Millennials Saddled with Student Loans that Prevents them from Becoming Homeowners

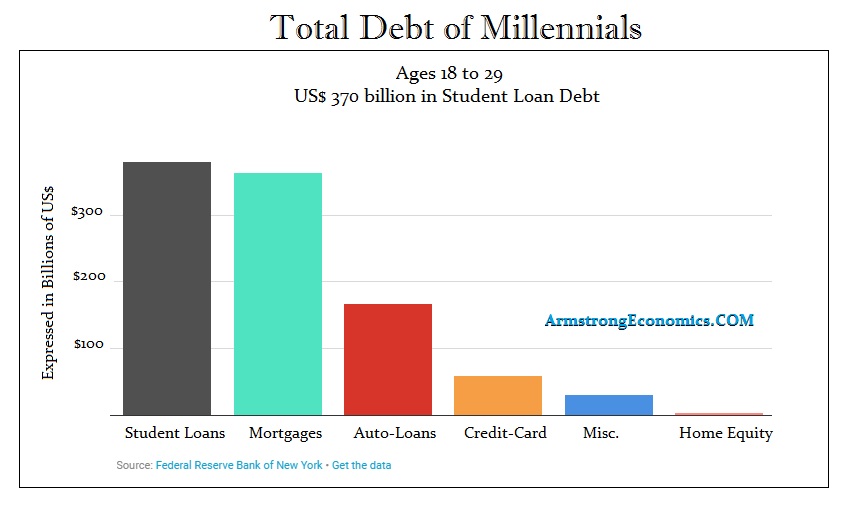

New findings are out from the New York Federal Reserve that reveal a troubling outlook for millennials who have now reached over US$1 trillion of debt, but the worst of it is student loans. This is a sharp rise of 22% over the past five years and is worse than any other generation in history. This debt crisis among millennials casts a dark cloud over the real estate market. With such high debt levels, this is a serious restraint upon obtaining home mortgages.

New findings are out from the New York Federal Reserve that reveal a troubling outlook for millennials who have now reached over US$1 trillion of debt, but the worst of it is student loans. This is a sharp rise of 22% over the past five years and is worse than any other generation in history. This debt crisis among millennials casts a dark cloud over the real estate market. With such high debt levels, this is a serious restraint upon obtaining home mortgages.

Ironically, millennials are much more conservative than the debt balances may indicate, but this could also be because of the student debt. In fact, in comparison to previous generations, this group is significantly more fiscally conservative with credit cards. Many into their 30’s are still living at home. With high student debt, many cannot afford a home, but another level cannot even afford an apartment. There is a new trend emerging whereby old motels are becoming housing. They lack the credit to rent an apartment with a security deposit. The new alternative is to rent per day in these old motels with rates of $50 to $80 per day.

Ironically, millennials are much more conservative than the debt balances may indicate, but this could also be because of the student debt. In fact, in comparison to previous generations, this group is significantly more fiscally conservative with credit cards. Many into their 30’s are still living at home. With high student debt, many cannot afford a home, but another level cannot even afford an apartment. There is a new trend emerging whereby old motels are becoming housing. They lack the credit to rent an apartment with a security deposit. The new alternative is to rent per day in these old motels with rates of $50 to $80 per day.

This is not painting a very nice picture of the American Dream. To get the donations from the bankers, the Clintons served them up on a platter by making student loans non-dischargeable in bankruptcy. The Clintons signed into law economic fraud and slavery. These kids are paying for degrees and then cannot find a job in what degree they have studied.

Universities are notorious for handing out degrees for fields with no prospects of employment. So many went for degrees in Marine Biology wanting to help dolphins. The prospect of a job was never high on the list of probabilities. There are studies that show colleges are not providing jobs. They have turned higher education into just a business and buyer beware. In fact, the research has found that those jobs requiring a bachelor’s degree list more soft skills than technical skills among the set of requirements. On top of that, there is a trend of rising suicides due to student loans.

Student loan debt is now the second highest consumer debt category — second only to mortgages as a whole and higher than credit card debt. There are more than 44 million borrowers who collectively owe $1.5 trillion in student loan debt and growing. Even Zillow’s research, the big realtor, has reported that student debt has impacted the real estate market in many ways by reducing future buyers. The real shocking number is that 40% of millennials are still dependent on mom and dad. The excuses seem endless. Student loan debt can make buying a home IMPOSSIBLE! This is part of the reason real estate has been in a bear market since 2007 when we look at the average home.