Do Commitment of Traders & Inventories Really Matter?

QUESTION: Do you think that the Commitment of Traders and reported inventories are relevant to gauge market performance?

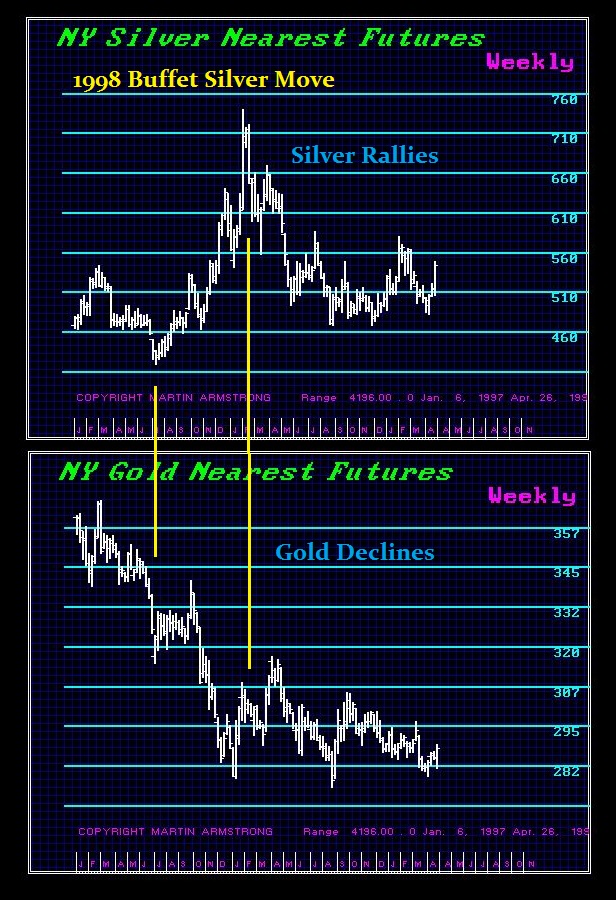

ANSWER: The oldest game in town is manipulating inventories. Commodities can be stored at many places, but only selected facilities are on the reporting list. During the famous Buffet Silver scandal of 1997-1998, to justify taking silver up in price they had to make the inventories appear to decline. The easy way to do that was simple. Buffet bought the silver but in the London market – not COMEX. Thus, the silver was moved from New York to London and then everyone touted silver was in short supply as if it had been consumed like wheat.

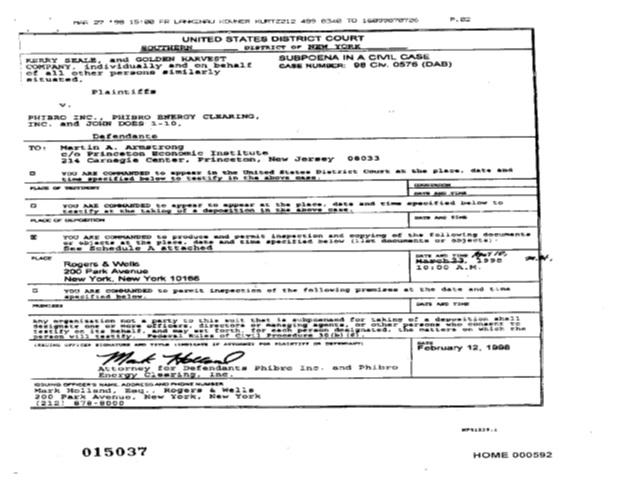

Phibro had one of their paid analysts to call the Wall Street Journal to try to stop me from warning clients that silver was being manipulated. Their mistake was getting mainstream media involved. Once the Wall Street Journal reported I said silver was being manipulated, the CFTC had to call me. I can write on this blog whatever. As long as it does not appear in the mainstream press government can ignore it.

Phibro had one of their paid analysts to call the Wall Street Journal to try to stop me from warning clients that silver was being manipulated. Their mistake was getting mainstream media involved. Once the Wall Street Journal reported I said silver was being manipulated, the CFTC had to call me. I can write on this blog whatever. As long as it does not appear in the mainstream press government can ignore it.

The CFTC called me and asked me where the “manipulation” was taking place. I told them it was out of their jurisdiction in London. They said they could make a call and I said that was what they had to do. The indeed called the Bank of England and all the silver dealers were ordered to appear in the morning at the Bank of England. Buffet would be found out and had to issue a public statement that he had amassed 130 million ounces of silver or about 25% of the world supply. He denied manipulating the market and announced that the company had taken delivery on 87.5 million ounces of silver, the remaining 42 million was on “call for delivery at varied dates until March 6, 1998.” The release went on to say that the he “is willing to defer delivery for a reasonable period upon payment of a modest fee.”

The press backed Buffet. Even Baron’s penned the “Silver Fox” concluding: “After that, silver prices will march on. For a while at least, Buffett’s play will continue to look golden.”

Of course, that was not the case even with buying 25% of the world supply.

Like the Hunt Brothers, with Buffet taking 25% of the world supply, he too could not force a bull market. This is telltale signs of a false rally which is indicative of manipulation. So commitment of traders and inventories are by no means fundamentals to hang your hat on for a guaranteed trade. They are more often than not used to get the sheep to buy in. You must also look around at other markets and how everything fits. You will notice that gold was not responding in sync with silver. If it was a true bull market, gold would lead the way.

I warned all our clients that silver was going to be manipulated and the target was $7. Phibro floor broker walked across the floor and showed Buffet’s orders to my people and said: “come on join us for once.” I declined because you simply can never trust the bankers. There are no ethics in New York City. You can think you are joining with them and they have someone else selling to you for a set-up. So yes, I seem to be in the middle of just about every scandal.