Can Central Banks Ever Control Long-Term Rates?

QUESTION: Marty, you said that central banks can only control short-term rates not long-term. Do you see a scenario where they could control the long-term rates?

Thank you for your insight

DH

ANSWER: If you ASSUME that there is a free market, then the answer is no possible way. Under a hybrid market, a central bank can split between public and private debt as is taking place in Japan. The Bank of Japan has announced it will buy unlimited amounts of government bonds to prevent interest rates from rising.

Under this hybrid market, a central bank can simply buy all government debt but this results in the total destruction of any free market in government debt. The government should at that point just print money and not even bother to issue any debt.

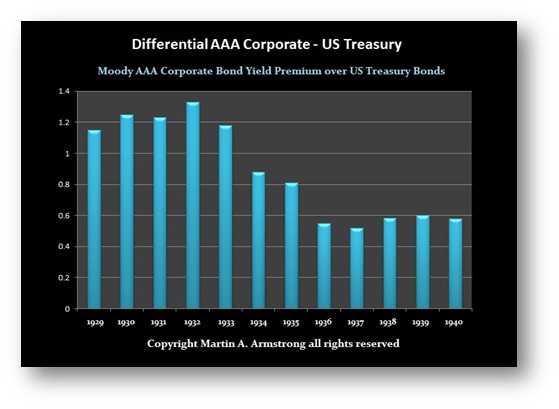

This results in a divergence between the fake government bond rates and the free market private interest rates. The spread will widen dramatically. Even during the Great Depression the spread between AAA corporate debt and government debt fluctuated according to where the confidence resided. As the sovereign debt crisis took place in 1931 with governments defaulting on their debts, the spread diminished as people began to trust corporate debt more so than government debt.

The third possibility is a closed market which means that the government can fix long-term rates that were done with usury laws. Even in Roman times, Cicero tells us how the cap on interest rates existed only in Italy. This led to excessive interest rates being charged by Brutus in Cappadocia of 40% compared to 10% in Rome.

Paul Volcker had to have the usury rates raised in order to raise interest rates to 14% to fight inflation back in 1981. It was also illegal for a Catholic to charge interest in loans so the Jews were the first bankers coming out of the Dark Ages. The Catholics got around that by stacking the interest costs into the price.

The final type of system that would control long-term rates would be Communism where everything is just outlawed and the economy is entirely closed.

Under a free market, the central bank sets the wholesale short-term rates which is why it has been focused in the repo market. If it attempts to just buy in all government debt, then private rates will rise and that is what is taking place right now. The Fed can peg long-term rates as they did during World War II, but that applied only to government debt. To prevent prices from rising the political legislature imposed wage and price controls.

So there are ways to fix the long-term, but at the cost of a free market.