation and the lowest U.S. unemployment rate since the 1960s. But the strength in the dollar is more than just interest rates. It is the prettiest of the three ugly sisters as they say – US – Europe – Asia.

The Fed has raised rates twice this year and is expected to raise rates a couple more times by year end which may attract more foreign capital into the U.S. dollar with monetary policy remaining loose to very insane in Europe and Japan. We have the ECM, which has destroyed the European bond market, frozen like a deal in headlights. It is trapped and it realizes that it has been buying the debt of member states who are now addicted to excessively low-interest rates. If the ECB actually stops buying, we are looking at a major debt crisis in Europe as interest rates explode exponentially. However, their policy of austerity has really oppressed the Greek economy and now they have their eyes set on Italy which will more likely create a revolution before the Italian accept going the way of Greeks – quietly into the night.

In Japan, there to they have wiped out the bond market. The government actually bragged that they bought 97% of the government debt auction. Hellow? That’s a good thing? The Bank of Japan has reduced debt purchases for a third time in June 2018, taking advantage of the recent stability in bond yields and the yen. At least Japan is reducing its purchases whereas the ECB talks a good game, but cannot actually do anything. The attempt to force austerity by the EU upon southern Europe is tearing the system apart.

The dollar bottomed in February 2018. It has yet to elect a Monthly Bullish Reversal. Trump has been unusually vocal about the dollar, unlike most Presidents, following more in the footsteps of Treasury officials. Trump has publicly been criticizing the dollar’s strength several times. He obviously thinks a lower dollar is better for trade. But the markets are going against Trump. You cannot “Make America Great Again” without also strengthening the dollar especially when we still have insanity in Europe economically and Japan still in never-never-land.

The dollar bottomed in February 2018. It has yet to elect a Monthly Bullish Reversal. Trump has been unusually vocal about the dollar, unlike most Presidents, following more in the footsteps of Treasury officials. Trump has publicly been criticizing the dollar’s strength several times. He obviously thinks a lower dollar is better for trade. But the markets are going against Trump. You cannot “Make America Great Again” without also strengthening the dollar especially when we still have insanity in Europe economically and Japan still in never-never-land.

In a CNBC television interview, Trump said he was concerned about the potential impact of a stronger dollar on American exports. He also broke tradition by criticizing Federal Reserve policy on raising interest rates, saying it takes away from the United States’ “big competitive edge”. Trump has had no problem with deficit spending hoping it would reduce the dollar to support trade and therefore jobs. While investors and traders have been concerned about the spending, they have been forced to attribute some of the gains to the Trump administration’s tax cuts which are bringing capital home. On the other hand, they see the tax cuts as widening the fiscal deficit, and that they expect leads to borrowing more on the government’s part. Then Trump’s imposition of import tariffs against China, Europe, Mexico and Canada, they generally think will contribute to inflation. But they fail to grasp that Trump is using Tariffs to force a better trade deal.

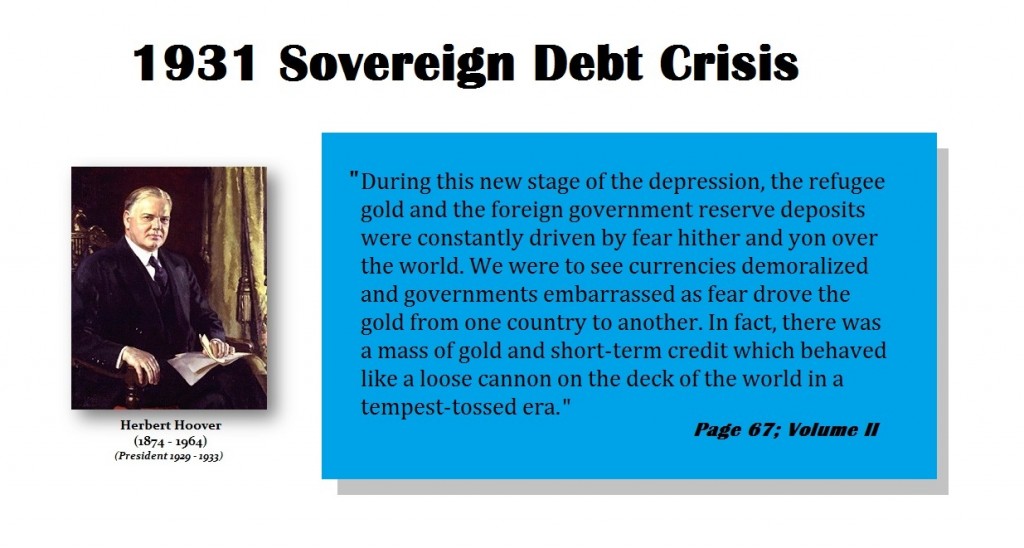

So hang on to your hat. The strength behind the dollar CANNOT be analyzed simply by looking at the domestic situation. We are in a position of capital flight on a global scale. All these arguments add up to nothing when capital begins to flee from one economic crisis to another. Remember Herbert Hoover’s words from 1931. When we begin to see the first crack in Sovereign Debt, both in Emerging Markets and inside the EU, it will be Kattie-bar-the-door!