Venezuela & the Flight of Capital from Public to Private

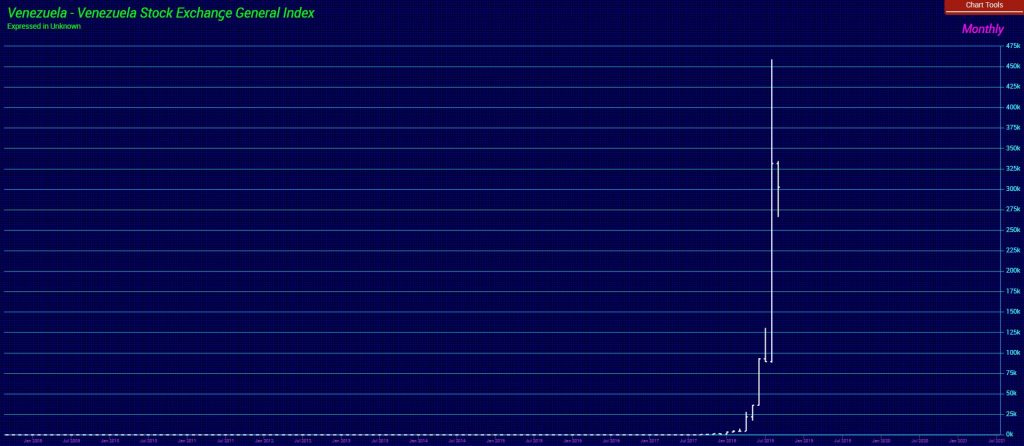

COMMENT: Mr. Armstrong; The chart you posted on the Venezuela share market really made me see what you have been saying. Collapse the confidence in government and capital flees to the private sector. This is never taught in school! You have to write a book for posterity. Please!

RW

REPLY: The Venezuelan share market has soared in terms of local currency. This does illustrate the entire point. When a currency collapses, the value of tangible assets rise. In the case of Venezuela, you have a socialist government that refuses to relinquish power in fact of a complete economic disaster with millions of people fleeing the country. Here we have a double hit. The currency normally is sufficient to bring about regime change. In this case, the army is still willing to kill its own people to support a leftist regime. This is the profound difference that concerns me about leftist governments. They are filled with such hatred and propaganda that killing anyone who disagrees is seen as justified because THEY are the people who have ruined the state – never the leftists who seek to vindicate their victimization.

REPLY: The Venezuelan share market has soared in terms of local currency. This does illustrate the entire point. When a currency collapses, the value of tangible assets rise. In the case of Venezuela, you have a socialist government that refuses to relinquish power in fact of a complete economic disaster with millions of people fleeing the country. Here we have a double hit. The currency normally is sufficient to bring about regime change. In this case, the army is still willing to kill its own people to support a leftist regime. This is the profound difference that concerns me about leftist governments. They are filled with such hatred and propaganda that killing anyone who disagrees is seen as justified because THEY are the people who have ruined the state – never the leftists who seek to vindicate their victimization.

In the case of Venezuela, the last check against the leftist government will be capital. They will be unable to borrow ANY money and they will not be able to offer fixed assets because there is no rule of law and they can then nationalize whatever stupid Western fund manager buys thinking it is a cheap deal. Just look at such revolutions in Iran and Nigeria. Whoever invested in those countries their assets were just confiscated. By no means invest in ANY fund that invests in Venezuela. Get out before you lose 100%.

In March 1951, the Iranian parliament (the Majlis) voted to nationalize the Anglo-Iranian Oil Company (AIOC) and its holdings, and shortly thereafter the Iranian public elected a champion of nationalization, Mohammed Mossadegh, Prime Minister. You cannot trust such regimes. Mossadegh was the head of an ostensibly democratically elected government that simply sought to confiscate foreign assets. He was eventually removed in a CIA coup in 1953 and the United Kingdom’s Secret Intelligence Service.

I have stated numerous times, my deep concern is what comes AFTER Trump? There is no question they will seek to stuff a career politician into office be it Democrat or Republican. As the debt crisis expands, they will turn to raise taxes. They will in the process destroy the very democratic process and we will witness rising taxes quite dramatically until the entire political system breaks apart.

This is simply the pattern throughout history. I do not see anyone who would stand in the way of this trend among the ranks in Washington. Nobody from the private sector will dare step forward again. Any career politician will defend their own self-interest and raise taxes trying to hold on to power regardless if they are Democrat or Republican. This is simply how the West enters its Decline and Fall and China will emerge as the sane economy after 2032.

You can see the policy already in Europe. Brussels will defend the Euro at all costs even if it suppresses the people because now it is just about their pensions and jobs. The Euro fails and there goes Brussels and its bureaucracy off the edge. There is no hope on the horizon of a knight in shining armor to come to save the day.