Capital Flow Movements

QUESTION: Dear Mr. Armstrong,

You said that people and institutions from Europe send their cash to the US to get a higher yield. This makes a lot of sense. At the same time, the dollar has been falling. You have also stated that US institutional investors are sending money to developing markets to get a higher yield. Is more money leaving the US to emerging markets then flowing in from Europe?

Thank you for your thoughts and wisdom.

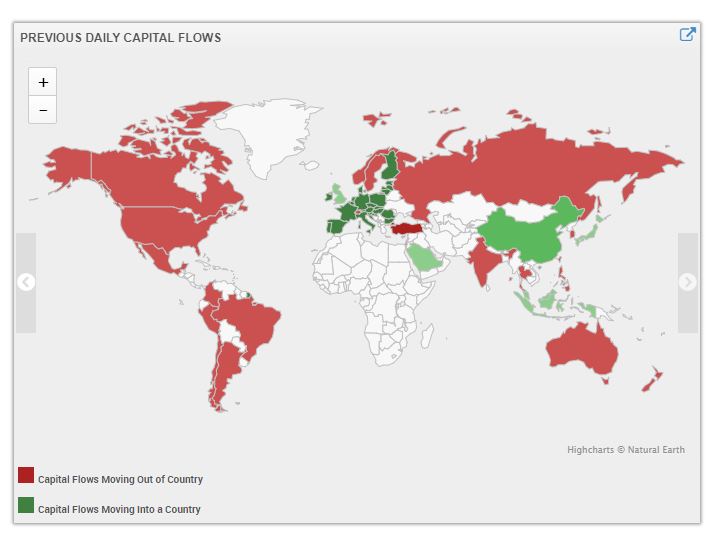

ANSWER: Yes. Here is our capital flow map, which is proprietary. Even central banks are using this. We are collecting the raw data globally and will be providing a breakdown in the future of volume and sector analysis we pick up in the flows. Nonetheless, there are diverse trends combining at all times. It is never everyone doing one thing for a single reason. The broader categories are three separate motives.

(1) the flow of capital from Europe to the USA is primarily institutional from (a) banks parking funds at the Fed rather than the ECB, and (b) playing the US equities which have been a boom since September in terms of Euros.

(2) You have US institutions who think the US sharemarket is overbought so then have shifted in any case up to 50% to overseas markets assuming they are not a frothy as the USA

(3) You then have American pension funds who have been buying high-yield third world debt to try to make up for the losses domestically with too low-interest rates.

Therefore, the net trend for the dollar has been down since February when the capital flows shifted. We will see this now beginning to shift reversing back into the dollar especially next year.