Greenspan Sees Inflation or Stagflation? There is a Difference!

QUESTION #1: Marty, Greenspan reads you without a doubt. You warned back in 2012 that we have to be concerned about the USA moving into stagflation with deflation in Europe and Japan. He said the same on Bloomberg. He also said the crisis is the aging population, lower birthrate, and that will result in higher costs without economic expansion. That is everything you said two years ago.

QUESTION #2: Marty,

Deflation is gripping Europe but Greenspan warns of inflation in the USA.

Is he right? What are your thoughts?

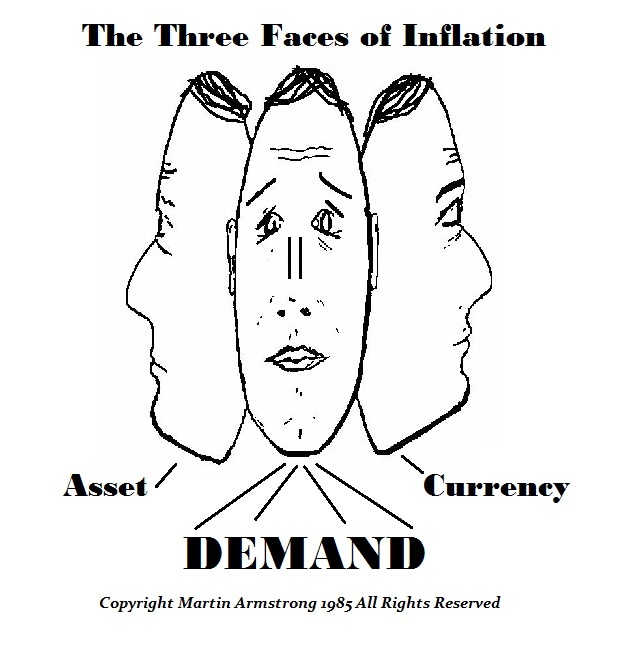

ANSWER: Inflation, like deflation, is multifaceted. There is no single dimension for it is not black and white. Most of the debate concerning inflation is fixated upon this basic expectation assuming that increasing money supply must be inflationary. That is just flat outright WRONG! There are times we have Currency Inflation since everything has a true international value. If a currency declines, assets will generally rise in proportion to the decline as long as there is no political risk as to the collapse of government or military invasion.

It is astonishing to me how people who claim they are analysts, economists, or political scientists, were all seriously wrong about BREXIT. Not that it won at the polls, but the aftermath. Goldman Sachs, Morgan Stanley and Credit Suisse are just the top three banks who were all WRONG on their forecasts predicting of a post-referendum recession as trade deficit narrows. None of them understand capital flows. They have never spent a dime to even do historical research. They are only interested is a quick buck and nothing more. To them, the economy is control by the state so bribe them to get what you want to see is generally their motto.

Note that the day of BREXIT, yes the currency collapsed because of their forecasts. But the stock market rose that day. It did not collapse. This is CURRENCY INFLATION and these people are clueless when it comes to understanding real international capital flows. I have told the story before that I bought a 328 Ferrari in London for about £30,000 when the pound fell to $1.03. The same car in dollars was selling for about $50,000. The pound had been over $2 when Ferrari priced what they would sell that car for to Brits. Since the pound fell so hard, the Italians raised the price to £45,000. Then the pound rallied back to almost $2. I drove the car in London for about two years and then sold it used for about $50,000. This created the false assumption that a Ferrari was a great investment and people began buying and storing them. It was just the currency — not the car. The same thing took place with property in London. Americans rushed in buying everything.

Note that the day of BREXIT, yes the currency collapsed because of their forecasts. But the stock market rose that day. It did not collapse. This is CURRENCY INFLATION and these people are clueless when it comes to understanding real international capital flows. I have told the story before that I bought a 328 Ferrari in London for about £30,000 when the pound fell to $1.03. The same car in dollars was selling for about $50,000. The pound had been over $2 when Ferrari priced what they would sell that car for to Brits. Since the pound fell so hard, the Italians raised the price to £45,000. Then the pound rallied back to almost $2. I drove the car in London for about two years and then sold it used for about $50,000. This created the false assumption that a Ferrari was a great investment and people began buying and storing them. It was just the currency — not the car. The same thing took place with property in London. Americans rushed in buying everything.

I also ran to British Airways and asked how many open tickets they would sell me for the Concorde. They looked at me like some sort of dodgy person and could figure out why I would do such a thing. They came back and said 25. I said great. A round trip was £2,000. Back when the Concorde began, it was about a $5,000 ticket when a first class ticket was about $3,000. So the Concorde was overpriced and mostly empty. With the drop in the pound to par, it was now cheaper than a first class ticket. I bought as many as they would sell me. I got on the Concorde and suddenly it was full with Americans all saying what a deal.

I also ran to British Airways and asked how many open tickets they would sell me for the Concorde. They looked at me like some sort of dodgy person and could figure out why I would do such a thing. They came back and said 25. I said great. A round trip was £2,000. Back when the Concorde began, it was about a $5,000 ticket when a first class ticket was about $3,000. So the Concorde was overpriced and mostly empty. With the drop in the pound to par, it was now cheaper than a first class ticket. I bought as many as they would sell me. I got on the Concorde and suddenly it was full with Americans all saying what a deal.

CURRENCY INFLATION is not created by normal supply and demand conditions they teach you in school. Perhaps if you were not an international traveler as I have been, you would never experience it. I use to have an American Express card from every office we had around the world. I would pay in the currency of my choice depending upon the market. Today, American Express will only issue you a credit card where you are domiciled.

ASSET INFLATION is different again. This unfolds much like negative interest rates and it is the same mechanism that is creating it. This is when money fears government, banks, or whatever, and it seeks to get off the grid. It will run into property, stocks, gold, art, collectibles, or antique cars. People are buying bonds at negative yields because they are parking money. In Europe, they have been rushing into Germany assuming if the euro breaks, they will get Deutsche marks. However, what is Deutsche Bank fails and the government has to blink and back-off of this insanity of bail-ins? They will suddenly find their conservative bet on Germany will turn into a blood-bath.

ASSET INFLATION is different again. This unfolds much like negative interest rates and it is the same mechanism that is creating it. This is when money fears government, banks, or whatever, and it seeks to get off the grid. It will run into property, stocks, gold, art, collectibles, or antique cars. People are buying bonds at negative yields because they are parking money. In Europe, they have been rushing into Germany assuming if the euro breaks, they will get Deutsche marks. However, what is Deutsche Bank fails and the government has to blink and back-off of this insanity of bail-ins? They will suddenly find their conservative bet on Germany will turn into a blood-bath.

The traditional view of inflation is DEMAND INFLATION where a shortage in supply will result in hire prices. But this assumes demand will not change. The whole theory of creating a monopoly is confined solely to this aspect. A Monopoly is actually impossible for if the assumption is prices can just be raised and people will have not choice.

The traditional view of inflation is DEMAND INFLATION where a shortage in supply will result in hire prices. But this assumes demand will not change. The whole theory of creating a monopoly is confined solely to this aspect. A Monopoly is actually impossible for if the assumption is prices can just be raised and people will have not choice.

Yes in “Debt is Destroying Everything. Where is Common Sense When We Need it the Most?” published August 19th, 2012 I wrote:

So we have to be concerned about STAGFLATION, rising costs with collapsing economic growth. We are living so far beyond our income that we are completely unconnected to any productive capacity. The debt can no longer be paid off. It is beyond several generations. Charles Dickens wrote in Little Dorrit that “[Credit is a system whereby] a person who can’t pay, gets another person who can’t pay, to guarantee that he can pay.”

Even the demographics are changing. As the older generation exceeds the working population, the Ponzi Scheme government established to pretend they would be there to take care of everyone are collapsing. This is why Obamacare is also collapsing. The youth are not joining the crowd. As the greater proportion of society is no longer productive, GDP declines while costs rise. This is the core of STAGFLATION. So we are not looking at inflation as we know in pre-1981.