World Economy – Which End is Up?

QUESTION: Hey Martin

First of all, great work with the new Socrates. Thank you very much for getting it to us.

You have said that rates are exploding with fed raising rates for the pension funds and because of the lost confidence in government, at least here in Europe.

Am I correct when I take what you have said, as European, to invest in short term US government paper, short term US corporate paper?

That way I won’t get much yield but I get to benefit from the currency also?

Isn’t floating rate paper also good in times like this?

I also get that there is no other place, so the Dow will go up so I want some exposure to that also?

The commodities are bottoming in 2020 so I want to get some exposure to them also?

But how about real estate?

We as small investors don’t have any other choice but REITs, especially apartment REITs and you have talked against them, saying that they are volatile. So is it best to AVOID REITs and that way real estate all together?

Even if it is a hard asset and a inflation hedge? Also as a European it would not hurt to have some USD income?

With the taxes going up and socialists getting in to power all over I guess it is better to invest in accumulating funds instead of distributing ones?

If you could please find the time to comment on this. I know that there are lots of people asking the same questions as I am.

JP

ANSWER: We are all connected. There is no possible way for any country to move counter-trend to the whole. The European Central Bank and the Bank of Japan have destroyed their bond markets. Their stupid idea of Quantitative Easing and lowering rates to zero and negative was under their theory that people would borrow if it was cheap enough. Over the years, I have received calls from banks asking me if I wanted to borrow money. They call because we run high cash balances and have no debt. They always want to lend money to people who do not need it, but that then begs the question, what would I do with it anyway? If you have nothing in mind you want to buy then you are not interested in borrowing. Yes, there are margin loans for investors in shares. But I am talking about borrowing to expand or buy some business. That is what the Central Banks failed to grasp. If there is no CONFIDENCE in the future, you will not borrow at any rate.

The Bank of Japan could simply agree to tear up its federal bonds. That would impact its balance sheet whereas Japanese bonds are not really held outside the country. The ECB, on the other hand, has no such option for the debt it holds is of individual member states since there was never any consolidation of the debt federally. As far as the US Federal Reserve, its holding of federal debt is under 20% of the $22 trillion and 30% of the debt is held by foreign governments with 28% held by interagency. The US could not be saved if the Fed tore up its bonds. It is not enough.

The pension funds are also linked to government debt. Defaulting on government debt would wipe out all pension funds. The interconnectivity is not considered by so many who summarily assume we can just tear it all up.

Rates will rise to start 2020/2021 as the general public begins to see there is trouble in the wind. The Bank of Japan and the ECB have already destroyed their bond markets and there will be no going back. There will be no buyers when they need them. This is why you need to stay short-term as a buyer of debt and if you are a borrower, then lock it in for as long as you can at a fixed rate.

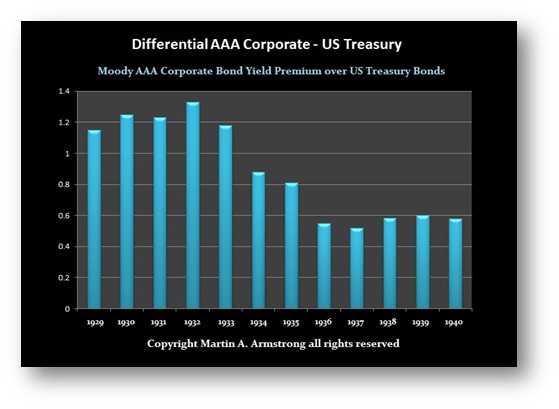

This is a cycle where governments are collapsing. Clearly, stay in the private sector. Blue-Chip corporate debt SHORT-TERM is better than a government. Even during the Great Depression, AAA corporate debt appreciated. The spread above US Treasury dropped from about 1.3% to 0.5% and the US was the safe haven back then as well. It was Europe which defaulted along with South America and Asia.

Real Estate is not a movable asset so it can be taxed and you cannot leave. They will raise taxes dramatically trying to survive. But governments cannot avoid their collapse for nobody is willing to step up and take decisions for the long-term.

Equities are liquid. This is going to be a game between value and liquidity. Remember! The City of Detroit suspended all debt in 1937. They resumed and paid it off with cheaper dollars in 1963. So they claim they never defaulted. Liquidity is also a top priority.