Trading Against the Reversals

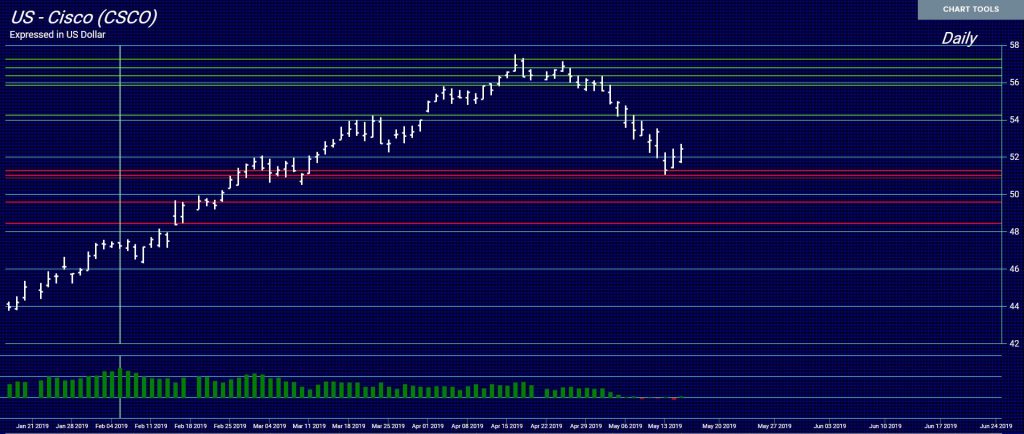

COMMENT: So guess what. I’ve always played the gaps when one elects and it’s a decent size and it lines up with the arrays and technicals I’ll get in and sell at the touch of the next reversal after the gap. Easy. But last month for the first time I tried trading against the reversal and it worked out amazingly. There was a quadruple bullish reversal in Cisco and a direction change the week and month after and I shorted it a few cents away from that reversal and basically got the high in a very strong uptrend. AM even thought I was crazy shorting it. The very next day it started falling and fell straight to the last major weekly yesterday.

Maybe not “Marty” type amazing trade, but I saw it unfolding the way Socrates said and I thought Damn haha

First time against a reversal!!! And a quadruple at that. Wanted to share that with you.

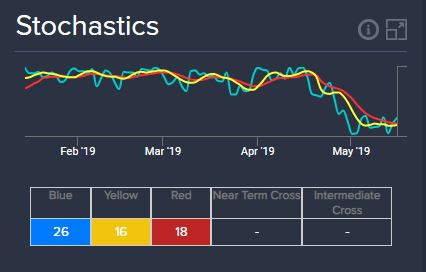

REPLY: Excellent. That was a good trade. Notice the energy. It peaked well before, so as the market is making new highs and failing to get through the reversals, look at the energy. If you see divergence and the stochastic, the odds are in your favor.

REPLY: Excellent. That was a good trade. Notice the energy. It peaked well before, so as the market is making new highs and failing to get through the reversals, look at the energy. If you see divergence and the stochastic, the odds are in your favor.

The divergences in those two indicators with the Array and the Reversal System allows for low-risk trades. Always know where you are wrong on a trade. In that case, the other side of the Reversals you are selling against. The declining energy with a rising market warns that the rally is not sustainable.