When did Trading Begin? Were Free Markets the Key to the Rise of Empires?

QUESTION: Mr. Armstrong; I figured there is nobody more qualified to answer the question of where and when did markets first begin to trade? Did markets have anything to do with the rise of nations you write about?

KD

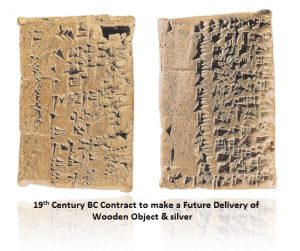

ANSWER: Only those societies that developed financial markets ever rose to greatness. Those who bash markets fail to understand that without them, most people would still be digging for potatoes. The evidence supports the first markets were futures markets which traded in Babylon, at least during the 19th century BC, since we have futures contracts from that period which have survived. All of the research I have conducted clearly demonstrates that economic growth is linked directly to the expansion of financial markets. Once there is a marketplace, then people will invest and economic growth will expand provided they know that if they needed to raise capital, they can sell their investments. Therefore, my research reveals that it takes CONFIDENCE in order to expand an economy and that translates into liquidity. Just look at this from your own perspective. You will buy a share in some company ONLY because you think you can make a profit. But how is that profit even attainable? The potential for a profit exists ONLY if there is a liquid market.

Agora, Athens

The Athenian economy had a financial marketplace in the Agora. There were bankers as well as insurance companies. Aristotle wrote about the people who made money from money. As the Athenian economy began to expand because of the introduction of financial markets, there was a transition of which Aristotle wrote about in his “Politics.” Aristotle believed that the Athenian economy was changing from what I call the Villa Model (Agricultural) of self-sufficient enclaves to an economy of market-driven incentives which encourage the production of excess for the purpose of trade giving rise to a Market Economy Model. Similarly, this was the same transition period emerging from feudalism. Once a financial marketplace emerges, then people will produce more if there is a marketplace where it can be sold.

There are academics who have tried to breakdown the Athenian economy with such detail that they could not see the forest while focusing on the bark of just one tree. They read Aristotle’s “Politics” but missed the whole point of his concern — the transformation of Athens into the financial capital of the ancient world which even predated China. Some have argued that the ancient Greek word oikonomia is the root of our modern English word “economy,” but it is not synonymous with our definition of “economy” as we perceive it today. They argue that today “economy” refers to a distinct sphere of human interactions involving the production, distribution, and consumption of goods and services; oikonomia meant “household management” because it was guide written by Xenophon — how to manage your Villa Economy. They then mix in the political system of Greek Democracy and claim family activity was subsumed into traditional social and political institutions. They then go as far as to degrade the Greek monetary system, admitting that they produced and consumed goods, engaged in various forms of exchanges including long-distance trade among nations, and developed monetary systems employing coinage. This is all discounted by many academics arguing that they did not see such activities as being part of a distinct institution which we call the “economy.” I really see these arguments as gibberish where they have had way too much time to think and produce nothing. Instead, they get lost in their own thoughts. They lack a complete knowledge of the monetary history and fail to comprehend that Athens’ coinage was so dominant in the ancient world it was imitated in the north by the Celts, Slavic people, Asians, and even down in Arabia. That would never have taken place if it was so de minimis as they have tried to portray.

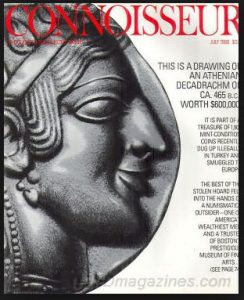

Athens produced the Decadrachm (10 drachmas) with a weight of nearly 42 grams. These coins would have been like 10,000 bills. They are very rare. Again, some academics tried to claim these were merely commemorative issues. They lack sufficient understanding of the world monetary system for these coins have rarely ever been discovered in Greece. Treasure hunters near the village of Elmali in southern Turkey unearthed a trove of ancient coins that included the rarest and most valuable Greek coins ever found. The coins, it said, were smuggled out of Turkey and sold to William I. Koch and two partners. It was the hoard of the century.

Athens produced the Decadrachm (10 drachmas) with a weight of nearly 42 grams. These coins would have been like 10,000 bills. They are very rare. Again, some academics tried to claim these were merely commemorative issues. They lack sufficient understanding of the world monetary system for these coins have rarely ever been discovered in Greece. Treasure hunters near the village of Elmali in southern Turkey unearthed a trove of ancient coins that included the rarest and most valuable Greek coins ever found. The coins, it said, were smuggled out of Turkey and sold to William I. Koch and two partners. It was the hoard of the century.

The Elmali Hoard was discovered around April 1984 containing nearly two thousand ancient Greek and Lycian silver coins. Turkish authorities contacted Interpol seeking international assistance to find and arrest the traffickers. In 1984, the consortium OKS Partners, which included Koch, purchased almost 1,700 of these coins for about $3.2 million. They began to sell the coins in 1987 and that is when the lawsuit was filed. The hoard was eventually returned to Turkey.

The Elmali Hoard was discovered around April 1984 containing nearly two thousand ancient Greek and Lycian silver coins. Turkish authorities contacted Interpol seeking international assistance to find and arrest the traffickers. In 1984, the consortium OKS Partners, which included Koch, purchased almost 1,700 of these coins for about $3.2 million. They began to sell the coins in 1987 and that is when the lawsuit was filed. The hoard was eventually returned to Turkey.

The significance of this hoard establishes that the Athenian Decadrachms were high denomination coins used in international trade. They are not found in Athens, but in ancient port cities around the Mediterranean coast. Some scholars claimed that the Athenian decadrachm is comparable to the more abundantly produced Syracusan decadrachm, which was minted around the same time. However, the Syracuse decadrachm was also minted for celebratory and practical purposes. The Syracuse minted their decadrachms in response to their defeat of the Carthaginians and they attempted to try to argue this was the same reason behind the Athenian decadrachms.

Numismatists have identified 24 separate reverse dies used for one issue of Syracusan decadrachms by created by the artist Euaenetus. This suggests that a minimum original circulation of just this issue would have been between 240,000 and 360,000 coins with a modern survival rate ranging between .08% and .25%. The Athenian decadrachm was used in international trade when they were attaining timber and metals from the Near East. The majority of Athens was composed of farmers who would never have a need for a decadrachm. The decadrachm became obsolete by the time of Pericles and Democracy for Athens was losing its supremacy and lost in war to Sparta. In fact, during the Peloponnesian War (431–404 BC), Athens lost its silver resources and began to issue its coins merely silver plated.

Numismatists have identified 24 separate reverse dies used for one issue of Syracusan decadrachms by created by the artist Euaenetus. This suggests that a minimum original circulation of just this issue would have been between 240,000 and 360,000 coins with a modern survival rate ranging between .08% and .25%. The Athenian decadrachm was used in international trade when they were attaining timber and metals from the Near East. The majority of Athens was composed of farmers who would never have a need for a decadrachm. The decadrachm became obsolete by the time of Pericles and Democracy for Athens was losing its supremacy and lost in war to Sparta. In fact, during the Peloponnesian War (431–404 BC), Athens lost its silver resources and began to issue its coins merely silver plated.

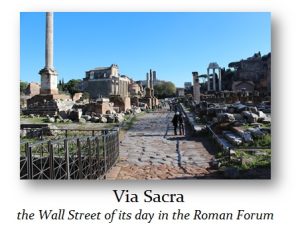

Therefore, both the Athenian and Roman economies began to expand into sophisticated agricultural-based economies only with financial markets. This is how the economies emerged from a Villa Model of self-sufficient enclaves as was also the case in feudal times into a integrated market economy which led to international trade and the birth of Mercantilism. Rome did not have a national debt nor did it possess a central bank. Consequently, there was a deep financial market which would also take place in the Roman forum along the Via Sacra — the Roman version of Wall Street.

Most people assume that the invention of corporations really began with the East India Company since it was the first share to begin trading in the 1500s. However, there were plenty of early examples of markets which were similar to stock markets. Even during the 1100s, France had a system where courretiers de change managed agricultural debts throughout the country on behalf of banks. This can be seen as the first major example of financial exchange because the men effectively traded debts — bonds. Later, the merchants of Venice were credited with trading government securities as early as the 13th century. Post-Dark Age, the first trading in any type of financial marketplace was confined to debt instruments rather than corporate shares.

What is typically overlooked is that the first public corporation concept is truly attributed to also the same man who gave us the word “economics” from the title of his book, “Oikonomikos” meaning actually how to regulate the household – Xenophon (431 – 350 BC). Xenophon was a student of Socrates. He became a mercenary and was the leader of the famous “Ten Thousand” (of recent movie epic). He was opposed to extreme democracy that sentenced Socrates to death. His last writing in 355 BC was his “Ways and Means” that advocated peace rather than war that destroyed the economy (yes, Congress’ committee is named after his work – Ways & Means Committee). Xenophon was not a philosophic intellectual, but rather a practical man of action who wrote from experience.

Xenophon proposed a public corporation for a bank that would be formed by shares subscribed to by all the Athenian people. Commerce was seen as more important than even agriculture. Xenophon proposed a public bank that would lend at interest to expand the economy. He proposed that the profits would be used to pay for public works. During the reign of Augustus (27 BC-14 AD) in Rome, there was such a public loan bank, but not subscribed to by individual members of society. This public bank provided loans to the poor without interest and it was funded by the confiscation of property from those alleged to be criminals, which would include political dissents as well. Collateral was required at twice the amount being borrowed. These types-of public banks aided the purchases of land.

The word “corporation” derives from corpus, the Latin word for body, or a “body of people.” By the time of Justinian (527–565 AD), Roman law recognized a range of corporate entities under the names universitas, corpus or collegium. These included the state itself (the Populus Romanus), municipalities, and such private associations as sponsors of a religious cult, burial clubs, political groups, and guilds of craftsmen or traders. Therefore, these bodies of people commonly had the right to own property and make contracts. They could also receive gifts and legacies, to sue and be sued. They could perform legal acts through representatives as well. Private associations were granted designated privileges and liberties by the emperor and these are the origins of corporations.

Roman knights of the republic did invest in small business and they would receive a share of the profits. These were contracts which could be resold to someone else, but they did not trade on an open exchange. Likewise, senators would also invest in land and gain a portion of the harvest as their return on investment. Trading in shares of corporations really materialized in the 1500s, but the Roman and Greek systems would be more like venture capital and private placements.