Up – Down – Sideways? What is Going On?

Of course, the markets have been causing losses among the bulls as well as the bears. This is what they do and MUST do before they can actually make a decisive move of the nature we are looking at ahead. It becomes rather amusing to watch the so-called professionals, who are constantly wrong, brood and proclaim this feels like 2000 or 2007 before the crash. Are they right? Or are they just angry because they lack the skills to forecast?

Nevertheless, our proprietary Golden Rule of the 3 Attempts (TM) is a very important tool to comprehend. (Details will be provided at the Technical Training Course).

Well, let’s look at 2000 from the Dow perspective. The 2000 high was a Phase Transition in the NASDAQ, DOT.COM bubble. When we look at the Dow, we still see a high, but it is more of a declining sideways pattern. There were three failed attempts to make new highs, but each was lower than the previous in compliance with our Golden Rule of the 3 Attempts (TM). This by no means appears similar to the current pattern.

When we compare this to the current pattern pictured here, we see that the third thrust broke through the channel and made a higher high. This is not showing long-term weakness. We have a different trading pattern going on here, one designed to create confusion to get the MAJORITY on the wrong side to enable a Phase Transition. To revisit key support, the Dow must now close back below 17120, and then we will get a correction.

Here is the 2007 high. Again, we can see our Golden Rule of the 3 Attempts (TM) rally, but each one was significantly lower with new lows each time. This patterns warned a crash & waterfall event was in motion. This reflects a clear bearish pattern with lower highs and lower lows.

Now, look at how a market knocks on the door three times before it breaks out. This is just one of our technical rules we call the Golden Rule of the 3 Attempts (TM). No doubt, other analysts will quickly plagiarize this and call it their own, and you will then see who is a real analyst and who is fake. Still, even the 1966 rally, which was the mutual fund bubble, and the 1968 rally when Bretton Woods started to crack, were the initial attempts to break 1,000. Then we had the 3 attempts which did exceed 1,000 before the breakout began with the beginning of this private wave. Note also that while gold rallied from $34 in 1970 to almost $200 by 1974, the Dow rallied and broke through the 1,000 level for the first time. They did not move in opposite directions.

So to those who keep yelling that the market will crash to 10 cents on the dollar, all I can say is that I suppose that means people will buy bonds at -10% interest rates just to park money. If what they are yelling is even possible, then interest rates must move lower and big money is willing to lose it all just to park money. I am sorry. I just do not understand such logic. This is normally the type of nonsense you get from people who want to pretend to be analysts but have no experience in the field so they lack any comprehension of the moving parts. To create a stock market crash, we need confidence to rise in government. Excuse me. Anyone hear of Donald Trump? Confidence in government is declining rapidly.

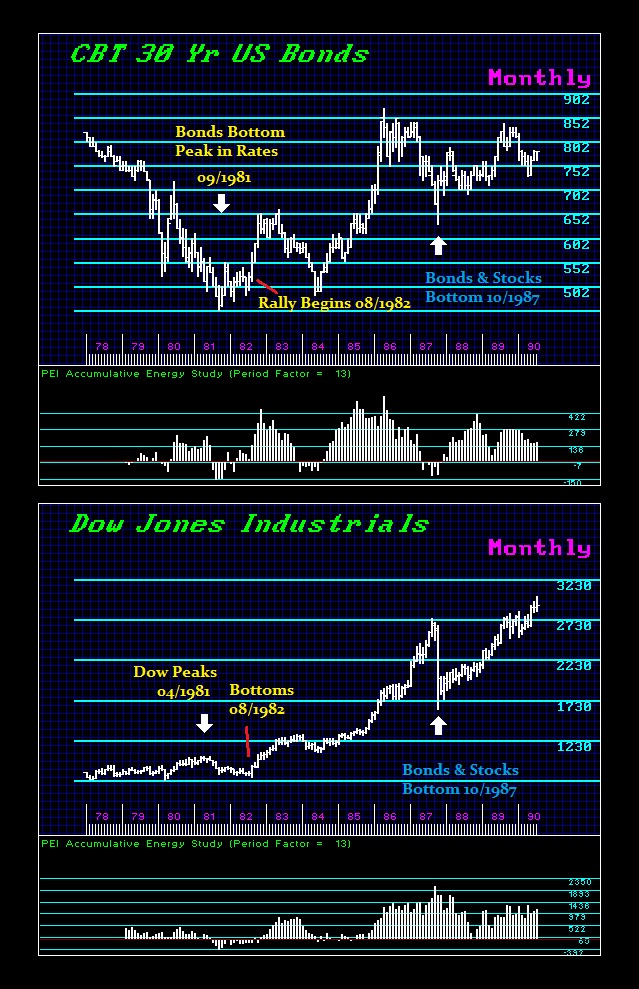

As for the dire prognostications that the stock market will crash because the Fed will raise rates, this once again demonstrates such people are not analysts at all for they have nothing original to add to the debate. I traded that rate hike under Paul Volcker into 1981. With each rate hike, the market declined and rebounded. The final hike in 1981 was a real lesson for the market rallied. It did not even decline. When that took place, I knew the ECM was correct and we peaked in rates right then and there.

So sure, we should expect the market to drop when the Fed raises rates. Fools will be easily separated from their money. This is why there are fools in the world. Every species serves a purpose as energy in the food chain for the next one up in the food chain. Trading markets amounts to the same process. We always need the person on the opposite side.

Rising US rates will be inevitable. This will drive the dollar higher, fuel the debt meltdown, and when the capital inflows push US assets higher, the Fed will be compelled to raise rates further to stop the speculation since that is pure Keynesianism that does not work — but hey, what else do they have to do?