How Can the Majority Be Wrong if they ALL Expect Interest Rates to Rise?

QUESTION: Today most analysts think higher interest rates are on the way. If the majority is always wrong how does that play into the expectations for higher interest rates?

HP

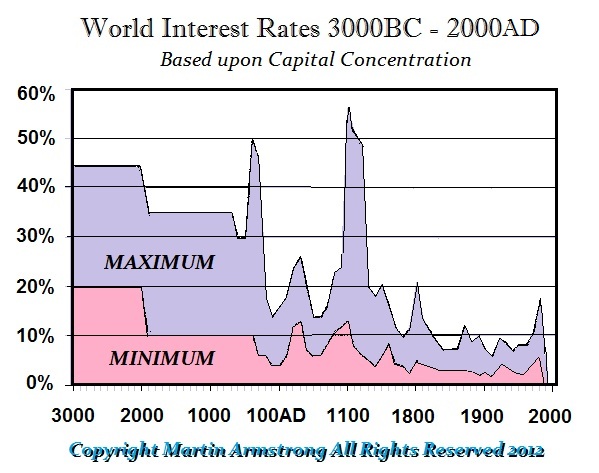

ANSWER: With the Federal Reserve stating they must “normalize” interest rates since 2014, of course, the majority will view that will be the trend. We are at a 5,000 year low in rates historically. Naturally, the only direction is now UP, UP, and AWAY! There are two ways that they will be wrong and that has to do with their interpretation.

First, they will not comprehend just HOW fast rates will rise or WHY!

Second, they will interpret higher rates as BEARISH for equities, as they traditionally do.

Therefore, the way the MAJORITY will be wrong is not in the mere fact that rates will rise, they read the statement of the central banks. It is the interpretation of what will follow from the simple trend. In equities, every new high was to be the last from 2009 right up to 2018.