Can the Stocks & Bonds Crash & Only Gold Rises?

QUESTION: Mr. Armstrong; I use to listen to the Goldbug analysts but they never change. Now the pitch is you have to protect your wealth from stock and bond market crash. They say that with the current equity bull market among the longest on record and the beginning of a bond bear market, once again they say you have to buy only gold. Being the skeptic that they have made me, is there any historical basis for what they are pitching now that both stocks and bonds will crash together? This seems to be just impossible. Can you shed some light?

PD

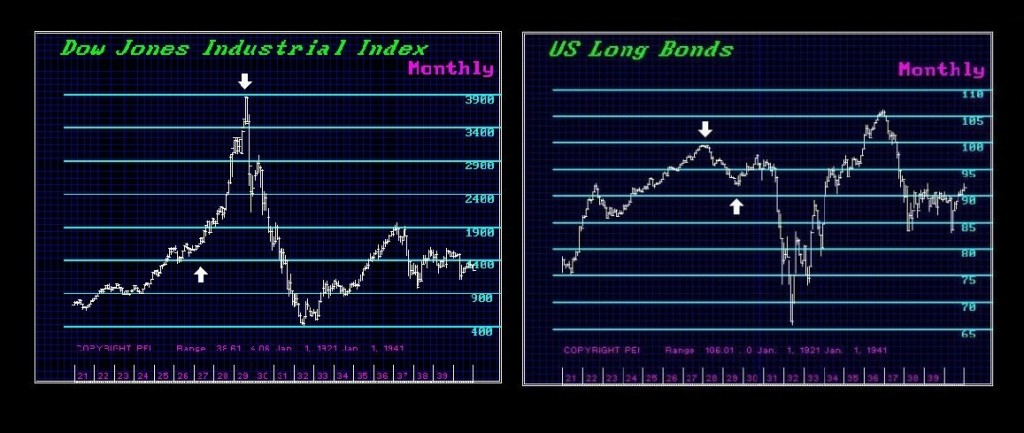

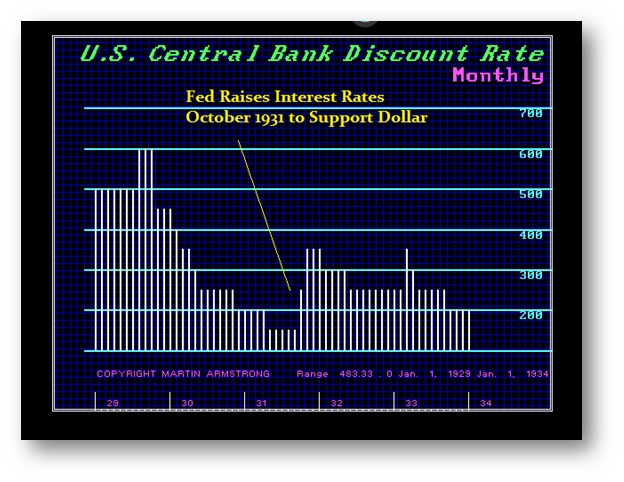

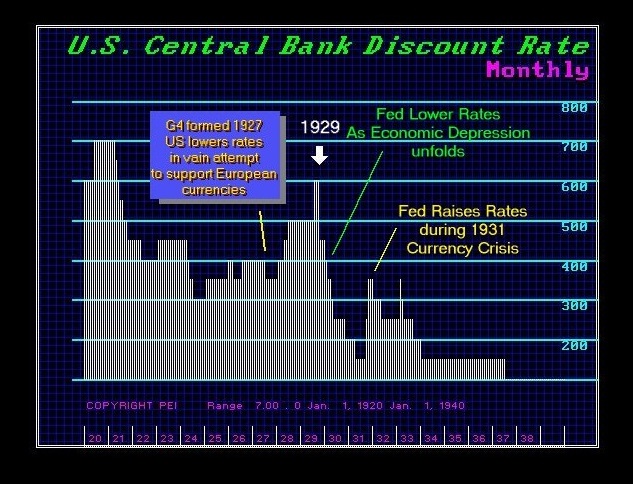

ANSWER: Your gut feeling is correct. No there is no such historical precedent for the stock and bond market to collapse and only gold rises. I honestly cannot explain where they come up with this stuff. The bond markets will decline as interest rates rise. The sole exception was the Sovereign Debt Crisis in 1931-1932. This is when the stock market did decline with the bond market. However, this was driven by a complete collapse in confidence in government bonds. The Fed raised rates in 1931 to try to support the dollar but as you can see, the bonds and stocks fell.

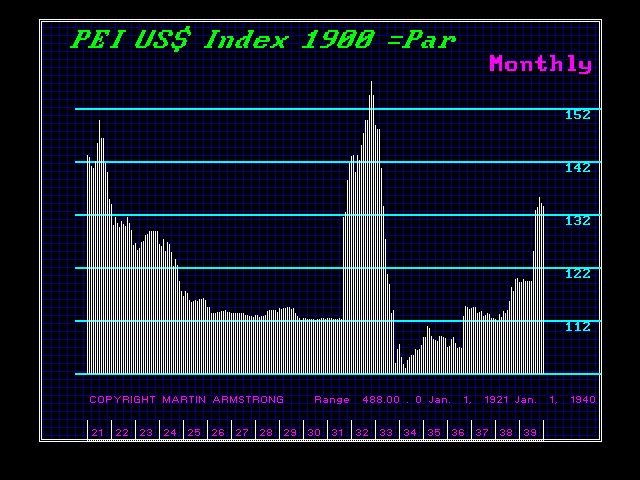

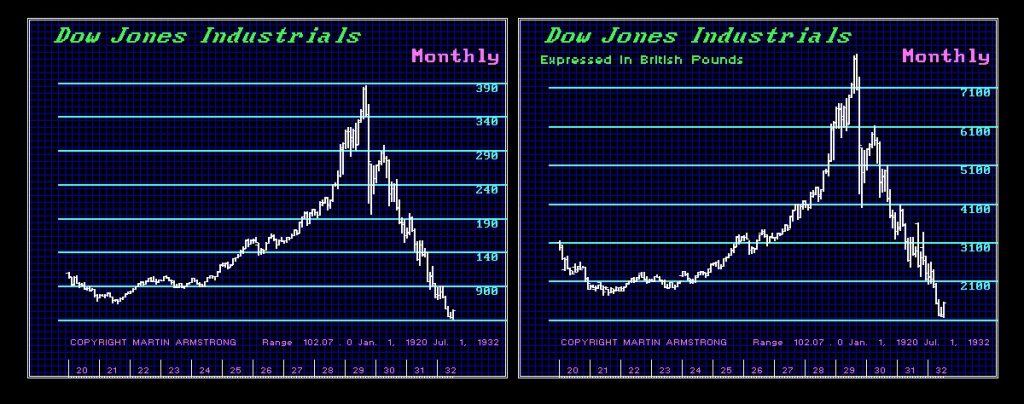

The dollar soared in 1931 and most of Europe defaulted as well as South America and Asia. This produced a mad rush into the dollar which distorted the Dow slightly at first. Then the rumors turned against the dollar and people began to expect that the dollar would be devalued.

There is no indication of what they are saying is even feasible. What will happen is the stocks will get hit at first with rising rates, but then they will turn and rally with rising rates as they did between 1927 to 1929.

Sorry, I can find no historical foundation to support such a forecast.