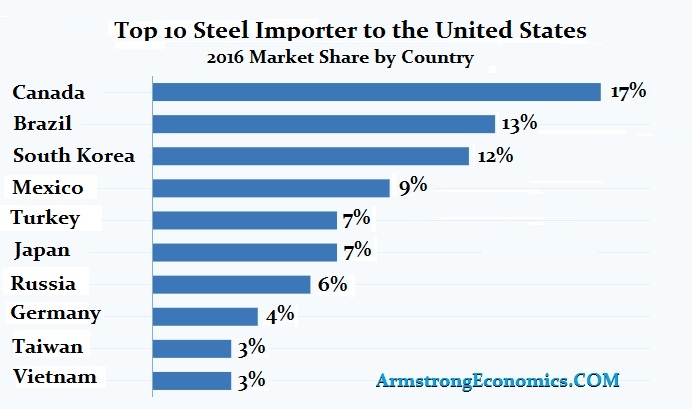

Canada Will be the Most Impact by a Steel Tariff

Canada is the largest exporter of steel to the United States. The decline in the Canadian dollar has helped this trend in particular. Trump is clueless when it comes to the impact of currency on foreign trade. If he wants to do tariffs, they MUST be indexed to the currency. Failure to do that will cause serious consequences as the dollar rises on the world financial markets in the years ahead. He will create a trade war globally and politicians on both sides remain ignorant of foreign exchange and its impact upon trade numbers.

I have stated many times that the entire system of trade is in a state of confusion. Following Bretton Woods, currencies were fixed to the dollar which in turn was fixed to $35 per troy ounce of gold. Therefore, the accounting system ONLY measured the amount of currencies moving back and forth. It was assumed that you imported more goods if the amount of outflow of dollars increased. Consequently, the way we measure trade today has NOTHING to do with the actual amount of product moving internationally. If you spent more dollars but the dollar declines in value by 20%, then even an increase in imports measured in dollars by 20% was not an indication that you purchased more goods – it was simply net currency movement.

I have stated many times that the entire system of trade is in a state of confusion. Following Bretton Woods, currencies were fixed to the dollar which in turn was fixed to $35 per troy ounce of gold. Therefore, the accounting system ONLY measured the amount of currencies moving back and forth. It was assumed that you imported more goods if the amount of outflow of dollars increased. Consequently, the way we measure trade today has NOTHING to do with the actual amount of product moving internationally. If you spent more dollars but the dollar declines in value by 20%, then even an increase in imports measured in dollars by 20% was not an indication that you purchased more goods – it was simply net currency movement.

Welcome to the world of trade statistics!