Real Estate v Quantitative Easing

QUESTION: Hi Martin,

I just finished your new NYSE Boom/Bust report. This is excellent work and as always extremely fascinating. Thank you for continuing to share these profound views with us.

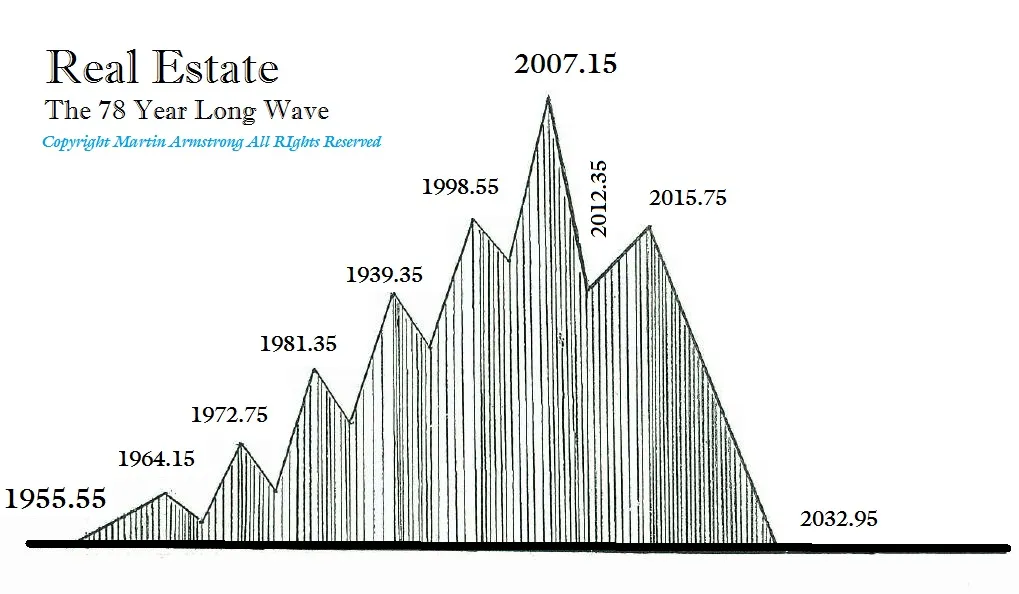

My question relates to your view that we are looking at a complete collapse of Quantitative Easing and that will likely see a massive capital flight to the dollar and the major safe haven will be EQUITIES. In the context of this possibility, are you able to comment on how this may relate to Real Estate. Your ECM seems to be calling for Real Estate to top out and structurally fall in 2032. Is it not possible that with the collapse of QE and potentially economies that we will see more negative rates in the short end and with the government powers to seize assets in bank accounts, would it not be prudent to have zero cash in hand and hence we see a massive capital flight to Real Estate too? Or will the collapse of QE lead to significantly higher rates across the curve and hence blow all leveraged exposure sky high?

Many thanks as always,

David

ANSWER: The problem with real estate has been that its value depends upon lending. This was what the government did as part of the New Deal by creating 30-year mortgages back during 1930s. This was a scheme to get prices up by extending the period people could pay off the loan. Typically, the duration was 5 years previously. Because of the 30-year mortgage, prices have risen to reflect the accumulative amount of earnings available. If there was no lending, prices would collapse to 10 cents on the dollar until cash buyers become interested.

The collapse in Quantitative Easing will have the effect of causing rates to rise on the long-term. However, there will be a shift toward private assets and this will help to a large extent. However, keep in mind that many institutions will be trapped and unable to shift to private assets. Many boards will not understand the shift and still believe, wrongly, that unsecured government debt is best.

Prices of real estate will decline in proportion to the decline in mortgage availability. The average home peaked in 2007 and the bounce we saw into 2015 was the high-end from foreign capital inflows around the world, but this was predominantly for cash not mortgaged property. This chart reflects “real value” not nominal so some areas will still see moderate price increases but that will not result in new real highs. This disparity among regions is tax-driven with a mass exodus beginning from California, New York, New Jersey, and Illinois to mention just a few.

We are already witnessing banks beginning to withdraw from lending on real estate.

I have provided the guide-posts for what is to come. This will be an interesting future.