When is Printing Money Deflationary rather than Inflationary

QUESTION: It seems the Left Wing Progressives in the US House (opponents of Pelosi) have adopted the Money Market Theory of Prof. Stephanie Kelton of U of MO.-Kansas City to justify unlimited deficit spending of the US Govt. OK as the Govt. can finance its deficits by unlimited currency printing.

Would you please comment.

Thanks and keep up the good work.

MP.

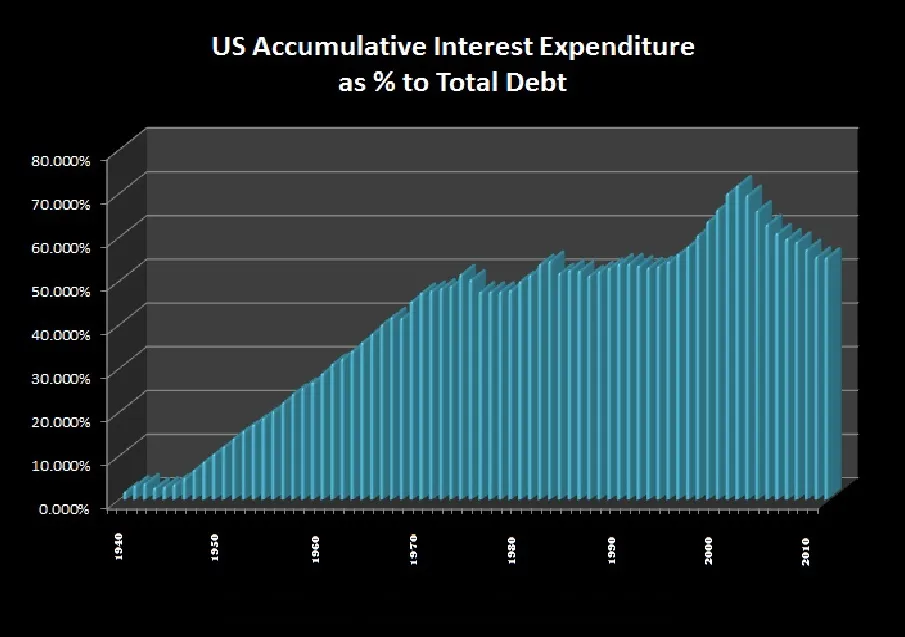

ANSWER: Actually, there would be no issue if the government simply created money to fund its normal expenditure. Historically, that will produce very modest inflation. The crisis is when you borrow to fund that deficit spending. In 2019, interest expenditures may now exceed the cost of defense. It is far cheaper to create the money needed than borrow and keep rolling the deficits forever. Then the cumulative interest keeps rising and crowds out all other expenditures. This is what is happening.

The process underway creates DEFLATION, not INFLATION, because the governments keep raising taxes to fund the deficits and that reduces the disposable income. This is why we see riots in France. Yes, people earn more, but they are being left with an eroding disposable income base. Governments need to fund themselves so they raise taxes. But the interest expenditures keep rising and consume all other areas of spending. It becomes a self-defeating process that leads to the crash and burn.