It’s The Impeachment That Would Tank the Market

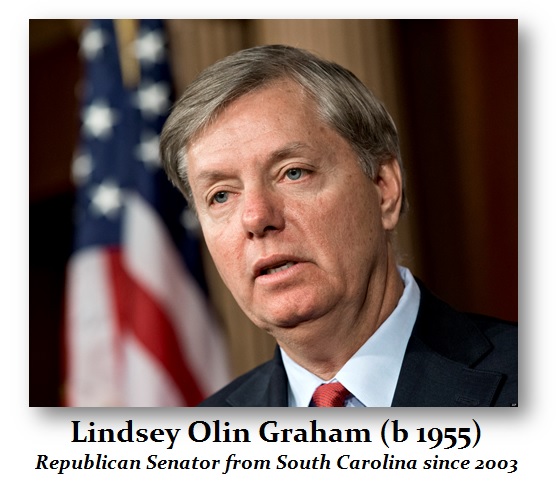

We have now reached the point where a pause in the uptrend of the US Share Markets comes into position. Republican Senator Lindsey Graham (R-SC) has been an elitist out for Trump’s head from the beginning. He was even trying to throw his hat in the ring to be President and took personal offense that an outsider would beat everyone.

He has publicly admitted there is no evidence that Trump colluded with Russia during the campaign. I believe my entire case revolved around the elements in the US government were colluding with the bankers to install a puppet government in Moscow and take over the country. Yeltsin turned to Putin for help and that is how Putin even got in. They would never allow a trial in my case fearing what would surface.

Despite the fact that Graham has admitted that there was no Russia involvement with Trump to rig the election, he has come out and said that Firing Robert Mueller would be the end of the Donald Trump presidency.

Make no mistake about it, Graham and the Democrats want Trump out of office. This is a club and they want to keep it that way. Grahm will help the Democrats accomplish that even if it means turning the elections back to the Democrats in November.

The killer of this Bull Market will be by the hand of people like Lindsey Graham. An IMPEACHMENT proceeding against Trump will see the Panic Cycle hit on an annual basis. This will actually be very bad for the entire world economy because Trump’s Tax Reform has forced other countries to look at how their tax systems are not competitive either. All of that will be reversed and clear this is what the Washington elite want like Lindsey Graham. They are clueless and believe getting rid of Trump will restore their control. What they overlook is the simple fact that Trump won because people have had enough of career politicians who always lie and support the status quo.

In the US Share Market, this is now a turning point we have reached. I have warned for months that exceeding the November high would lead to a January high. Now, the failure of February to make new highs warns of a March low. The support for a correction now lies at the 25637 level on a weekly closing basis (this is not a reversal). We will elaborate today on the Private Blog.