The Third & Fourth Reversal

Many have asked for some clarification on the Reversal System and how we use it to ascertain changes in real trend. As stated previously, trend changes ONLY on the Monthly Level of time. The Daily and Weekly levels are the noise. This is where most people lose their money trading because a correction may appear to be a change in trend but it will suck them into a false move and the reverse again. Only at the Monthly level can we determine the true character of a market be it bearish or bullish.

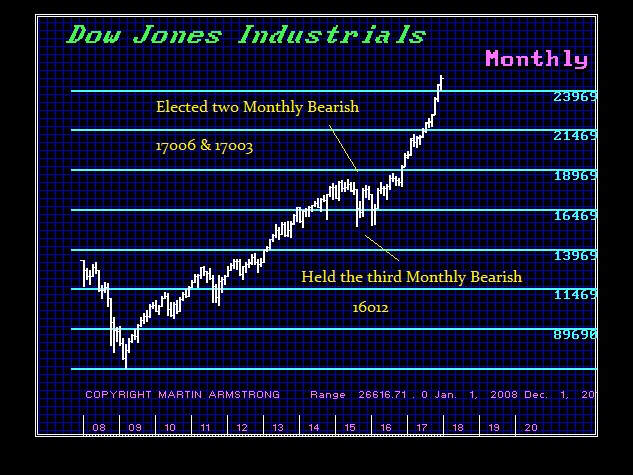

We can see that there were periods in the Dow that provided brief corrections. The challenge was to determine if those corrections changed the trend. On our model, we can draw lines in the sand that if crossed provide the identification that the trend is actually changing. The trend is changed by electing all FOUR Monthly Bearish or Bullish Reversals. What is typical is the fact that we elect the first two and hold the third. This is a strong correction which typically moves the majority to assume the trend has changed when it has not. This is how the market traps the majority and cleans out their pockets making them pay their dues for learning.

All FOUR Monthly Bullish Reversals were elected in the Dow on the close of September 2012. There was one-month follow-through, a pull-back to retest the reversal, then it simply took off.

In the case of Gold, why have we been optimistic that gold will turn around and rally when the Monetary Crisis Cycle begins? When we look at the Monthly Reversals, gold has pushed through the first THREE reversals yet stopped before the FOURTH both on the upside and downside. From the major high, we elected the first THREE Monthly Bearish but not the FOURTH at $903. This is why a dip below $1,000 remains possible but unlikely to elect that reversal. Such a move would be enough to trap the majority and set the stage for a rally that is at last not believed as we have seen in the Dow. We have had the most hated bull market in history going on for 9 years now and the retail public is still not foaming at the mouth. Analysts are only now starting to consider it will continue and that is based only on Trump’s tax reform.

Then from the 2015 low, gold rallied and again moved through the first THREE Monthly Bullish Reversals stopping at the FOURTH. We have the perfect balance that is often the character of markets – equal opportunity for each side.

The major TREND is determined ONLY at the Monthly Level. Electing all FOUR Monthly Reversals to change a trend from bullish to bearish or bearish to bullish is by no means an easy accomplishment. Never get fooled by short-term moves on the Daily and Weekly level. So many people immediately call for a change in trend based upon just a few days price action. These are the people who are easily separated from the money rather quickly and will blame everyone else but themselves.