Fractal Nature of Trading

QUESTION: Marty; you said at the cocktail party that there are four level of time within each major level of time from daily to yearly. You said that trading results depend upon how you use the model for it is not a one dimensional model so people trying to compare trading results are usually lost. I have seen people who try to bash you and it becomes so obvious that they are mad because they have been wrong and just blame you. I looked at your track record from Deutsche Bank when you managed the hedge fund for them. You had the lowest drawdown of anyone probably in history. There is proof you have done what others cannot do. Can you explain a bit more how you see into the world connections and markets?

Thank you for a wonderful conference. You also put on such a first class even with unlimited food and drinks. They are better than any wedding or bat mitzvah I have ever been invited to. You have to spend hundreds of dollars per head per day. Your staff were very professional and your daughter ran the show. She can stand up before the crowd with no fear just like you. Hope you are grooming her to replace you.

LF

ANSWER: Yes absolutely everything is connected. Once you see it, it might be a bit like Neo in the Matrix and you cannot go backwards. You certainly cannot be a hedge fund manager unless you think dynamically and see the connections. If you cannot do that, do not try to manage money.

ANSWER: Yes absolutely everything is connected. Once you see it, it might be a bit like Neo in the Matrix and you cannot go backwards. You certainly cannot be a hedge fund manager unless you think dynamically and see the connections. If you cannot do that, do not try to manage money.

You must understand that markets are fractal. So each level daily to yearly is the first step in carving up time. Time is totally arbitrary. I can start a week on Tuesday or make it 8 days instead of 7. Each slice of time will reveal the trend. We can produce a Yearly Bearish Reversal every day of the week by recalculating a year to end that day. There is so much we can do but it requires tremendous computer power.

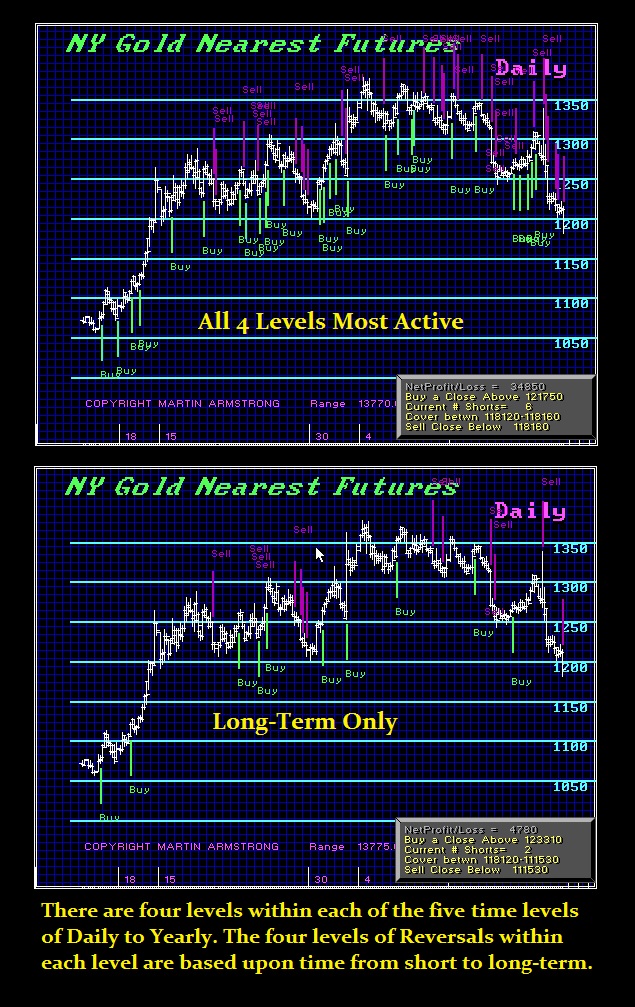

The Reversal System defines four sub-levels within each major time level. So it depends on how you wish to use them. You can use them all and you will get one result with greater trading activity. The lower chart just use the long-term. This reduces the trading activity and produces a different net return of 4780 compared to 34850.

Now, you can take these results and add in the Weekly Reversals, then Monthly, Quarterly, and Yearly. We will be adding these option to the Trader Pro version. This way you can tailor the model to your particular desire. It is by no means quantifiable as a single one-dimension tool.

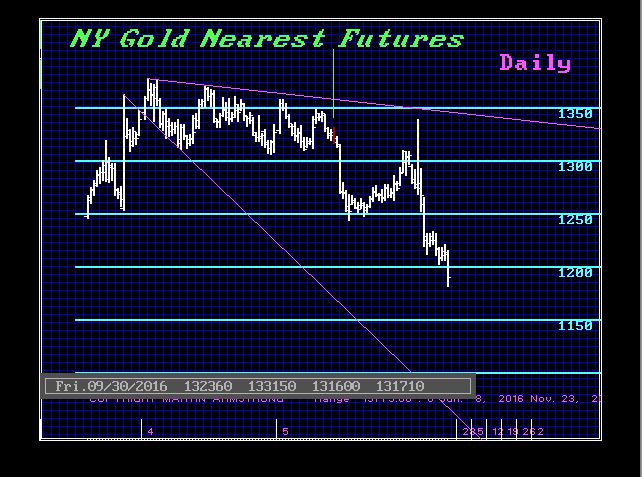

Then the model can be used for speculation or hedging. A hedging model is either long or short. It does not add to positions as the trend unfolds. The Reversals are definitive numbers, but they are separate and distinct from TIME. Reversals do not tell us WHEN they will be elected. That is where the cycles come into play. In the case of gold, we had the Monthly Bullish Reversal 1362 and ONLY exceeding that would it change the direction of gold. I wrote on February 11th, 2016: “The Monthly Bullish stands up at 1362. That is what we need to elect to suggest that a change in trend is possible. Otherwise, be cautious. We are looking at all markets pushing to their extremes. This is the prelude to the chaos coming in 2017.”

If you are going to change trend, that takes place ONLY at the Monthly level. This is why I have stated countless times you must define where you are right and and where you are wrong. I did that – 1362. You cannot get more black and white than that. I warned that the Quarterly Bullish Reversal was 1347. On August 2nd, I wrote on the Private Blog:

“We still need to get a monthly closing above 1362 to suggest that the 2015 low would potentially hold. We would also need to close September above 1347 and year-end above the 2015 high technically. These targets must be met to imply gold will hold.”

Gold crashed to avoid also the Quarterly Bullish Reversal at 1347 on September 30th. Meanwhile, the angle of the market points to new record lows. I have been warning that we face a major dollar rally. Only such a rally will break the back of the world economy. A lower dollar will bailout the Emerging Markets where a high dollar will create sovereign defaults around the globe.

Gold crashed to avoid also the Quarterly Bullish Reversal at 1347 on September 30th. Meanwhile, the angle of the market points to new record lows. I have been warning that we face a major dollar rally. Only such a rally will break the back of the world economy. A lower dollar will bailout the Emerging Markets where a high dollar will create sovereign defaults around the globe.

Opinions are something we all have. But TIMING comes first and then the NUMBERS. This is very black and white. The people who are so desperate to also prove me wrong rage against my opinion. That’s fine. I really do not care because they are absolute fools. They attack me like everyone else and fail to comprehend this is not about my opinion. Neither the Reversals nor the Cycles are based upon my subjective opinion. The model was correct it forecasting both Trump and BREXIT. That was not my personal opinion or desire.

As long as idiots try to attack me personally, they are revealing that they are linear thinkers, more suited to work for government, and are incapable of seeing the world around them as interconnected and dynamic. They are the same type of people who fought against the idea that the world was round because how could you stand upside down on a ball? They lacked to understanding of gravity and burned Bruno alive at the stake for daring to say that the earth revolved around the sun.

In this instance, they do not comprehend the global economy and how we are all connected. Leonardo da Vinci also said: “Learn how to see. Realize that everything connects to everything else.”

As along as they continue to rail against me, don’t worry, we will always have fools to trade against. We need them on the other side. I have no desire of convincing them otherwise. As long as they attack me, it proves they are not capable of learning how to see the world in which they live.