Renminbi v the Dollar

The dollar haters have been touting that the Chinese yuan, or otherwise known as the renminbi, would kill the dollar and gold will soar. I have warned that China will take the spotlight as the Financial Capital of the World once again but only after 2032. A real assessment of international capital flows reveals the truth. The Chinese renminbi accounts for only a 1.85% share of the international cash flows. In fact, the renminbi’s global share has declined from nearly 2.5% of total global capital flows in 2015, for that was its peak in September 2015 actually on target with the Economic Confidence Model. So despite all the fanfare, China has entered a decline since 2015 – not a rally to kill the dollar.

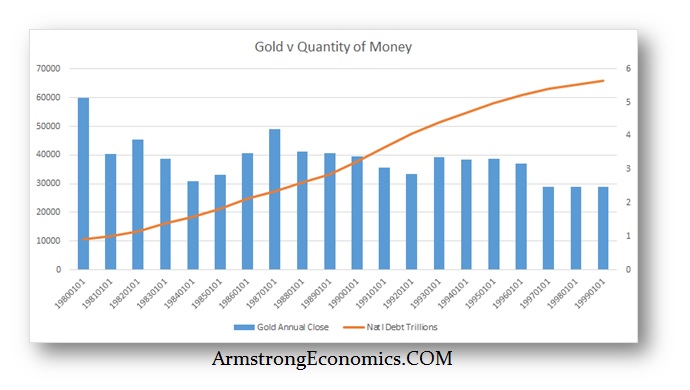

The Beijing government has opened foreign capital markets in recent years. Since 2016, China’s currency has officially been the fifth world currency of the International Monetary Fund alongside the dollar, euro, yen and British pound. That was supposed to kill the dollar. That had zero impact contrary to the dollar haters who concoct endless scenarios to paint the picture of the end of the dollar. One has to wonder why people continue to read these self-proclaimed forecasters. They have NEVER been right. They have used the scare-tactics that increasing the money supply would devastate the dollar and create hyperinflation. Another failed scenario.

Then there was the one about China was going to trade “real” gold, not paper futures as in New York COMEX. That one was supposed to kill the COMEX and everyone would rush to China. Well, that did not happen either. They lack any comprehension of how the world functions and were blind to the fact that by starting with gold trading in yuan, it was a tiny test market for the floating of the yuan itself. It would allow arbitrage between New York and China yielding the next difference being the yuan. Buy gold in China and sell it in New York, and the difference is the currency. So they got that one wrong and the both the COMEX and the dollar managed to survive.

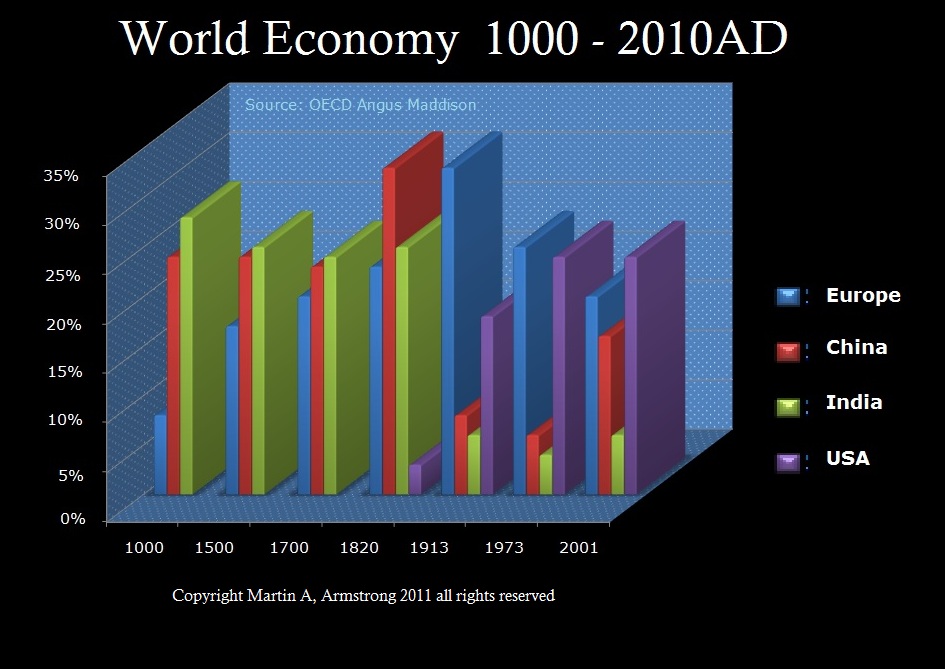

There continues to be a willingness of Chinese policymakers and business leaders to help shape the currency, which is the world’s second-largest economy. For example, the Chinese will soon offer oil contracts in yuan as well and all of this is an indirect way of floating the currency. This willingness on the part of the Chineses government is why it will take time, but their economy will become the biggest in the world after 2032.

There continues to be a willingness of Chinese policymakers and business leaders to help shape the currency, which is the world’s second-largest economy. For example, the Chinese will soon offer oil contracts in yuan as well and all of this is an indirect way of floating the currency. This willingness on the part of the Chineses government is why it will take time, but their economy will become the biggest in the world after 2032.

What makes the US economy the biggest? The American consumer and lower taxes than Europe. When you leave more money in the hands of the people, they spend it creating jobs for everyone. Europe is following Marx. They think the government is better equipped to spend other people’s money. That produces corruption, not economic growth.

As long as China keeps its tax rate low and allows the people to spend the benefits of their labour, then it will continue to rise economically and displace those in the West who are blinded by power and pursue this Hunt forever more Taxes. The West has to learn that Marx was just wrong. The strongest economic growth unfolds when people are allowed to spend their own money.