Did the Fed Really Say they Could Buy Stocks?

The Fed told Congress it would buy stocks if Congress allowed it. This statement has caused a lot of people to scratch their heads. Will this cause all the stock bears to rethink their prognostications of a major stock market crash? This was not even on the radar of most people.

Some have reported this story as “the first time in U.S. history” that the Federal Reserve has openly spoken about purchasing of stocks rather than bonds and mortgage-backed securities. While this news may have been shocking to most, South Carolina Republican Mick Mulvaney asked Janet Yellen before the House Financial Services Committee about the Fed’s authority to buy stocks to stimulate the economy. Mulvaney asked:

“There’s been some attention in the last few months about the recent decision by the Bank of Japan to start purchasing equities and my question to you is fairly simple. Is the United States Federal Reserve looking at the possibility of adding the purchase of equities to its tool box as it looks at monetary policy?”

Yellen answered:

“Well, the Federal Reserve is not permitted to purchase equities. We can only purchase U.S. treasuries and agency securities. I did mention in a speech in Jackson Hole, though, where I discussed longer term issues and difficulties we could have in providing adequate monetary policy. Accommodation may be somewhere in the future, down the line that this is the kind of thing that Congress might consider, but if you were to do so, it’s not something that the Federal Reserve is asking for.”

This response shook many on Wall Street. It is true that buying equities has been a part of Japan’s effort to stimulate its economy. We will most likely see this tool attempted by Draghi on Europe since he has run out of things to do. But let’s put this all in perspective. Even China bought US equities, as have other central banks, to diversify since all they can do is have dollar debt given the collapse of the euro and the lack of central European debt. Yet, that is not even the issue at hand.

When the Fed was first established to stimulate the economy during a downdraft, the Fed bought ONLY private corporate paper. It was because of World War I that Congress ordered the Fed to buy only government debt to help fund the war. That was NEVER put back after World War I. Then during World War II, Congress ordered the Fed to SUPPORT government debt at 100% par. That they repealed in 1951.

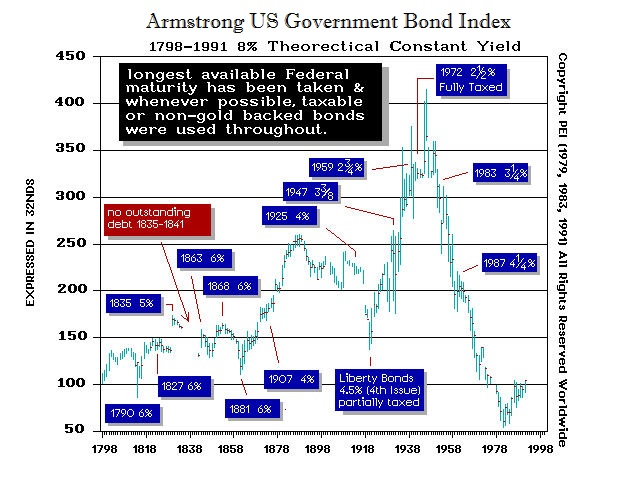

You can see here in our chart of the US bond market back to inception that there was an immediate surge when the World War began in Europe as capital fled to the USA. Then you see the lows holding a steady line. That was the order to support the US federal bond market. You then see the bonds crash into 1981 (note: blue labels market the start of the issue used 30 year bonds).

Everyone is shocked that Yellen did not say no to buying equities, but a little history is required to understand that it is Congress — not the Fed — who dictates what they can and cannot buy.