Thanks to Bankers – Student Loans Are Suppressing our Future & Destroying the Real Estate Market

I have warned that the entire Student Loan Crisis has significantly altered the economy thanks to the Clintons courting the New York bankers making Student Loans the exception to bankruptcy. In Florida, like many other states, if you are in default on your student loans, the medical license to obtained is suspended. The Florida State Board of health has stated that some 900 healthcare workers were in danger of losing their license over the past two years because they were in default of their student loans. The board clarified it worked out repayment plans with most of those workers. It estimates the actual number of health care license suspensions is between 90 and 120 since November 2016. We may yet see the Yellow Vest Movement erupt in the United States over Student Loans.

I have warned that the entire Student Loan Crisis has significantly altered the economy thanks to the Clintons courting the New York bankers making Student Loans the exception to bankruptcy. In Florida, like many other states, if you are in default on your student loans, the medical license to obtained is suspended. The Florida State Board of health has stated that some 900 healthcare workers were in danger of losing their license over the past two years because they were in default of their student loans. The board clarified it worked out repayment plans with most of those workers. It estimates the actual number of health care license suspensions is between 90 and 120 since November 2016. We may yet see the Yellow Vest Movement erupt in the United States over Student Loans.

The situation with student loans has gone from bad to worse. Bankers will try to get the parents to still co-sign for their child – DO NOT DO SUCH A THING!!!!! The degrees are worthless in most fields except health and law. The bankers have circumvented all your legal rights because the student loan is the exception to bankruptcy so they can take your house and you cannot even argue fraud.

Then there is the fact that even death does not relieve a parent of a student loan. Marcia DeOliveira-Longinetti’s son was killed, and after death, the remaining balance of his federal student loans were written off, but not by the state of New Jersey. The state told his mother, “Your request does not meet the threshold for loan forgiveness.” What the Clintons did to students is really horrible. Even Zillow’s research, the big realtor, has reported that student debt has impacted the real estate market in many ways reducing future buyers.

FOX News reported that the U.S. Marshals Service in Houston was arresting people for failing to pay their outstanding federal student loans. Actually, Paul Aker, the subject of the Fox News report, failed to appear in court so the court sent U.S. Marshals to his home where he was arrested for a $1500 federal student loan he received in 1987. Of course, when they arrest anyone, the reason is irrelevant. Everyone is treated the same. If he ran, they would have shot him in the back and killed him on the spot and they would NEVER be prosecuted.

FOX News reported that the U.S. Marshals Service in Houston was arresting people for failing to pay their outstanding federal student loans. Actually, Paul Aker, the subject of the Fox News report, failed to appear in court so the court sent U.S. Marshals to his home where he was arrested for a $1500 federal student loan he received in 1987. Of course, when they arrest anyone, the reason is irrelevant. Everyone is treated the same. If he ran, they would have shot him in the back and killed him on the spot and they would NEVER be prosecuted.

After seven U.S. Marshals burst into Aker’s home with guns drawn, they took him to federal court where he had to sign a payment plan for the 29-year-old school loan. Thank you, Hillary. I honestly do not know how anyone could have possibly voted for her. This is totally insane. The judge could just as easily thrown him in prison on contempt of court and not release him until he pays the $1500. It’s all about a judge’s power to act as if he still represents a king.

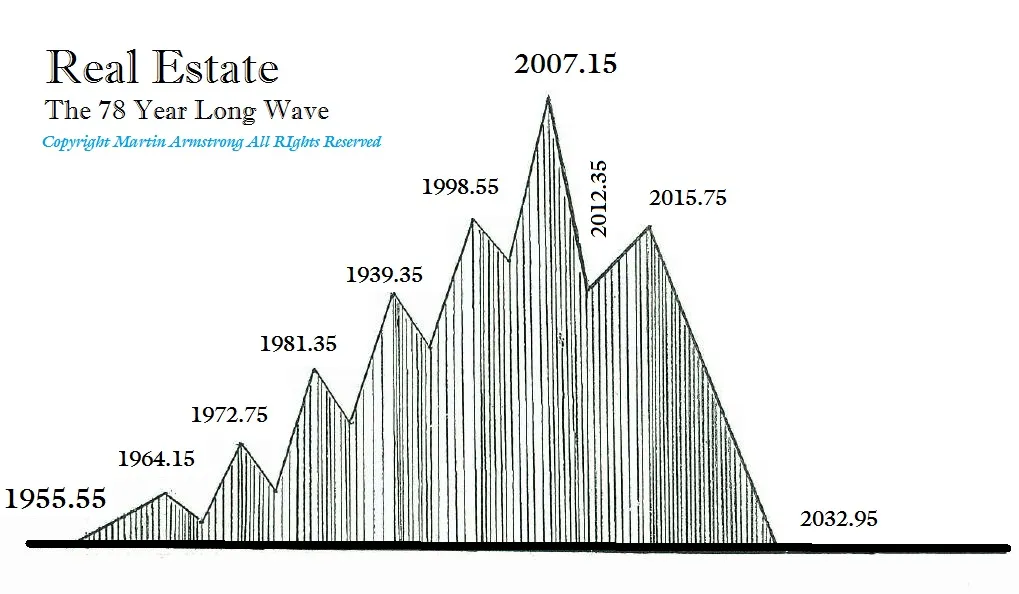

The Student Loan Crisis is serious. The US census showed that one-third of children over 30 were still living with their parents. This is also taking place in Britain thanks to rising taxes which lower disposable income. There are greater odds of your children living with you until they are 35. The real shocking number is that 40% of millennials are still dependent on mom and dad. The excuses seem endless. Student Loan debt can make buying a home IMPOSSIBLE! This is part of the reason real estate has been in a bear market since 2007 when we look at the average home.

The entire Student Loan Crisis has altered the real estate market significantly. While the High-End rallied into 2015 as capital was trying to get off the grid, as one friend in the real estate business put it, if prices ever got back to 2007, 50% of the State of New Jersey would go up for sale. The average market for homes has been declining overall. There are pockets where houses have risen, but these upon close inspection are the destinations where people are fleeing to from states like California, Illinois, New Jersey, New York, and Connecticut among others.

The real estate profile has another weight dragging it down – TAXES. Real Estate is IMMOVABLE and as states go broke, they keep raising property taxes. The states with NET declines in population because the smart people have been fleeing, leaving behind people who are not paying attention and become trapped because there are no buyers. One friend here in Florida moved from New Jersey and rents out his home back there because he cannot sell it. He rents it at this stage just to pay the taxes.

The states with no income taxes are a net migration seeking refuge from other places. Florida seems to get New Jersey, New York, and Connecticut. Nevada and Texas are getting those fleeing Illinois and California. Nonetheless, the overall view of real estate looks rather grim into 2032 insofar as scoring REAL gains over the depreciation in the purchasing power of a currency. Then add the rising interest rates and you will discover that bankers are no longer willing to lend money at fixed rates for 30 years.