Italy Falls into Recession

QUESTION: It is official. Italy is now in recession. Obviously, the Fed is looking outside its own economy. Your Economic Confidence Model is remarkable. I have been following you now for more than 10 years. It has always been correct. Why does the economic community and governments pretend you cannot forecast the economy? You have proven the economy can be accurately forecast.

PV, Rome

ANSWER: Yes, Italy has turned down. The Fed knew what is coming. All these pundits who claim the stock market forced the Fed to change policy have only shown their total ignorance of the true factors upon which central banks will act.

I have probably met with more central banks than anyone. They all know the Economic Confidence Model. That is one of the primary questions I am asked by them – where does it stand now. They cannot publicly come out and say the economy will turn down now for fear that they will be blamed. Just look at the Russia-Trump nonsense. They want to pretend that Hillary would have been elected BUT FOR the release of the emails which showed her true colors. Our computer was forecasting she would lose BEFORE any emails were released. The trend was already set in motion – anti-career politicians. Just look around the world and you see the same trend. But it is easy to always blame someone else for your failure. Thus, central banks cannot forecast a decline because if it happens, they would be blamed just like the Russians right now for Hillary’s loss. The central banks can only forecast economic growth, not recessions.

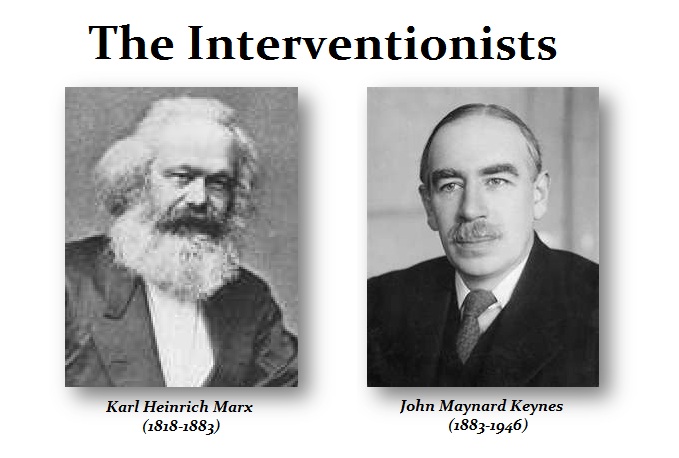

As for the academic community maintaining that the business cycle cannot be forecast, this “opinion” is self-serving. To announce that the business cycle is regular means you cannot control the economy and the entire theory of Marx and Keynes is completely wrong. The Russians killed Kondratieff because he warned the business cycle would kill communism. The economic community would not be able to put out theories to manage the economy and they would have no importance if they admitted they cannot control the business cycle. It is just self-interest.

I have been talking with central bankers for months and it has been about the decline into 2020. That is the backdrop to the Fed’s actions – not the stock market. And as for gold, it rallies because interest rates will decline when the Fed said there is less of a risk of inflation? It just seems the reasoning is never consistent.