Brenner & Kondratieff Waves v Economic Confidence Model

COMMENT: Marty, I began following you in 1985. That is when everyone was using the Kondratieff Wave and admitted it averaged 45 to 60 years. They were all predicting another Great Depression. You were the only one right back then as well. I remember your advertisement in the Economist saying a new Private Wave was beginning. The ECM has called every turn ever since and even to the very day.

Now the Brenner Chart is floating around all because it points to 2023. The 1999 turning point which was supposed to be the high, was not just off from the stock market and the 2000 Dot-Com Bubble, but 1999 was low in gold. The 2019 target was also off for it was 2020 which was a low.

I think both the Kondratieff and the Brenner cycles have caused more harm than good in furthering cyclical analysis. You are right. They were commodity based not economic-based.

I just wanted to share my observations because people need to understand the difference.

Jeff

REPLY: Oh yes. I remember 1985. It was high in the dollar and the British pound hit nearly par dropping from $240. Yes, we took the back cover of the Economist for 3 weeks during July 1985 to announce the start of inflation and the Private Wave. I was shocked that people held on to those advertisements and we would get letters even 2 years later.

The Kondratieff and Benner cycles were constructed during the 19th century. You cannot create a model on Wheat and then try to use it to trade Copper. Sometimes it will line up, and other times it will not.

Both Kondratieff and Brenner waves were not just based on commodities/sunspots, but they were in turn influenced by war and climate, unbeknownst to either. Kondratieff and Brenner followed agriculture/commodity prices when agriculture accounted for 70% of the GDP pre-20th century. That only began to decline from 1850 forward, dropping to 40% by 1900 as the Industrial Revolution emerged with the invention of the steam engine. Then there was climate change. The Little Ice Age bottomed in the 1600s.

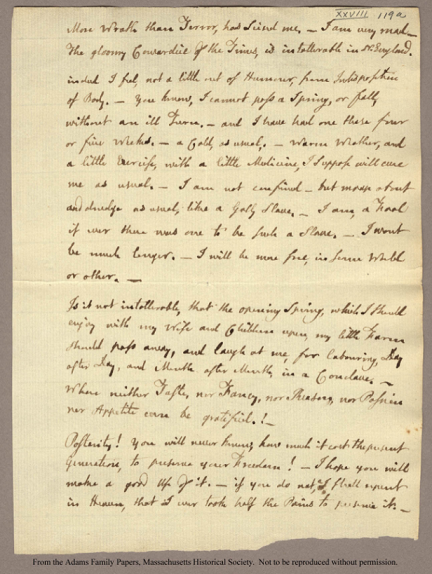

Then there was the volatility in weather that also impacted the commodity prices. This too has contributed to the inaccuracy of both waves. During the late 18th to early 19th century, it was still very cold and the ground would freeze down a couple of feet preventing winter crops. The ground froze to a depth of 2 feet according to John Adams. When John Adams set out to travel to Philadelphia, it was bitterly cold and there was a foot or more of snow that covered the landscape that had blanketed Massachusetts from one end of the province to the other. Beneath the snow, after weeks of severe cold, the ground was frozen solid to a depth of two feet. I grew up near the Delaware River. NEVER in my lifetime did I ever see the river frozen as you see in paintings of Washington crossing the Delaware River. In a letter to his wife, John Adams wrote:

“Indeed I feel not a little out of Humour, from Indisposition of Body. You know, I cannot pass a Spring, or fall, without an ill Turn — and I have had one these four or five Weeks — a Cold, as usual. Warm Weather, and a little Exercise, with a little Medicine, I suppose will cure me as usual. … Posterity! You will never know, how much it cost the present Generation, to preserve your Freedom! I hope you will make a good Use of it. If you do not, I shall repent in Heaven, that I ever took half the Pains to preserve it.”

“Indeed I feel not a little out of Humour, from Indisposition of Body. You know, I cannot pass a Spring, or fall, without an ill Turn — and I have had one these four or five Weeks — a Cold, as usual. Warm Weather, and a little Exercise, with a little Medicine, I suppose will cure me as usual. … Posterity! You will never know, how much it cost the present Generation, to preserve your Freedom! I hope you will make a good Use of it. If you do not, I shall repent in Heaven, that I ever took half the Pains to preserve it.”

On September 8, 1816, Jefferson described the weather in a letter to Albert Gallatin:

“We have had the most extraordinary year of drought and cold ever known in the history of America. In June, instead of 3¾ inches, our average of rain for that month, we had only 1/3 of an inch; in August, instead of 9 1/6 inches our average, we had only 8/10 of an inch; and it still continues. The summer too has been as cold as a moderate winter. In every state North of this there has been frost in every month of the year; in this state we had none in June and July but those of August killed much corn over the mountains. The crop of corn through the Atlantic states will probably be less than 1/3 of an ordinary one, that of tobacco still less, and of mean quality.”

Obviously, the Kondratieff and Brenner Waves did not understand the external forces. The climate was impacting the food supply, there were also wars. This is why their waves have not been consistent. If we extend the K-Wave 54 years from the commodity high in 1919, that brings us to 1973 which missed the end of Bretton Woods in 1971 by 2 years, but it was near the OPEC Oil crisis, which was imposed in retaliation for helping Israel in war. The Dow Jones Industrials peaked in January 1973 and crashed into December 1974. The Brenner wave did not bottom until 1978.

Another 54 years from there will bring us to 2027 while the Brenner Wave targeted 2019 and projects the low in 2023. Wheat peaked in March 0f 2022. So you can see if any of these targets were to actually work on time, it tends to be more of a coincidence rather than an accurate forecast. So I can see what you say that they have perhaps led some to think cyclical research is snake oil. It is so important to understand that you cannot create a model on potatoes and then use it to trade the Dow. We must understand the nature of markets to comprehend what we are really looking at in the first place.

There is a cycle of industrialization as well. Rome began as an agrarian society and moved toward trade, which brought them into conflict with Carthage. We see this cycle even in their coinage. The first silver coins of Rome were struck using the monetary system that was Greek in origin from the days of Athens and Alexander the Great. Only after the Second Punic War did Rome create its own monetary unit which was a debasement (reduction in weight) from 6.5 grams to 4 grams. That reflected both the inflation due to war, but also the rise of Rome whereby they no longer cared about complying with the Greek standard but set out to establish the Roman standard. To this day, many denominations still retain derivatives of the word “denarius” such as in the Iraqi Dinar or the French denier. The Germans called it the pfennig and the English adopted that as the penny.

There is a cycle of industrialization as well. Rome began as an agrarian society and moved toward trade, which brought them into conflict with Carthage. We see this cycle even in their coinage. The first silver coins of Rome were struck using the monetary system that was Greek in origin from the days of Athens and Alexander the Great. Only after the Second Punic War did Rome create its own monetary unit which was a debasement (reduction in weight) from 6.5 grams to 4 grams. That reflected both the inflation due to war, but also the rise of Rome whereby they no longer cared about complying with the Greek standard but set out to establish the Roman standard. To this day, many denominations still retain derivatives of the word “denarius” such as in the Iraqi Dinar or the French denier. The Germans called it the pfennig and the English adopted that as the penny.

Rome itself became more like New York and grain was imported from Egypt. As agriculture became more of an import, Rome blossomed like New York in the arts and culture. It built the massive port of Ostia which was celebrated on the coinage of Nero (54-68AD) securing the food supply.

Rome itself became more like New York and grain was imported from Egypt. As agriculture became more of an import, Rome blossomed like New York in the arts and culture. It built the massive port of Ostia which was celebrated on the coinage of Nero (54-68AD) securing the food supply.

The shift toward industrialization in the Roman Empire also resulted in a decline in birth rates for children as we see in modern times. Large families were needed in an agrarian society, but not so much in a developed society – hence the family laws of Augustus. We see the same patterns repeat throughout history.

The first known Clean Air Act occurred in 535 AD by Emperor Justinian in Constantinople. He proclaimed the importance of clean air as a birthright. “By the law of nature these things are common to mankind—the air, running water, the sea.” Even Cicero wrote about pollution in the ancient city of Rome. This went hand and hand with developed societies and urbanization.

Joseph Mois Schumpeter (1883-1950) was an Austrian economist, educated in Vienna. He taught at Czernowitz, Graz and Bonn. In 1932, he moved to Harvard where he taught until his death. Among Schumpeter’s writings is Theory of Economic Development (1912), Business Cycles (1939), Capitalism, Socialism and Democracy (1942), and History of Economic Analysis (1954).

Joseph Mois Schumpeter (1883-1950) was an Austrian economist, educated in Vienna. He taught at Czernowitz, Graz and Bonn. In 1932, he moved to Harvard where he taught until his death. Among Schumpeter’s writings is Theory of Economic Development (1912), Business Cycles (1939), Capitalism, Socialism and Democracy (1942), and History of Economic Analysis (1954).

Schumpeter developed a theory of trade cycles and growth; he argued that abnormal profit was the entrepreneur’s reward for innovation. He predicted, however, that the scope for innovation would be declining in the course of capitalist development as competitive market structures were replaced by monopolies. He believed that capitalism would gradually evolve into socialism. Like Malthus, he could not look into the future and see all the technological advancements that would constantly create waves of new innovation.

In 1939, it was actually Schumpeter who suggested naming the cycles “Kondratieff waves” in his honor. To explain the Kondratieff Wave, Schumpeter called them waves of innovation that result in waves of creative destruction. Each wave of some new innovation destroys the last. Cars wiped out horses & buggies. The internet is wiping out local stores, and the post office, as technology has introduced streaming that has wiped out VCRs and DVDs, and even movie theaters. The cryptocurrency advocates promote the end of central banks and paper currency.

There has always been a cycle of innovation. That was one of Joseph Schumpeter’s main theories to explain the business cycle. For example, first, there was the Canal Bubble that peaked during the Panic of 1825. There was the invention of the telegraph followed by the telephone. The ancient Romans had invented the first version of the Pony Express and could get a letter from Britain to Rome in about 7 days. That too was celebrated on the coinage of Emperor Nerva (96-98AD).

There has always been a cycle of innovation. That was one of Joseph Schumpeter’s main theories to explain the business cycle. For example, first, there was the Canal Bubble that peaked during the Panic of 1825. There was the invention of the telegraph followed by the telephone. The ancient Romans had invented the first version of the Pony Express and could get a letter from Britain to Rome in about 7 days. That too was celebrated on the coinage of Emperor Nerva (96-98AD).

This age of communication with the Pony Express and stagecoach travel was followed by the invention of the steam engine. That gave birth to the railroad boom which lasted from the 1860s and peaked in 1907. It was on May 10th, 1869, when the Union Pacific and Central Pacific railroad lines joined 1776 miles of rail at Promontory Summit, Utah Territory connecting the East and West by rail. The Railroad Barrons became famous millionaires and that innovation boom peaked initially with the Panic of 1893, but the final rally in the railroads peaked in 1907. Thereafter, the combustion engine took over for the next wave of innovation giving birth to the automobile took over and peaked in 1929, tractors, and air travel.

This age of communication with the Pony Express and stagecoach travel was followed by the invention of the steam engine. That gave birth to the railroad boom which lasted from the 1860s and peaked in 1907. It was on May 10th, 1869, when the Union Pacific and Central Pacific railroad lines joined 1776 miles of rail at Promontory Summit, Utah Territory connecting the East and West by rail. The Railroad Barrons became famous millionaires and that innovation boom peaked initially with the Panic of 1893, but the final rally in the railroads peaked in 1907. Thereafter, the combustion engine took over for the next wave of innovation giving birth to the automobile took over and peaked in 1929, tractors, and air travel.

On January 1, 1914, the world’s inaugural scheduled flight with a paying passenger hopped across the bay separating Tampa and St. Petersburg, Florida. Planes were used during World War I, but after the war, there were thousands of unemployed pilots and a surplus of aircraft along with an appreciation for the future significance of this new technology.

It was after World War I that civilian airliners began to emerge. The Fokker Trimotor built in Europe by the Dutch with an 8-12 passenger capacity was the most popular airliner in the 1920s. It had a range of about 600 miles. World War II was coming into play when the USA built Douglas DC-3 with a capacity of 28 passengers. It had a range of nearly 1500 miles. The DC-3 made its maiden commercial flight in 1936 between New York and Chicago and thus the airline stocks were the big innovation for the rally into 1937.

It was after World War I that civilian airliners began to emerge. The Fokker Trimotor built in Europe by the Dutch with an 8-12 passenger capacity was the most popular airliner in the 1920s. It had a range of about 600 miles. World War II was coming into play when the USA built Douglas DC-3 with a capacity of 28 passengers. It had a range of nearly 1500 miles. The DC-3 made its maiden commercial flight in 1936 between New York and Chicago and thus the airline stocks were the big innovation for the rally into 1937.

It was 1938 when televisions first began to be commercially available. It would be after World War II when this became the next real innovation boom. It was 1954 when color RCA TV C-100 systems were sold across America. By 1960, there were four debates between John F. Kennedy and Richard Nixon that were broadcast and changed the manner in which presidents would campaign. By 1969, Neil Armstrong walked on the moon for the first time as millions of American viewers watched live on network TV.

It was 1938 when televisions first began to be commercially available. It would be after World War II when this became the next real innovation boom. It was 1954 when color RCA TV C-100 systems were sold across America. By 1960, there were four debates between John F. Kennedy and Richard Nixon that were broadcast and changed the manner in which presidents would campaign. By 1969, Neil Armstrong walked on the moon for the first time as millions of American viewers watched live on network TV.

Of course, we have the internet boom in 2000, etc., and there is a clear cycle of innovation that Kondratieff and Brenner could not see before even the invention of the combustion engine that led to tractors changing agriculture forever. There is a difference between when something is invented and when it becomes commercially viable.

Of course, we have the internet boom in 2000, etc., and there is a clear cycle of innovation that Kondratieff and Brenner could not see before even the invention of the combustion engine that led to tractors changing agriculture forever. There is a difference between when something is invented and when it becomes commercially viable.

For example, the FAX machine was actually invented by the Scottish inventor Alexander Bain (1811–1877) who was famous for being the first to patent the electric clock and was also involved in installing the telegraph lines between Edinburgh and Glasgow in Scotland. He could see in his mind’s eye that the Morse Code of dots and dashes invented several years earlier by Samuel Morse, could take an image and transmit it by reducing it to a binary image. He envisioned the first fax machine. In 1846, he was able to reproduce graphic signs in laboratory experiments. He applied and received a British patent #9745 on May 27, 1843, for his “Electric Printing Telegraph”, but it took more than 100 years to actually become usable. We have embarked on the next wave of innovation that includes quantum computers and Artificial Intelligence.

Consequently, when you are looking at long-term cycles, a few hundred years is not enough data. If Kondratieff were alive today and based his study on just the current system, he would be focusing on services rather than commodity-based economies. Agriculture has fallen to just 1.41% of the civil workforce.

It is simply vital to grasp the very nature of the data that you are intending to use to create models, which is itself in its own cycle of innovation. This is why the Economic Confidence Model is totally different. It is NOT panic on any single sector. It is based on the boom and bust movement irrespective of the sector and it embraces the entire world, not a single economy. Back-testing revealed that not only did the Roman Monetary System collapse in just 8.6 years, but this cyclical frequency appears throughout the ancient monetary systems globally.

It is simply vital to grasp the very nature of the data that you are intending to use to create models, which is itself in its own cycle of innovation. This is why the Economic Confidence Model is totally different. It is NOT panic on any single sector. It is based on the boom and bust movement irrespective of the sector and it embraces the entire world, not a single economy. Back-testing revealed that not only did the Roman Monetary System collapse in just 8.6 years, but this cyclical frequency appears throughout the ancient monetary systems globally.

There is a lot more hidden behind the cloak of what people think is just chaos.

The post Brenner & Kondratieff Waves v Economic Confidence Model first appeared on Armstrong Economics.