Trump’s Federal Reserve nominee Judy Shelton & Gold

QUESTION: Hello

Where do you guys see as the next World economic conference in 2020?. Will there be another one in Asia? or Europe?

Also, I wanted to try to give this question to Marty, although I never had the luck to get his response… more than once. “Trump just announced to nominate Judy Shelton as the next candidate for the Fed chairmanship. Judy has been promoting to peg the dollar to gold and going back to Gold standard once again, What do you think about this?. Is it possible for the Fed to go back to Gold standard?. I thought we’ve much more issues when we had Gold standard, why are they keep pushing for this agenda?.”

Thank you.

CK

ANSWER: We have not yet decided where to hold the next overseas WEC. Given the seriousness of things developing in Europe, we may hold it in Germany. This is still in question.

President Trump’s Federal Reserve nominee Judy Shelton has long been a proponent of free trade and once advocated for an open border with Mexico back in 2000. Shelton would not be the first free trader to get a top job from Trump. Larry Kudlow, the president’s top economic adviser, is a longtime friend of Shelton and has been a “free trader” who initially criticized Trump’s calls for tariffs. Trump explained to him that free trade will never exist without using tariffs as a negotiating strategy. Indeed, Trump offered to drop all tariffs with Europe if they would do the same — France refused. Trump’s prior Fed nominee, Stephen Moore, also fits this pattern of free trade. I have known Steve over the years and he backed out because of the onslaught of personal threats and attacks against him and his family by the left. Herman Cain also dropped out of consideration for similar reasons.

Last year, Shelton called for a “new Bretton Woods conference,” akin to the 1944 meeting that established the post-war economic order, perhaps to be held at Mar-a-Lago, where a return to the gold standard could be considered. “We make America great again by making America’s money great again,” she wrote in the journal of the Cato Institute. This nostalgia with a return to the gold standard is really insane. The very reason Bretton Woods collapsed was that you cannot fix or peg the dollar to gold while you continue to create dollars without restraint. You would think a third grader would figure that out, but those in power seem to understand less about reality for they spend too much time talking among themselves.

Yet the idea that every US dollar should be backed by a small amount of actual gold may seem to be a popular idea and enthusiasm for a return to the gold standard has become more prominent since Trump’s most recent nominees to fill the vacant Federal Reserve governorship have endorsed a return. The problem with this idea is that the entire socialistic agenda has to come to an end. You cannot run deficits perpetually and we can not continue to accumulate debt with no intention of ever paying anything off.

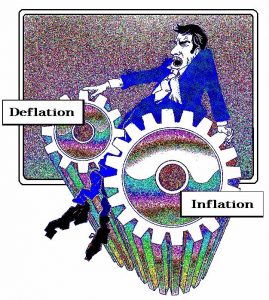

The only way to return to a gold standard is to abandon the entire political agenda currently. When the left is advocating the Modern Monetary Theory of endless creation of money, the gold standard represents the extreme in the opposite direction. We die by hyperinflation on the one side or deflation on the opposite. Both will lead to the destruction of Western Civilization as we know it.

I fully agree that we will be forced into a new Bretton Woods meeting probably 2021/2022. But make no mistake about it, a serious political reform will be required.