Is it Our Time to Rock & Roll?

QUESTION: Marty,

Sometime you compare today’s financial markets and economy to what was going on in the mid to late 1920s . Woodrow Wilson is even referenced concerning the flight of capital and of course that flight came to the United States.

You also say that the global markets and economy are unlike anything in modern history. I can only assume that you are referring to the artificial bond yields and prices due to central banks buying so much of the sovereign debt.

How is this period that same as the late 1920s and how is it different?

I am a huge fan of your work. Thanks for the blog and for Socrates!

NM

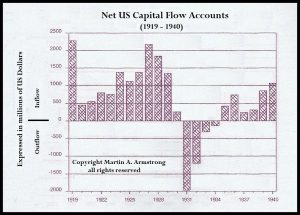

ANSWER: There was a flight of capital to the United States pushing the dollar higher for World War I. Woodrow Wilson was president 1913 – March 4, 1921. Wilson introduced a comprehensive program of domestic legislation at the outset of his administration, something no president had ever done before. Willson took a rather interesting view of tariffs. He argued that the system of high tariffs

“cuts us off from our proper part in the commerce of the world, violates the just principles of taxation, and makes the government a facile instrument in the hands of private interests.”

Tariffs were really an additional tax on consumers which Trump does not understand for he is looking only at jobs which is typical. Tariffs benefits only the producers by rewarding them with a higher income than the free market would provide. However, the other side of the coin on this issue was that Wilson also created the income tax. The Revenue Act of 1913 reduced the average import tariff rates from approximately 40% to about 26% and the revenue shortfall was to be be made up with income taxes.

Wilson created the Federal Reserve in 1913. He also moved for major legislation seeking antitrust legislation to enhance the Sherman Antitrust Act of 1890, which was really a response to the consolidation of railroads. The politicians saw mergers as destroying jobs rather than creating an efficient railway system. Wilson was also against the position that the USA should own colonies, and thus he promoted the independence of the Philippines. From 1914 until early 1917, Wilson’s tried to keep the USA out of the war in Europe. That did not sit well with the hawks in Congress.

All of that said, on the one hand we have Trump against war, as was Wilson, but in favor of tariffs as a tool to win free trade ignoring that they are really a consumer tax and protectionism for overpaid jobs. It was Wilson who told the Fed they had to buy US government bonds to prevent the yield from rising, which is sort of the problem we still have today. The Fed was originally designed to stimulate buying corporate paper directly when banks would not lend. Now the Fed stimulates by supporting government buying bonds from the banks who in turn still do not lend to support the economy in a crisis. The very idea why we needed the Federal Reserve has been completely reversed.

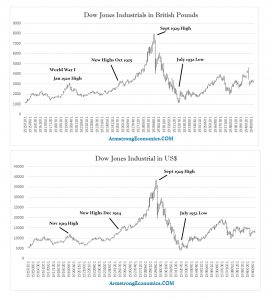

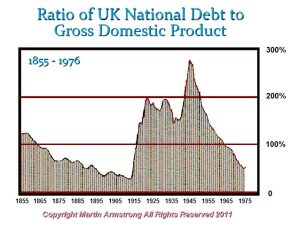

The primary difference today is the debt. The capital shifted into the USA and we see divergences between the highs and lows centered around World War I, whereas the 1929 and 1932 lows take place in both British pounds and dollars. For the World War I commodity boom, the US high was November 1919, whereas the British pound high was January 1920.

There was a major debt crisis in Europe, but not the United States. This is what wiped out Britain as it lost the crown of the financial capital of the world to the USA. This time, the debt crisis is systemic. The currencies are showing divergences as they did pre-World War I. But we have a socialist crisis whereas Western economies are collapsing unable to fund all the promises, as was the case with Communism in 1989-1991 in China and Russia. The central banks only keep governments on life-support and there is no direct stimulation of the economy. Every lesson from the past has been forgotten. We have put all the eggs in one basket (government) and we have politics in meltdown as republics are collapsing and the left v right is becoming much more intense which will, as always and without exception, lead to violence, civil unrest, separatist movements rising, and could result in revolutions which increases the risk of international war as politicians need a distraction from their failed domestic agenda.

It is just now our turn to rock & roll.

This will make for a very interesting WEC this year in Orlando.