Modern Monetary Theory v Central Bankers

QUESTION: Hi Mr. Armstrong et al: Read your blogs daily with great interest & recommend them to all my friends. You’ve absolutely changed my perspective on so many issues. There is a contradictory theme that I & my friends can’t figure out – hope you could respond.

You have an obvious animus with Mr. E Griffin & his “Creature” book.

It’s our observation that both you & Mr. Griffin arrive at more or less the same destination-political chaos & possible currency disruption, as a result of politicians stupidity & short term thinking. You both just take different routes to arrive at similar conclusions.

The RESULTS of this stupidity are more important to all of us little people than the REASONS for all this impending upheaval. Could you respond? It’s quite a conundrum to my group.

Thanks for all you do.

ANSWER: That book all focuses on the elastic creation of money and puts all the blame on the Fed and bankers. I understand that central banks have been demonized and the great conspiracy centers around their ability to create money. Creating money is not really the issue for the amount they have created is peanuts compared to the continued debt created by politicians. Congress just created $1 trillion-plus in December 2015 and nobody noticed.

You now have people proposing the Modern Monetary Theory (MMT or Modern Money Theory) because they have witnessed central banks increasing the money supply post-2007 and have been unable to create inflation. They then use this as evidence that the government can just create money at will and it does not lead to hyperinflation.

The approach of MMT typically seen as an evolution of Chartalism and is sometimes referred to as Neo-Chartalism. They argue that in sovereign financial systems, banks can create money but these “horizontal” transactions that do not increase net financial assets as assets are offset by liabilities. Therefore, they argue that the balance sheet of the government does not include any domestic monetary instrument on its asset side. In MMT, “vertical” money enters the economy through government spending. Since money is legal tender meaning the government accepts it for taxes, this creates the demand for currency. You need the paper dollars to pay the government its pound of flesh.

At the state and local level, we also have fines, fees, and licenses that all combine to also create demand for the currency. This can be a currency issued by the domestic government. Because the government can issue its own currency at will, under MMT it is argued that the level of taxation relative to government spending is, in reality, a policy tool that regulates inflation. Therefore, under MMT, the dreams of Bernie Sanders making everything free becomes possible. Of course, this all ignores the question of control and public confidence.

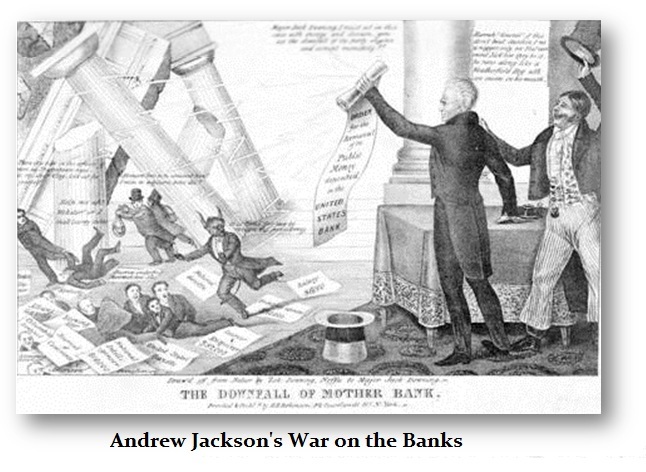

We need central banks as a clearing mechanism and to maintain reserves of member banks. The problem is that central banks are not all created the same. Jackson destroyed the Bank of the United States, which did not engage in quantitative easing and had no such power to create elastic money. They simply lent money to Jackson’s opponents. The destruction of the central bank resulted in the Panic of 1837 and the sovereign defaults of the states during the 1840s that occurred after the states had issued debt in an attempt to bailout state banks that went nuts without a central bank to control anything.

You ended up with banks creating their own money and they would print notes and sell them at a discount to brokers in New York to circulate notes of banks nobody heard of. The wholesale creation of money did not work well when the government began to refuse to accept these notes for taxes and the sale of land. Once that took place, the value of money collapsed and nobody would accept it. The government refused to accept it because it had already declined in purchasing value.

That book focuses on the central bank and ignores everything else. It is distorting the reality just as MMT is misleading people into thinking they can just print their way out of this mess. The fiscal side of the balance sheet has a national debt that is over $20 trillion and that really just cash that pays interest. Stop worrying about the Fed and look at the entire picture.