Jobs v Asset Inflation

The job market collapsed in May as the Labor Department reported on Friday that the nation’s economy added only 38,000 jobs. The experts were expecting a modest gain of 150,000 jobs. Additionally, there were actually 59,000 fewer new jobs in March and April than previously estimated. Then, looking closely at the 38,000 new jobs that were created, only 25,000 were in the private sector with the rest created in non-productive government jobs which feed off of taxes.

What people are also ignoring is regulation. Under Obamacare, there is absolutely no possible way even I would hire more than 24 Americans. We have people working in Beijing to Germany. Then you have the pension crisis. Companies are hiring part-time to avoid pensions. Even the US Post Office is playing that game. The heaps of regulation associated with this entire mess is crazy. And politicians want to raise the minimum wage to $15? All they will do is replace workers of a major scale. We already have robots and drones replacing workers because of regulation, pensions, and healthcare. Eliminate all that, and $15 is no big deal. If government wants to get more money into the pocket of workers, how about eliminating the income tax. Even if the lower income does not pay income tax and get the bilk refunded at year-end, the government has borrowed that money for free cheating them out of an opportunity to invest, and then they complain the rich get richer from investment while denying that opportunity to the lower classes.

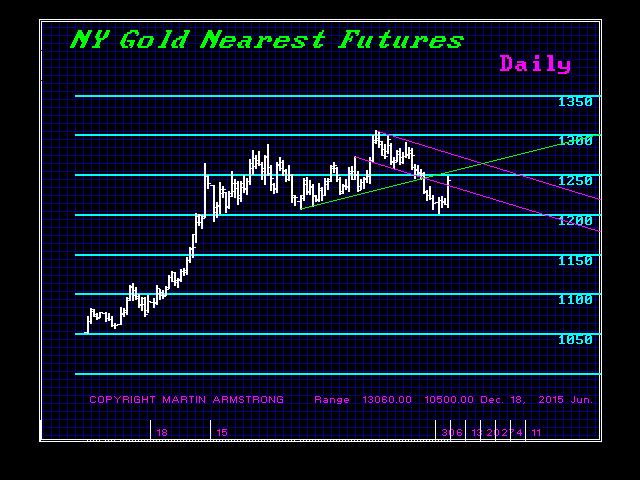

When we look at the markets, each has moved to our key numbers are bounced. The Dow bounced off of the Month Bullish to close below it, gold held the critical number on a daily closing that would confirm the break under $1,000, and the euro also bounced from the key support. The markets are showing the lack of a decision to breakout or breakdown just yet as people remain confused. Nevertheless, the Dow did not crash and technically is holding still.

This is all reflective of the confusing trends as the economy is shifting. The jobs numbers on the one hand would say no rate hike. However, if assets continue to take off, the Fed will be accused of helping the rich get richer and will have to raise rates of be crucified by the socialists. So as we have been saying, this is the crazy times. All we can do is watch the key numbers and timing.